If proponents of the theory of using gold as an insurance against inflation were asked a year ago what would happen if consumer prices in the United States exceeded 5% for 5 consecutive months, they would not hesitate to answer that XAUUSD would be quoted above 2,000. You cannot compare the events of 2020 and 2021. At that time, the Fed was very patient and stuffed the economy with money, trying to save it from a recession. Now the central bank doubts the temporary nature of the high CPI.

As history shows, gold does not react to inflation, but to real rates on the US debt market, which are very sensitive to the Fed's monetary policy. Precious metal is a limited asset that has its value. Its competitor in the modern world, Bitcoin, is also limited and has value as well. Therefore, some investors were quick to call it an alternative to gold as a hedge against inflation risks.

The dependence of XAUUSD on the US debt market leads to a decrease in the pair's quotes as bond yields rise. At the same time, speculative net longs on 2-year securities have been at their maximum levels since October 2017, which theoretically should have increased the risks of a sharp rollback in the event of massive triggering of stop orders. Hedge funds have found a very effective strategy: they sell debt obligations and buy futures contracts on them. As a result, the rally in profitability does not even think to stop.

Dynamics of speculative positions on 2-year US bonds

The sale of precious metals is facilitated by the return of investor interest in the US dollar. During the second half of October, there was a correction in related pairs against the background of expectations of the start of monetary policy normalization in New Zealand, Britain, Canada, and other countries that issue G10 currencies. There were rumors in the market that they could afford to raise rates, unlike the Fed, which thus risks provoking global stagflation. Nobody wants stagflation in their country. And the departure of the Bank of England from the "hawkish" rhetoric leads to a weakening of the pound.

On the contrary, strong statistics on US retail sales, business activity, labor markets, and real estate are pushing the date of the first federal funds rate hike from September to June, which strengthens the US dollar and provokes a sell-off in XAUUSD. Investors believe that if inflation remains at elevated levels and US data continues to improve, the Fed will have no choice but to tighten monetary policy. At the same time, the risks of a hawkish surprise at the November FOMC meeting are quite high. We are talking about a possible more aggressive folding of QE than the markets suggest.

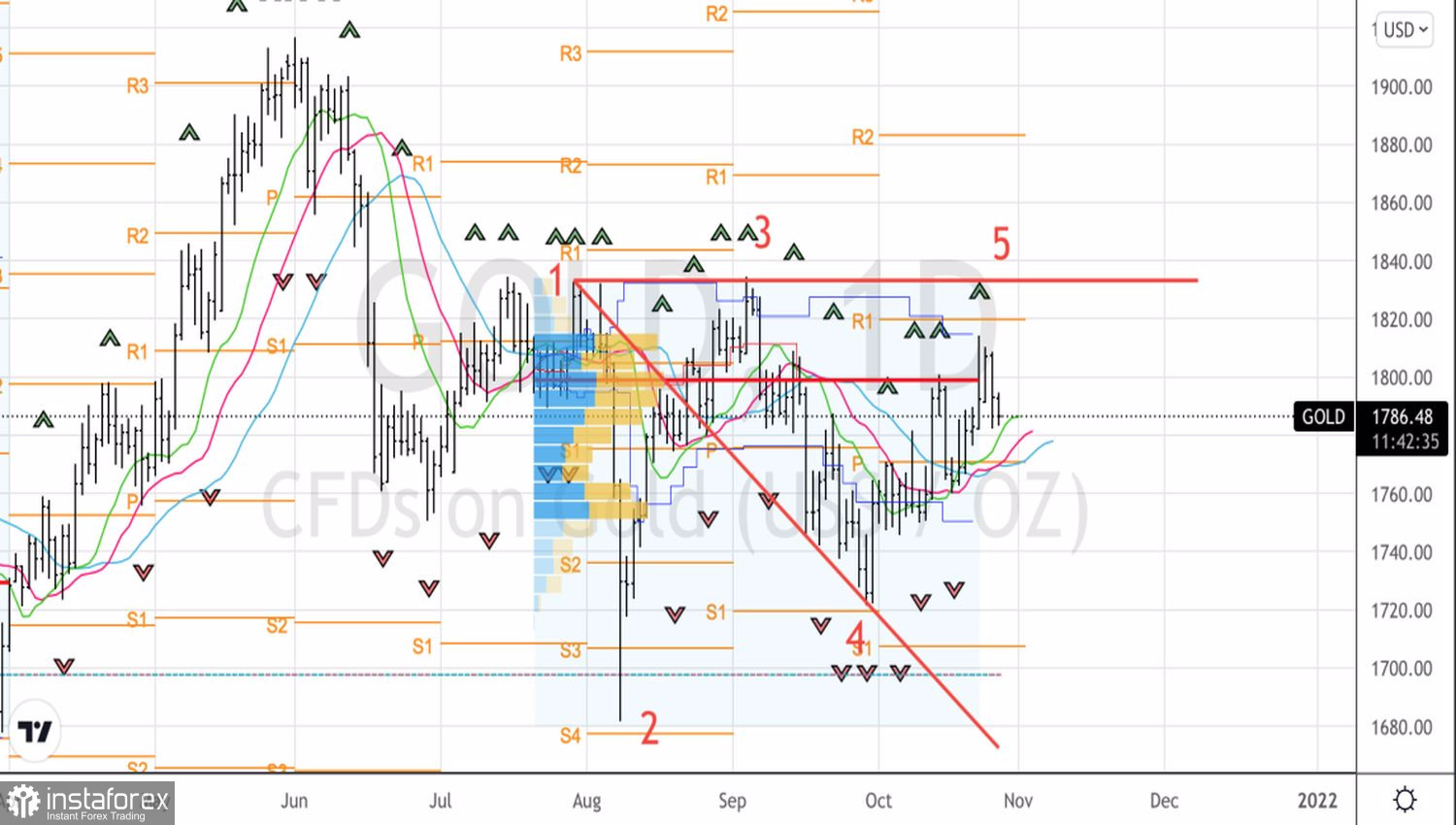

Technically, the inability of gold bulls to gain a foothold above fair value by $1,800 per ounce indicates their weakness. I recommend keeping the shorts formed on the growth in the direction of $1,815 and increasing them from time to time. The targets are $1,765 and $1,740.

Gold, Daily chart

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română