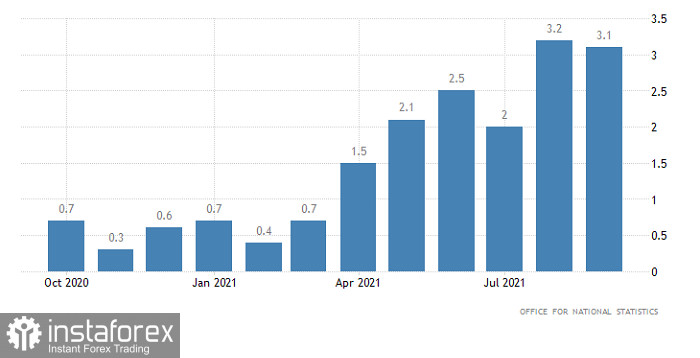

Yesterday's trading began with the pound's steady decline, although this contradicted the logic of the inflation data published at the same time. After all, the growth rate of consumer prices in the UK slowed from 3.2% to 3.1%. In the context of growing concerns about the global growth of inflation, any news about its decline is perceived as extremely positive. However, the pound behaved as if none of this had happened. In fact, it completely repeated the dynamics of gas prices yesterday, which were steadily rising at the beginning of the trading day. So, the energy crisis is still one of the main factors affecting the currency market. Following the opening of the American session, gas prices rapidly plunged, and then the pound began to grow, eventually returning to corrective highs.

Inflation (UK):

A similar situation is observed in Europe, where the final data on inflation were published. However, they usually do not affect anything, since they often completely coincide with the preliminary assessment, which just leads to noticeable changes in the market. But yesterday, there could still be a feeling that the confirmation of the fact of inflation rising from 3.0% to 3.4% provoked the euro's weakening, which began to decline at about the same time as the inflation data were published. However, this is a deceptive impression.

The reason is exactly the same as in the situation with the pound. The European trading session opened with a steady increase in gas prices, and then rapidly went down after the opening of the American trading session. At the same time, the Euro currency just started to rise and eventually returned to corrective highs.

Inflation (Europe):

Nevertheless, the main reason for such market behavior is the lack of serious macroeconomic data, especially if we talk about the pound. This is because the growth of inflation in the UK began much later than in Europe or the United States and they have already had cases of a slight slowdown in consumer price growth. However, inflation grew rapidly again and so, a similar scenario is possible in the United Kingdom.

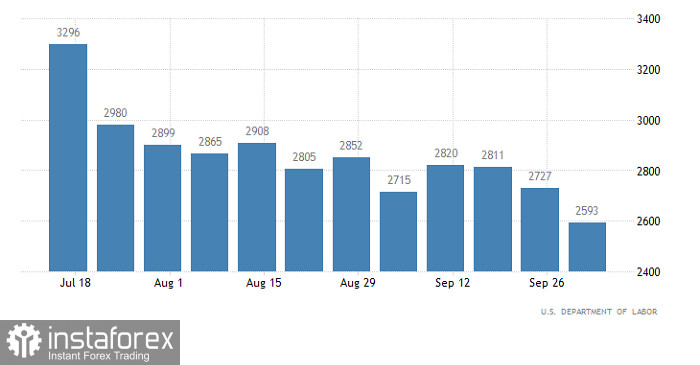

In this case, it is extremely dangerous to draw any hasty conclusions based on yesterday's inflation data. But things are somewhat better today with macroeconomic statistics since data on applications for unemployment benefits are published in the US. And although the number of initial requests should increase by 2 thousand, the number of repeated requests may decline by 118 thousand. It can be seen that the situation in the US labor market continues to improve steadily, which may lead to a resumption of the trend for the strengthening of the US dollar.

The number of re-claims for unemployment benefits (United States):

The EUR/USD pair is marking time within the local high on October 19, but market participants failed to break through it. The failure to break through the level of 1.1669 may eventually lead to a sideways amplitude and, as a result, the continuation of a downward course.

