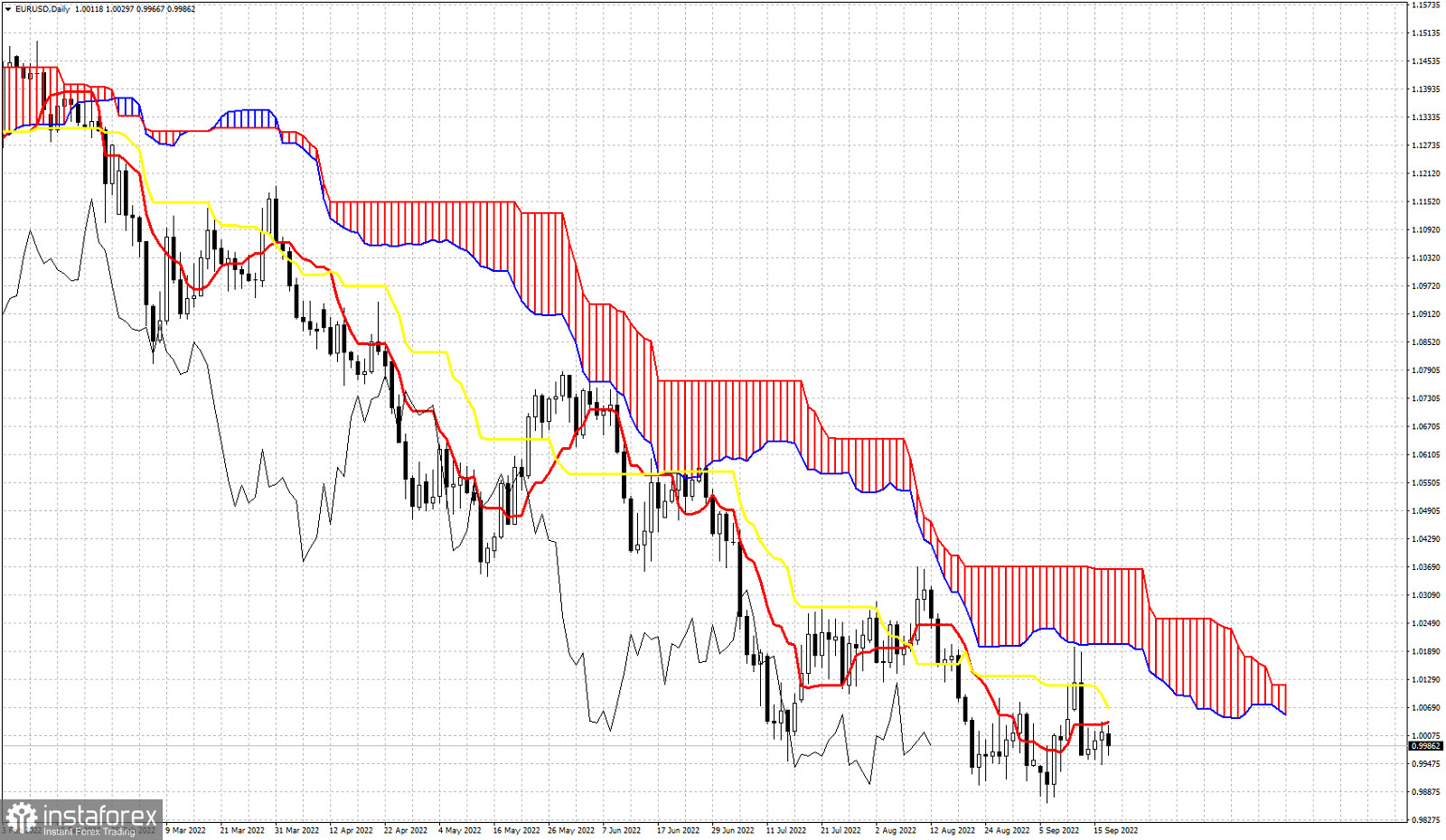

Euro is trading below parity against the Dollar. In Ichimoku cloud terms trend remains bearish since February of 2022 when price initially broke below the Kumo (cloud) and the kijun-sen (yellow line indicator). Since then price remains below the cloud resistance and each time we saw a major bounce and test of the cloud, bulls were unable to break above the Kumo and price got rejected. Price continues making lower lows and lower highs. The Chikou span (black line indicator) remains below the candlestick pattern. Price is still below the tenkan-sen (red line indicator) and the kijun-sen. The tenkan-sen remains below the kijun-sen. All indicators confirm that bears remain in control of the trend. In order to see a trend change we need to see EURUSD break above 1.02. This would turn trend to neutral with increased chances of continuing higher above the cloud. Until then, bears are in control.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română