The current week may be a turning point for Bitcoin and the entire cryptocurrency market due to a confident upward movement and making fundamental decisions for the development of the digital asset industry. Bitcoin is close to its all-time high, while other coins continue to gain in value. The bull market is entering the stage of a broad movement upside and is only gaining momentum. However, the consequences of euphoria on the market can be dire for the entire industry, since there is a possibility that the current rally in price is the final one in this development cycle of the crypto market.

This opinion was expressed by the well-known analyst Alessio Rastani. The trader is confident that Bitcoin is approaching the final stage of the global bull market, which has been going on since 2019. According to him, Bitcoin and all digital coins are moving towards a global bearish trend. Rastani's calculations are based on a wave analysis of the movement of bitcoin and according to this data, the first cryptocurrency is capable of reaching the $100k mark. However, subsequently, the market will be covered with a powerful and long wave of corrections and bear traps.

According to the analyst, the BTC bull trend was launched in 2019 and will end next year, after which the entire market will begin to decline. As of October 19, the crypto market is entering the fifth wave structure, which should become the final one in the upward trend. Rastani also uses data from classical financial markets in his analysis and believes that they may be covered by the crisis in the next few years. According to the trader, this will negatively affect the dynamics of investments in BTC, as well as affect the movement of the price of cryptocurrencies. At the same time, the first digital asset will manage to reach an absolute maximum of around $100k, but this will be a fly in the ointment.

Meanwhile, Bitcoin continues to fight for the $64k mark, and as of 14:00 UTC, it is trading in the $62.8k region. Over the past day, the coin has increased by 2% in value and is confidently moving towards breaking a historical record. Cryptocurrency technical indicators signal that BTC will be able to test its all-time high Wednesday this week. Thanks to a strong upward movement in MACD, Stochastic and Relative Strength Index, Bitcoin will move out of the $ 61k- $64k range by the end of Tuesday's trading. Right now, the news background and the confidence of the bitcoin audience leave no doubt about setting a new all-time record this week.

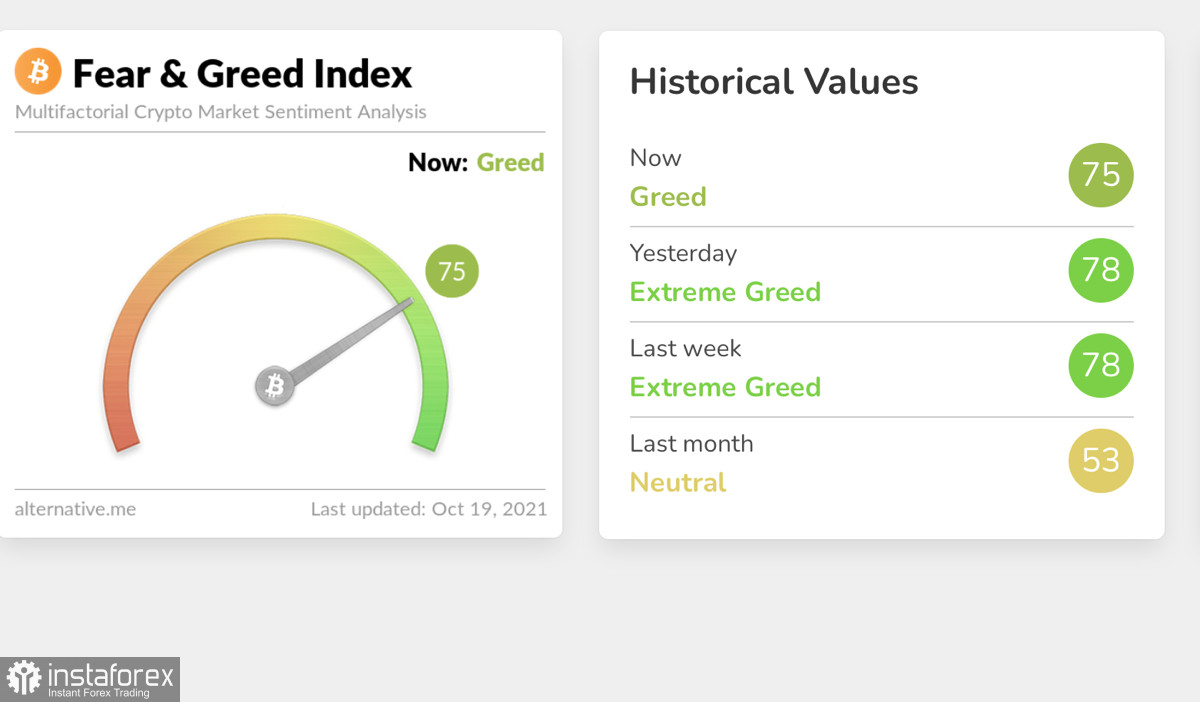

It is likely that after such a protracted growth and confident overcoming of the 78 mark on the Fear and Greed Index, the market expects a strong correction. However, to assume the onset of a full-fledged bear market in the context of several years looks like a premature statement due to the increasing autonomy of the crypto market and the start of a new period of development. Important areas of digital assets are the DeFi and NFT markets, which find their audience and begin to influence cryptocurrency quotes more than economic factors.

In addition, the downturn of the entire market may be associated with BTC, since Rastani uses its wave analysis, but many crypto-assets can avoid direct correlation with Bitcoin. By developing their own ecosystems, the quotes of the coins will have less influence from the main asset, and the developers of the leading coins have already begun to invest in the development of ecosystems.

A recent example is the statement of Vitalik Buterin, who noted the priority of the development of other sides of the ether since it is they that affect the price of the asset. The ADA and SOL projects also broke into the top 10 thanks to the wide capabilities of the blockchain. The DOT project management has allocated more than $800 million for the development of the ecosystem of the coin.

All this makes cryptocurrencies more versatile and independent in their attempts to occupy their niche in the developing digital financial world. Therefore, the indicators of the spot market will fade into the background, and the functionality of the network will become a priority for market participants.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română