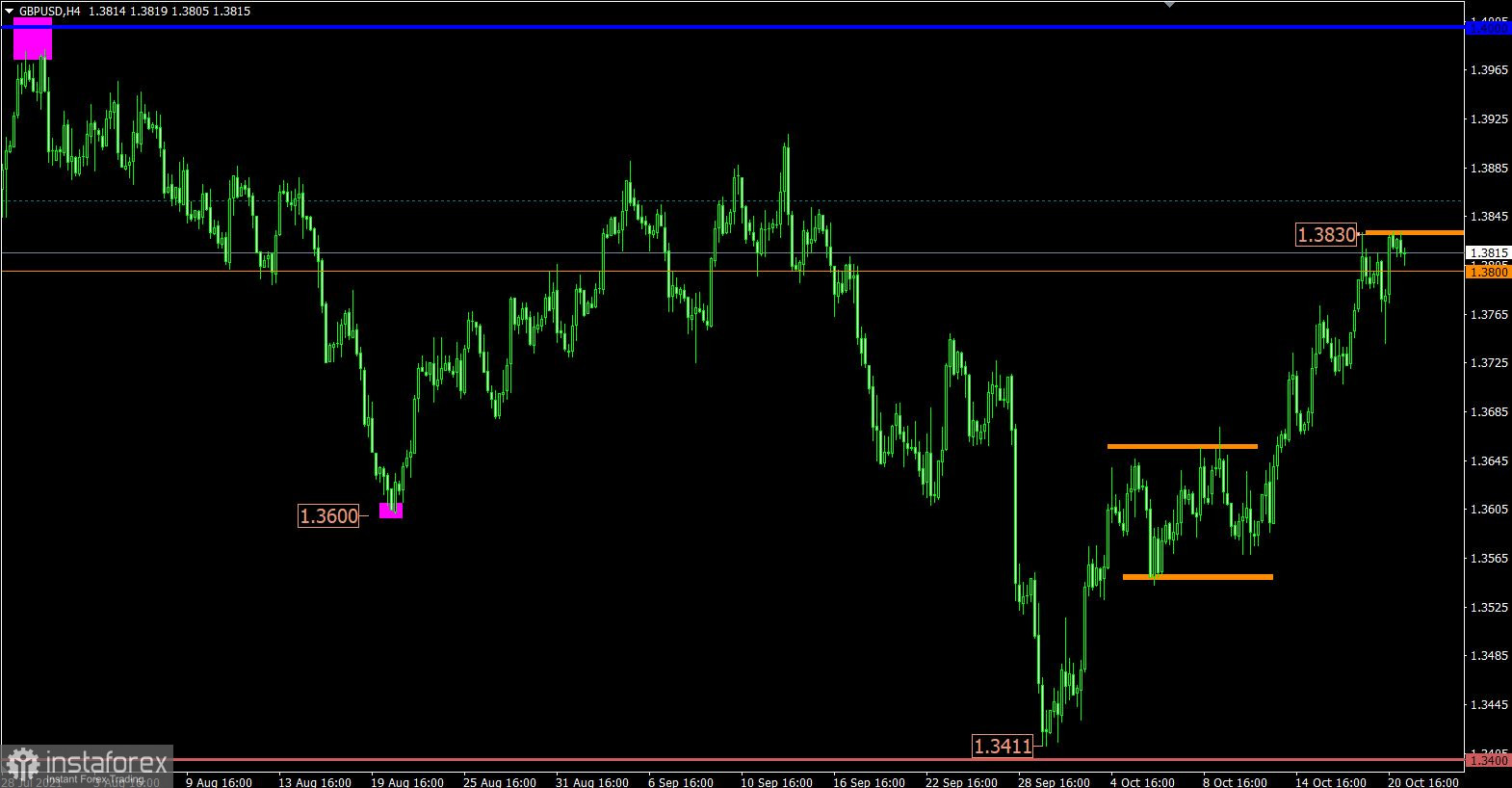

The GBP/USD pair is moving within the high of the corrective move, where the price area of 1.3800/1.3830 serves as resistance. The scale of the pound's strengthening signals the early completion of the correction. The first sell signal will arrive when the price is kept below the level of 1.3780.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română