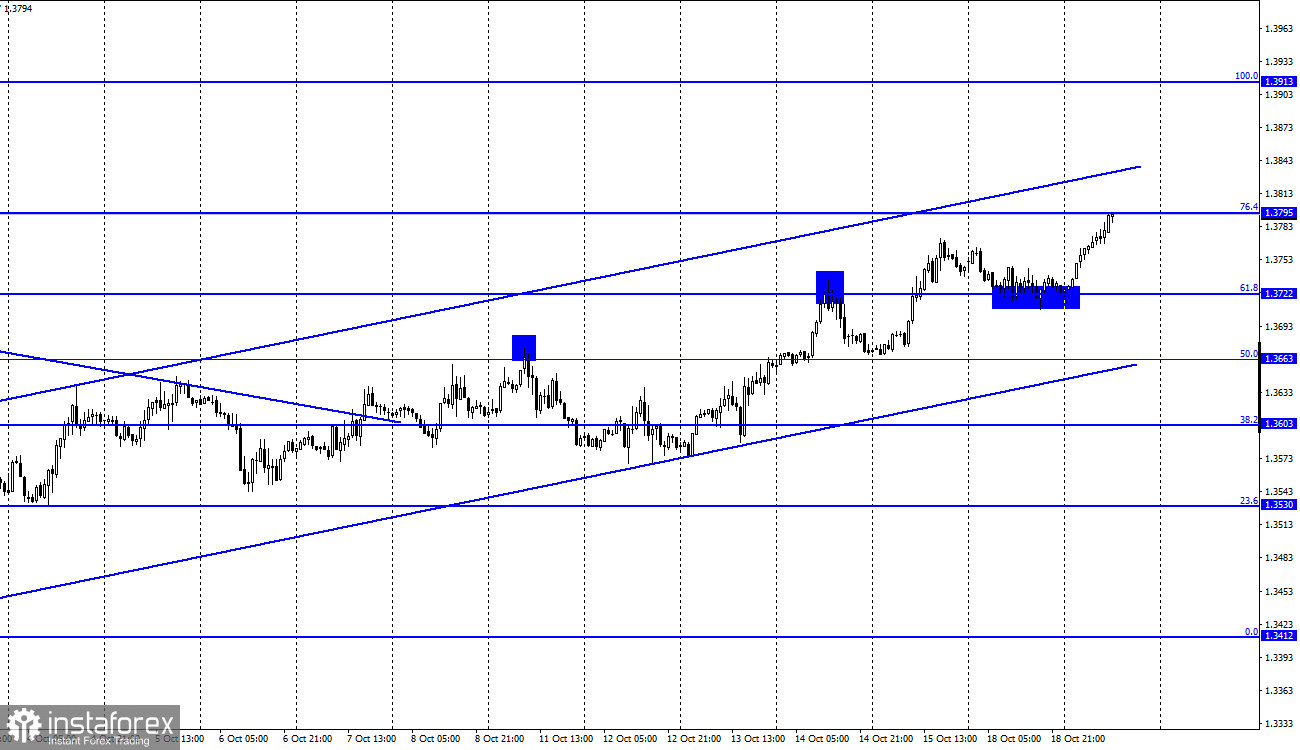

GBP/USD – 1H.

According to the hourly chart, the GBP/USD pair performed a rebound from the corrective level of 61.8% (1.3722), a reversal in favor of the pound, and an increase to the Fibo level of 76.4% (1.3795). The rebound of quotes from this level will allow us to expect a reversal in favor of the US currency and a slight drop in the direction of the 1.3722 level. Closing above the level of 1.3795 will increase the probability of further growth in the direction of the next corrective level of 100.0% (1.3913). The upward trend corridor still characterizes the mood of traders as "bullish." The information background for the British yesterday was as weak as for the euro/dollar. The same report on industrial production in the United States did not affect the mood of traders on Monday, as their activity was minimal, and the dollar was growing all the time during the day. But today, it's not even morning yet, and the pound has already resumed the growth process. And quite strong.

Thus, I conclude that the information background now plays only a minimal role in shaping the mood of traders. Several FOMC members, including Mary Daly, Michelle Bowman, and Raphael Bostic, will give speeches in the US today. Each of them can start talking about the QE program again. Let me remind you that earlier, all three of them repeatedly supported the Fed's transition to curtailing incentives as quickly as possible. It can be assumed that Daly, Bowman, and Bostic will again talk about the need to end QE against the backdrop of rising inflation again. However, it is unlikely that this will somehow support the US dollar. Traders are already fed up with these statements and are waiting for concrete actions from the Fed, not another batch of promises and assumptions. Approximately the same applies to the speech of the Governor of the Bank of England, Andrew Bailey. He can also talk about inflation, tightening monetary policy, and the end of the stimulus. However, in this case, traders will also wait for either specific actions or clear promises to perform this or that action within a certain period.

