About a year ago, Pfizer announced the development of a vaccine against COVID-19, which improved market sentiment. Many assets, including stocks and commodities, have been able to advance considerably despite the emergence of new strains of the virus, the pandemic situation in India, and AstraZeneca's vaccine investigation. Gold was not on this list. It lost about 3% of its value. Only in November, the price managed to recoup some of its early losses.

Many analysts were surprised that XAU/USD failed to resume bullish momentum amid rising inflation and the QE program.

Among the 10 major central banks, only the Reserve Bank of New Zealand raised the key rate and the Bank of Canada abandoned QE. Other banks are still reluctant to tighten monetary policy. Naturally, they want to curd growing inflation. Yet, they are worried that this may lead to stagflation and even trigger a recession. So, the Bank of England initially made hawkish statements hinting at interest rates hike. However, during the meeting, it maintained a dovish stance and did not raise the interest rate. Market participants were disappointed by this decision.

Apart from that, this decision affected the global debt market. US Treasury yields dropped following UK government bonds. As many analysts expect inflation to rise higher in the US, a decrease in the nominal key rate led to a fall in the real one. As a rule, it is bullish for XAU/USD.

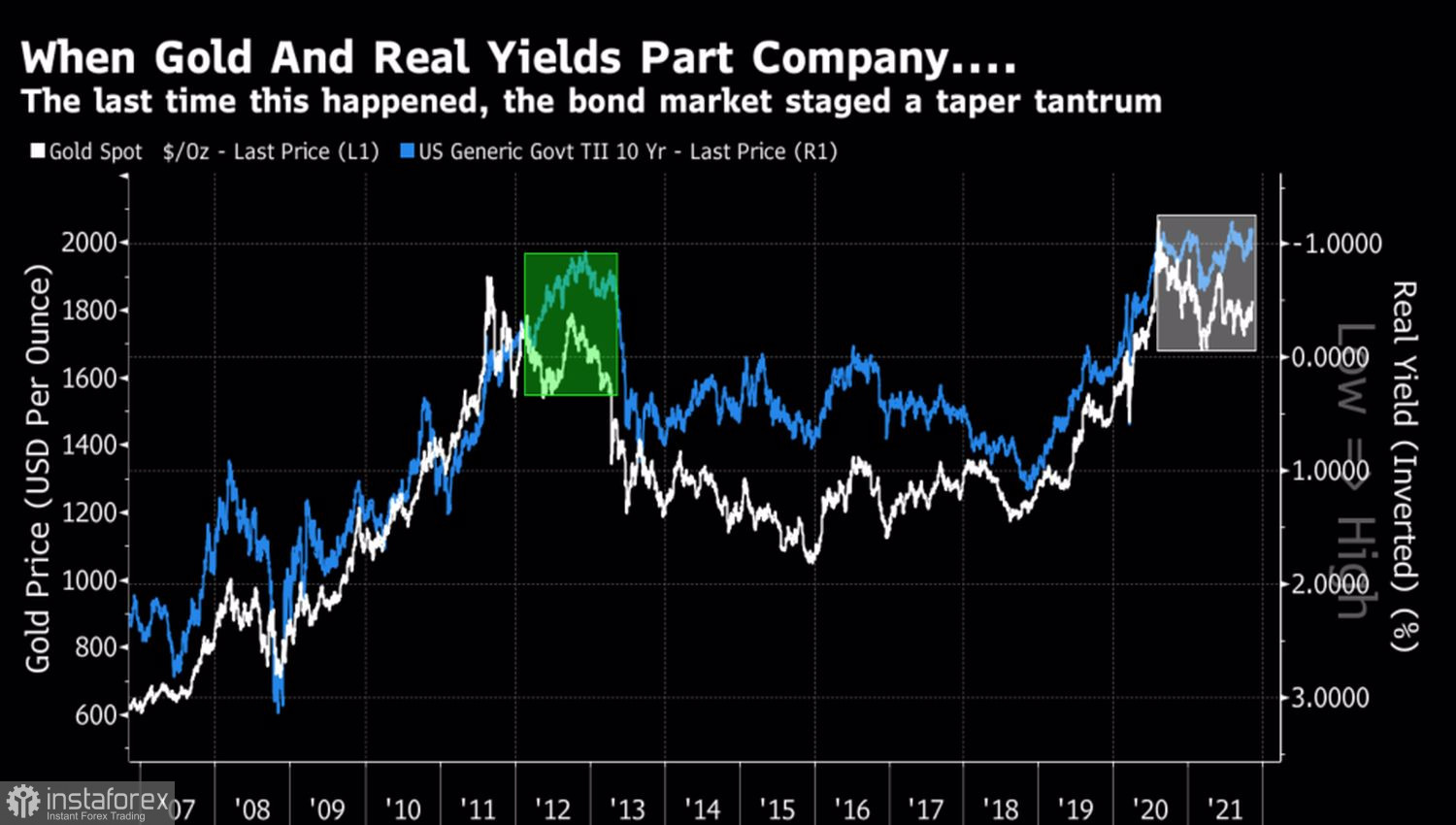

Price dynamic of gold and US Treasury yields

However, there are exceptions to any rules. In 2012 - early 2013, when the key rate remained low during the quantitative easing, gold has been falling. Then, in 2013, bears took the upper hand due to the panic in the market. Now, the real key rate on debt obligations remains at a low level. Attempts of gold to regain momentum are rarely successful. Should traders expect a collapse in 2022?

