The historic Federal Reserve meeting has passed as expected. The tapering of bond purchases is set to begin in November and will last until mid-2022. This has been already priced by the market. Therefore, the greenback was steady after this announcement.

According to the CME Group FedWatch Tool, there is a 61.5% chance that interest rates will be raised by mid-2022. Earlier, Jerome Powell stated that the Fed would not immediately increase the interest rate after ending the QE policy. However, market players ignored his remarks.

The Federal Reserve has once again pinpointed that the current period of high inflation is transitory. Powell is likely to stick to this scenario while he is still the Fed's chairman. Thus, investors should not expect any imminent rate hikes.

Winding down the asset purchase program is likely to push the US dollar upwards in the short and medium term.

USD rally

The dollar is unlikely to increase sharply. The Federal Reserve's move greatly resembles its actions in 2013-2014. Back then, the Fed tapered bond purchases very slowly. The central bank's balance began to decrease only in 2018, when bond-buying slowed down. At that moment, there was a bullish trend with minor corrections in the market.

It is likely the Federal Reserve would exercise caution and be consistent in reducing the monetary stimulus. The market reaction may be muted, and technical corrections are inevitable.

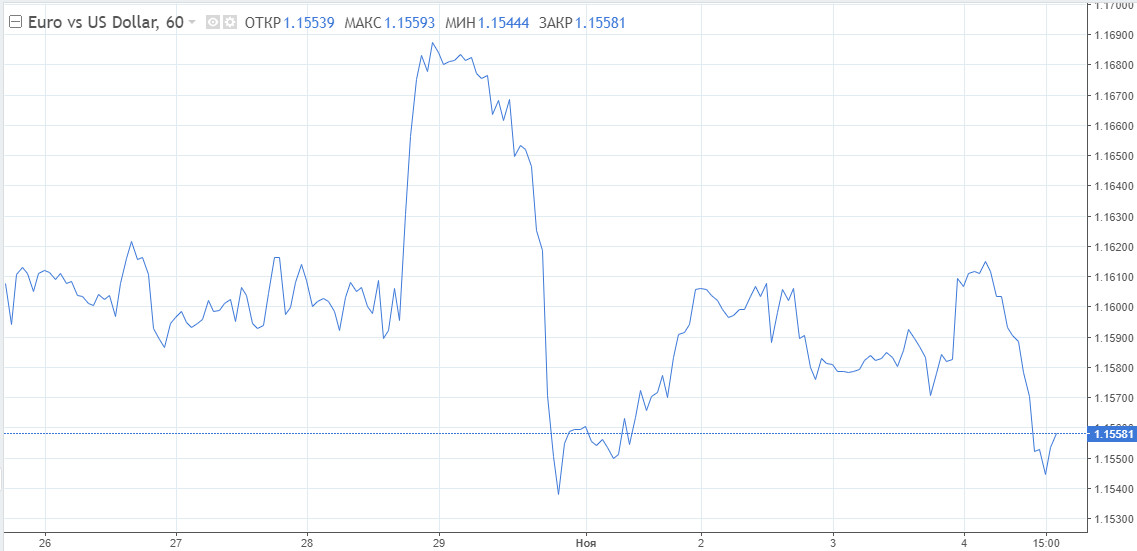

Weak EUR

At this moment, the euro is facing pressure. The European Central Bank refuses to consider raising the interest rate, going against market expectations.

ECB's president Christine Lagarde stated on Wednesday conditions for the interest rate increase would unlikely be fulfilled in 2022. Similarly, ECB's governing council member Pablo Hernandez de Cos said the regulator's recommendations did not confirm market expectations of a rate hike in the third quarter of 2022 or the near future. He was supported by Francois Villeroy de Galhau, who commented that the ECB should not hike interest rates in the following year.The euro is facing additional pressure from weak European macroeconomic data. The Composite PMI fell in October to 54.2 from 56.2 in September. It is the lowest level in 6 months.

Today, markets are trading under the influence of the Fed's meeting and are awaiting US labor market statistics set to be released on Friday. After last month's disappointing data, it is forecasted non-farm payrolls would rise in October to 450,000, twice the amount of 194,000 jobs recorded in September.

However, the ADP Non-Farm Employment Change report released on Wednesday suggests October payrolls would not meet market expectations.

The euro has attempted to recover, but these attempts would be further limited to a downward correction, as observed today. The fundamental picture favors the dollar.

The first target for bears is the yearly low of 1.1524. A breakout below this level would encourage sellers to overcome the psychological level of 1.1500. The next target is 1.1440.

The resistance levels are seen at 1.1600, 1.1620 and 1.1670.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română