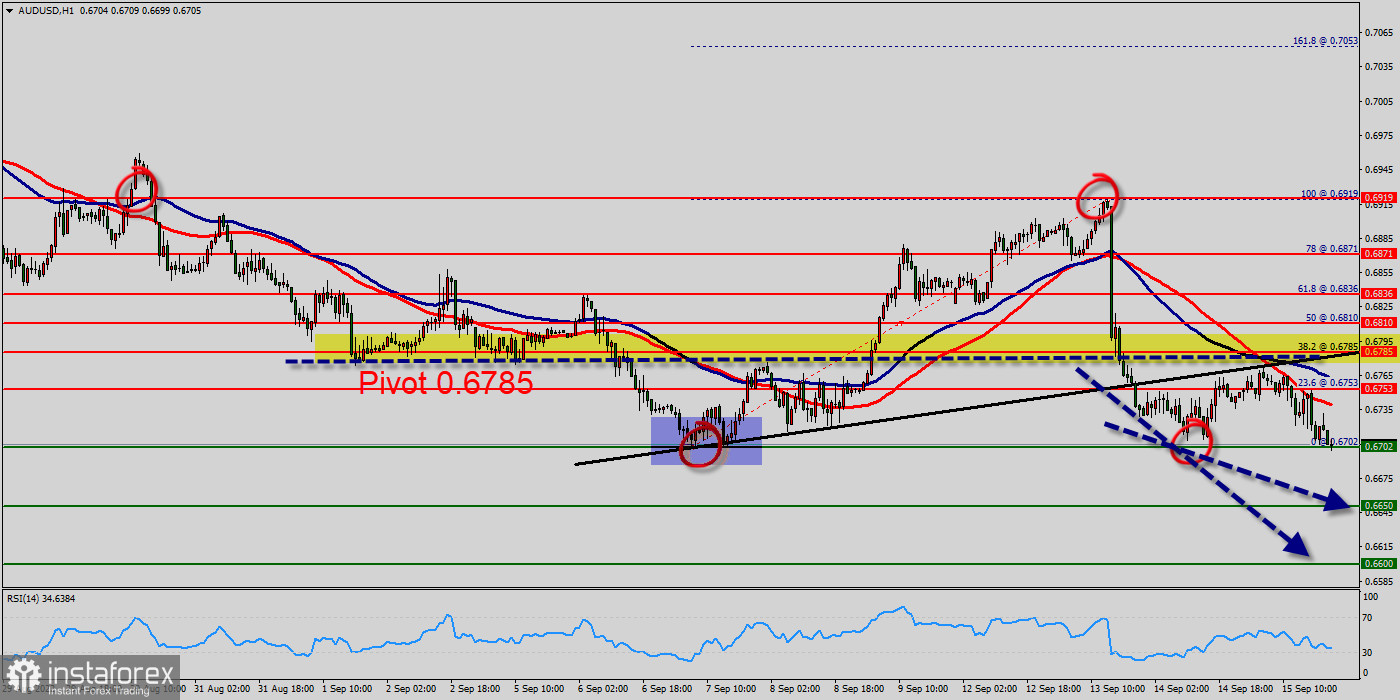

The AUD/USD pair's outlook and further decline is expected with 0.6785 minor resistance intact. Current down trend should move from the last resistance levels of 0.6785, 0.6836 and 0.6919.

Firm break there could prompt downside acceleration to last bearish wave of 0.6702. On the hourly chart, the EUR/USD pair suggests the corrective advance could continue, particularly if the pair surpasses the immediate resistance level at 0.6785.

On the hourly chart, the AUD/USD pair is again trading below the MA (100) H1 moving average line (0.6785). The situation is similar on the one-hour chart. On the downside, break of 0.6702 minor support will argue that larger down trend is ready to resume. Intraday bias will be back to the downside for retesting 0.6650 low first.

Based on the foregoing, it is probably worth sticking to the south direction in trading, and while the AUD/USD pair remains below MA 100 H1, it may be necessary to look for entry points to sell for the formation of a correction.

Technical indicators are recovering from extreme oversold readings, holding far below their midlines, a sign that there's a long way ahead before a substantial recovery takes place. Moving averages, in the meantime, maintain their bearish slope way above the current level. Furthermore, although the news is bearish for the AUD currency, professional may not want to sell weakness, but rather following a rebound rally.

Additionally, some aggressive counter-trend buyers may be defending parity. On the upside, break of 0.6785 minor resistance will turn bias back to the upside for stronger rebound. The AUD/USD pair will have been trading in a tight sideway range since yesterday for that the price has also set below the daily resistance 1 at the level of 0.6785, moreover the price has already formed double bottom at the 0.6702 level.

In particular, it should notice that at the level of 0.6650 which represents the support, we can expect explosive breakout and it is likely that the market is going to start showing the signs of bearish market.

In other words, it will be a good sign to re-sell above double bottom at the level of 0.6702 with a first target at 0.6650 in order to test the next new support and it will drop towards 0.6603.

However, if the price of the AUD/USD pair breaks 0.6785 and closes above it, the market will indicate a bullish opportunity above 0.6836 for temporary time.

Trading recommendations:

According to previous events, the AUD/USD pair is still moving between the level of 0.6753 and the 0.6650 level (these levels coincided with the last bearish wave and Fibonacci retracement levels 23.6% and the last bearish wave). It should be noted that the 0.6753 price will act as a minor resistance on Sept 2022. Therefore, it will be too gainful to sell short below 1.1879 and look for further downside with 0.6650 and 0.6603 targets. It should also be reminded that stop loss must never exceed the maximum exposure amounts. Thus, stop loss should be placed at the 0.6836 level today.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română