Monday's volatility remained at low levels after a slight turmoil on Friday. The yields of T-bills changed slightly, and there are fluctuations in stock indices within small limits without any definite direction. At the same time, the markets barely reacted to the adoption by the US Congress of law on additional infrastructure spending in the amount of $ 550 billion.

Fed members are starting discussions about the prospects for inflation again. Clarida said that he expects a decrease in the surge in inflation this year since the imbalance of supply and demand will disappear over time. Evans voiced the same point of view, but on the contrary, Bullard from the St. Louis Fed is hawkish and expects 2 rate hikes next year. There is no consensus and there are no benchmarks for the markets either.

In general, the positive growth has so far been supported by the dynamics of commodity prices, so we expect a faster growth of commodity currencies.

NZD/USD

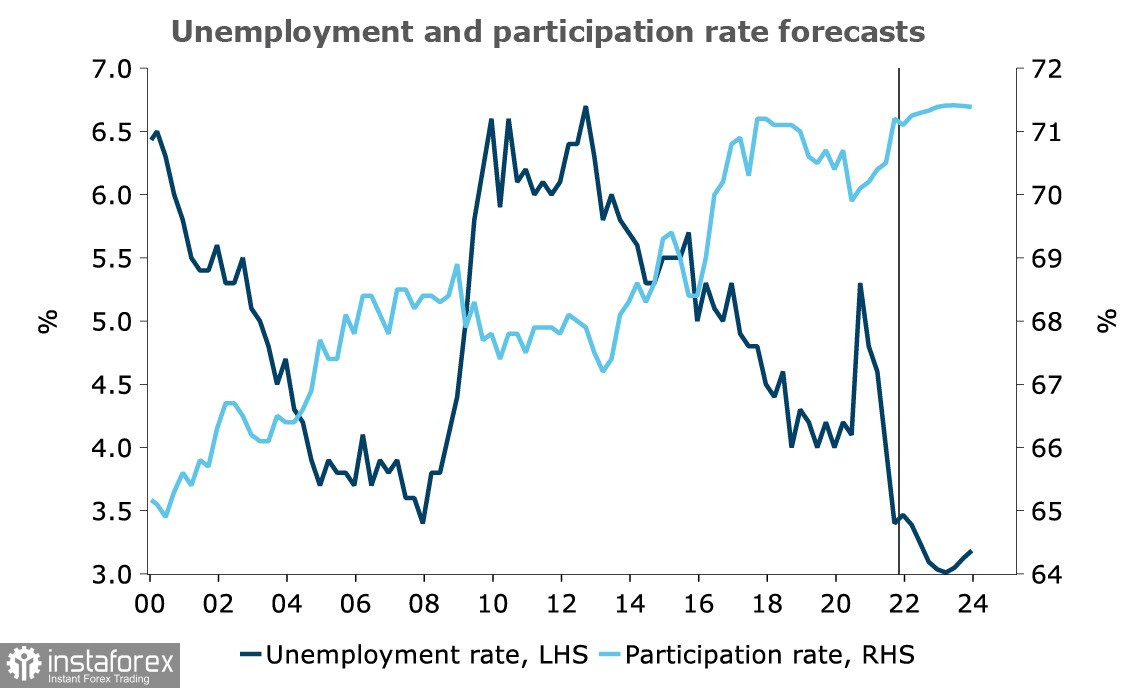

New Zealand's economy continues to recover at a high rate. The labor market looks better than it has since research began in 1986. The unemployment rate has fallen to a record 3.4%, while it is predicted that it will fall to 3% at the end of 2022, that is, the decline in unemployment at current levels will not be completed.

The trend suggests that average wages will increase sharply next year as employment growth outpaces labor force growth, and this trend is expected to continue.

As for RBNZ, the situation looks quite clear. They did not expect that unemployment would decline below 3.8%. The forecasts were much more modest and considering the inflation growth, which will reach the level of 6% in the 1st quarter of 2022 according to forecasts, there is every reason to assume that the RBNZ will continue to aggressively raise the rate. Moreover, there is a growing probability that the RBNZ may raise the rate not by 0.25%, but by 0.50% before the end of the year, which will make the NZD the most profitable currency of the G10.

