As promised at the beginning of this week, we return to the dollar/yen currency pair. In today's review of this trading instrument, we will analyze the current technical picture and predict the preliminary results of the end of the trading week so far. However, before that, let us briefly talk about the macroeconomic reports from Japan that night. Thus, the national consumer price index in Japan increased by 0.2%. Compared to the previous indicator of minus 0.4%, this is certainly strong data. The national consumer price index, excluding fresh food prices, coincided with the forecast value of 0.1%. Business activity in the manufacturing and services sectors also turned out to be better than economists' expectations. In general, Japanese statistics should be considered very positive. However, the impact of the price dynamics of the yen and the macroeconomic data from Japan is very mediocre.

Another thing is important American statistics. Although the indices of business activity in the manufacturing and services sectors of the United States can be attributed to important, today, at 14:45 London time, they will be published. They may have an impact on the price dynamics of USD/JPY. However, according to the author's personal opinion, the main influence on the movement of the quote was exerted by the technical picture, which we are going to consider right now.

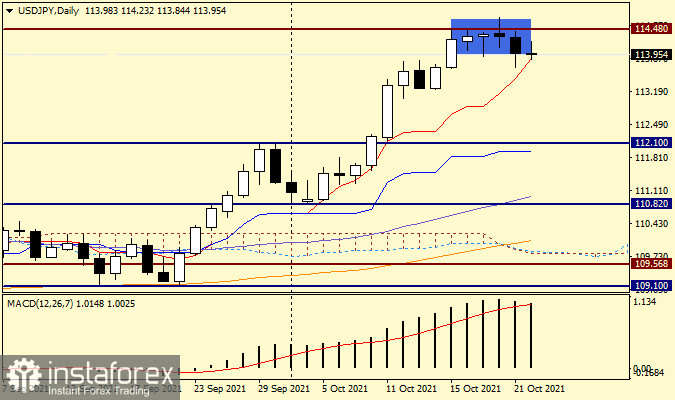

Daily

On the daily chart, everything is visible. The assumption that the resistance of sellers in the area of a strong technical level of 114.50 will be a very difficult task for the bulls was fully confirmed during the auction. Look at the Doji candles highlighted in a blue rectangle, and everything will become clear to you without unnecessary and lengthy descriptions. Attempts by players to increase the exchange rate to break through the resistance of 114.48 on October 20 were unsuccessful, only a shadow remained at the top, and the candle's closing price was below this mark. In my personal opinion, the combination of highlighted candles is nothing more than a reversal signal for a decline, which means that we need to prepare for sales. However, the fact that a reversal is brewing for the pair should be confirmed by the weekly candle, which at the moment looks like a reversal. However, since there is still time before the end of the weekly trading, USD/JPY bulls can still correct the situation in their favor. However, they will have to make incredible efforts to do this. And again, a serious driver is needed, which may be today's speech by Fed Chairman Jerome Powell, scheduled for 16:00 London time. Of course, if Powell can surprise and motivate market participants for active actions. In the meantime, I recommend preparing for USD/JPY sales, which are better to open on Monday, considering the shape of the current weekly candle. For those who want to take a risk and trade a pair today, I recommend looking for options to open short positions after climbing into the price zone 114.00-114.20.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română