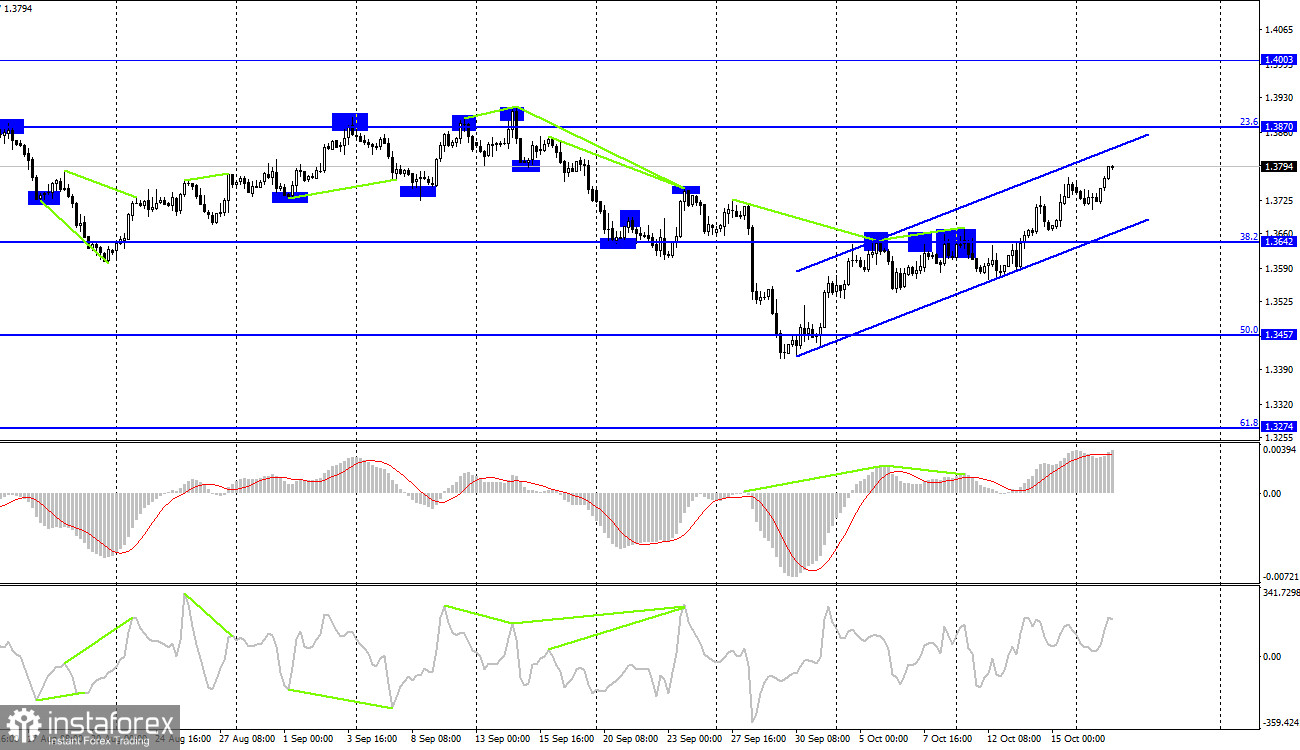

GBP/USD – 4H.

The GBP/USD pair on the 4-hour chart also continues the growth process inside the ascending trend corridor. Thus, the "bullish" mood of traders is now evident on both charts. The growth can be continued in the direction of the corrective level of 23.6% (1.3870). Fixing quotes under the corridor will work in favor of the US currency and the beginning of a new fall in the direction of the corrective level of 50.0% (1.3642). Emerging divergences are not observed in any indicator today.

News calendar for the USA and the UK:

UK - Bank of England Governor Andrew Bailey will deliver a speech (12:05 UTC).

US - FOMC member Mary Daly will give a speech (15:00 UTC).

US - FOMC member Michelle Bowman will deliver a speech (17:15 UTC).

US - FOMC member Rafael Bostic will deliver a speech (18:50 UTC).

There won't be a lot of important economic events in the UK and the US on Tuesday. Only speeches by members of the Bank of England and the Fed. I don't think traders will react to them in any way. The only exception may be the performance of Andrew Bailey.