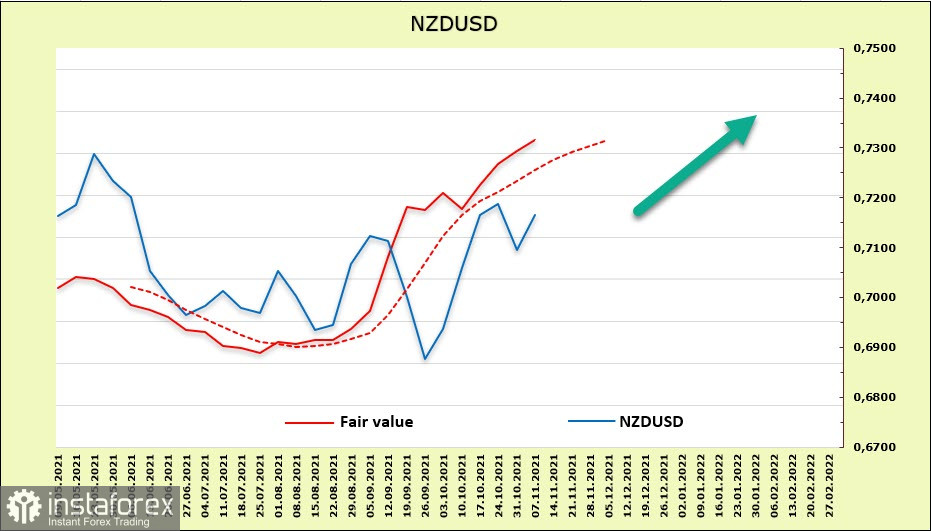

According to the CFTC report, the net long position rose by 348 million, reporting to 986 million over the reporting week. The dynamics of T-bills yields are also clearly in favor of the New Zealand dollar. As the estimated price goes further up, there are clear signs of prospects for further growth of NZD/USD.

We expect that there will be another attempt to break through the resistance zone of 0.720010 in the very near future, which has a good chance of being successful. After that, the targets of 0.7312 and 0.7460 will be considered.

AUD/USD

The latest research on the state of the Australian economy looks noticeably more optimistic than a month ago. The partial lifting of restrictive anti-science measures led to a strong increase in optimism and business activity, capacity utilization increased to 81.5%, forward orders noticeably went up, and both indicators became above average again. Business conditions rose by 6p to +11p in October, exceeding the long-term average. All components of the index recovered.

The increase in the purchase price of enterprises has reached a record over the past ten years (2.7% q/a), the growth in labor costs is also growing in October. Everything indicates that consumer inflation, which usually lags slightly behind production prices, will also resume growth.

The analysis of the dynamics of the national debt and the balance of the RBA, conducted by the NBA bank, suggests that the deficit by the end of the year will be much smaller than predicted a month ago (the forecast was 5%, 3.3% is expected). The situation has become much better for the RBA, which increases the chances of an earlier exit from support programs.

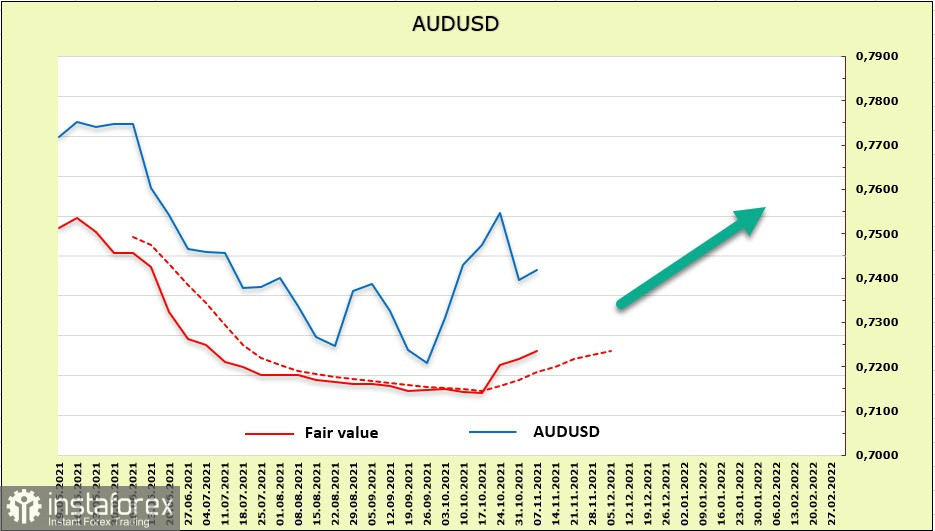

Despite the rather optimistic fundamental data, traders are not in a rush to reduce the short position on the Australian dollar. The weekly change is only +36 million and the bearish advantage is still significant (-5.609 billion). At the same time, the signs of a reversal are becoming stronger, which is especially noticeable in the dynamics of yields. Here, the reversal of the estimated price upwards is fundamentally justified.

It can be assumed that the reversal has taken place, which means that the support level of 0.7363 is unlikely to be updated in the medium term. It is advisable to try reducing it for purchases. The target is the resistance zone of 0.7550/70, the chances of exiting this channel upward have increased.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română