Time will show. The main reason for the rally in November was the refusal of the Bank of England to raise the key rate. It caused a reduction in debt rates and the strengthening of assets vulnerable to changes in the debt market, including gold. The fact is that the BoE's actions are unlikely to have a prolonged effect on hedge funds and other investors. If the Fed starts aggressively tightening monetary policy due to high inflation, US Treasury yields will roar. This is why data on US consumer prices for October is of great importance. Bloomberg analysts expect inflation to grow to 5.8% year-on-year and by 0.6% month-on-month. If the figure turns out to be higher, gold may face a strong bearish pressure.

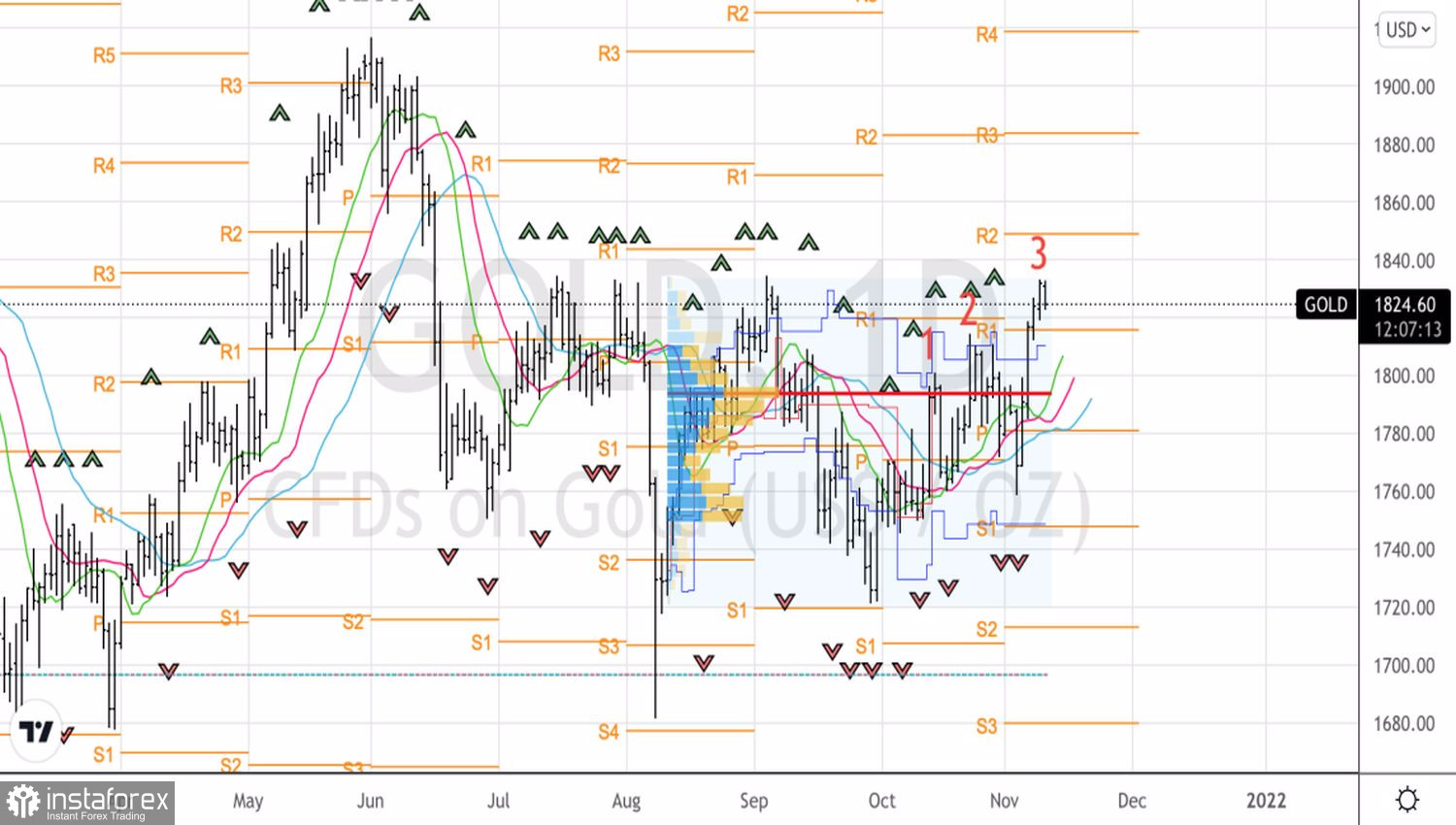

Technical indicators signal the formation of the reversal pattern Three Indians. It indicates that bulls have pushed the gold price too high. So, the drop may be rather steep. If the quotes break through the pivot levels of $1,820 and $1,815 per ounce, gold may edge lower to $1,795.

Daily chart

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română