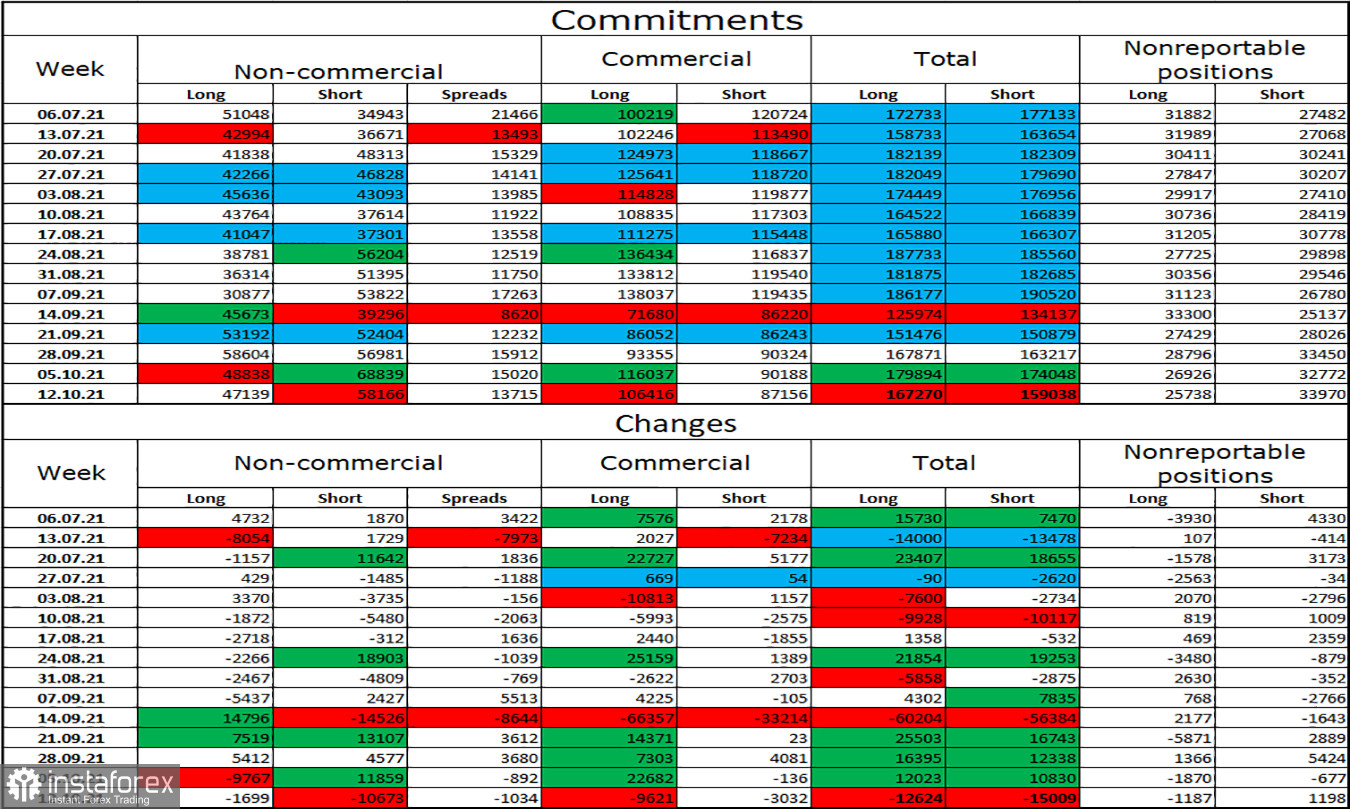

COT (Commitments of Traders) Report:

The latest COT report from October 12 on the pound showed that the mood of the major players had become much more "bullish." In the reporting week, speculators closed 1,700 long contracts and 10,673 short contracts. Thus, the "bearish" mood has become much weaker. Nevertheless, the number of short contracts concentrated in the hands of speculators still exceeds the number of long contracts by 11 thousand. It still indicates a fairly strong "bearish" mood. Thus, we can expect a resumption of the fall of the British dollar in the near future. However, the current growth of the British dollar corresponds to the actions of speculators in the last week. And both upward trend corridors support the further growth of the British dollar.

GBP/USD forecast and recommendations to traders:

I recommended buying the British when closing above the level of 61.8% (1.3722) on the hourly chart with a target of 1.3795. This goal has been achieved. I recommend new purchases when closing above 1.3795 with a target of 1.3913. I recommend opening sales if there is a rebound from the 1.3795 level on the hourly chart with a target of 1.3722.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy foreign currency not to make speculative profits, but to ensure current activities or export-import operations.

"Non-reportable positions" are small traders who do not have a significant impact on the price.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română