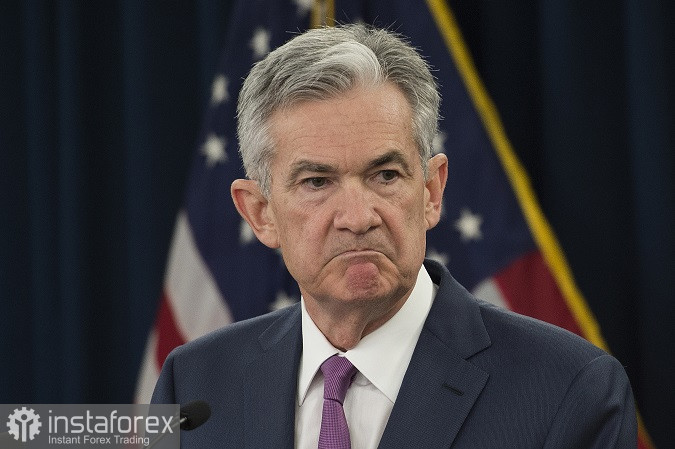

US stocks initially fell last Friday, after Fed Chairman Jerome Powell expressed concern over rising inflation. The S&P 500 dropped by 0.26%, while the Nasdaq 100 slipped by 0.9%. Powell said the central bank is closely monitoring price pressures and will adapt to it accordingly. But surprisingly, by the end of the US session, the quotes almost returned to its previous levels.

"The global supply chain constraints and shortages that have driven inflation up are likely to last longer than expected, probably next year, which is still the most likely case as those constraints ease," Powell said.

Investors have been worried about rising prices and bottlenecks in the global supply chain that could force the Fed to raise interest rates earlier than scheduled.

"The market is getting more worried that we are in some kind of a longer term inflation rise," said Jim Bianco, president and founder of Bianco Research

In fact, the 10-year U.S. Treasury yield fell to 1.64%, but remained higher for the week. Meanwhile, dollar edged lower, on track for a second week of declines.

The losses occurred after the S&P 500 slumped amid poor results the previous day. Snap's ad spending warning has driven the market value of the social media company and its competitors to more than $ 100 billion, including Facebook, Alphabet, Pinterest and Twitter. Intel also posted lower-than-expected sales due to shortage of components.

"A double whammy of bad news for the tech sector could well mean that record highs are out of reach for now,"said Fiona Cincotta, senior financial markets analyst at City Index

But despite the threat of price pressures, global stocks are on tack for a third week of gains, thanks to the ongoing recovery from the health crisis.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română