Major US index futures are trading quietly on Monday morning, after the 5-week uptrend of the S&P 500 came to a close. The Dow Jones futures gained 102 points, the S&P 500 added about 10 points, the NASDAQ - 38 points.

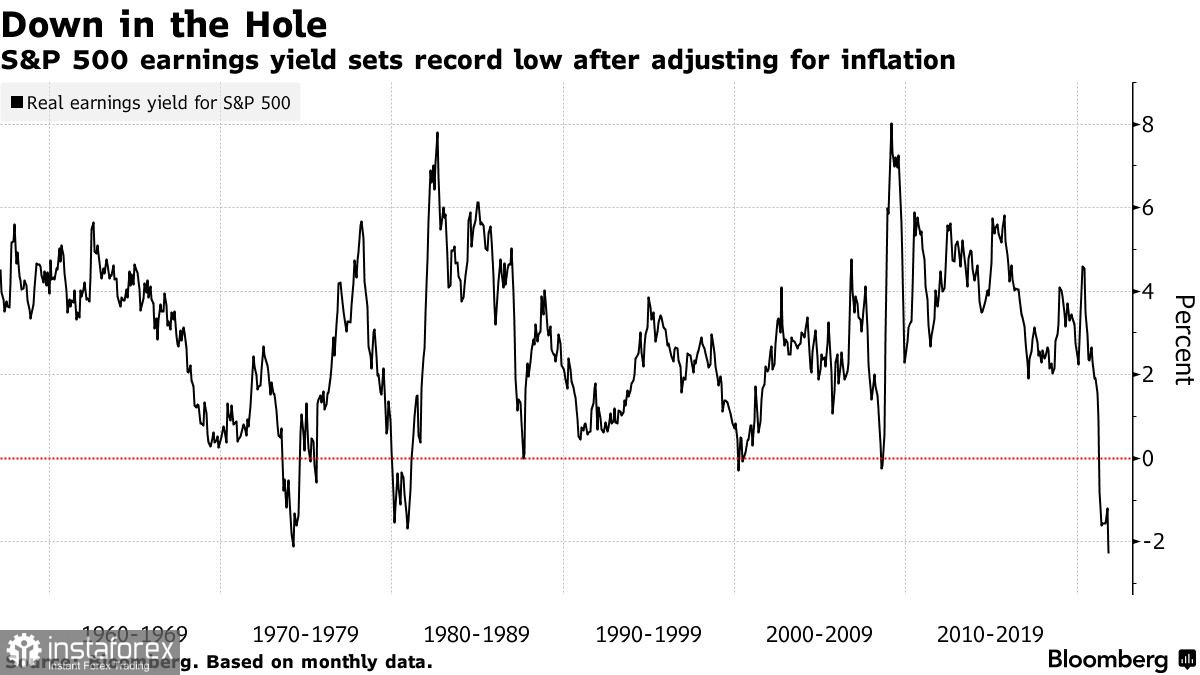

Some stock market traders cashed in on the last week's US inflation data, apprehensive about a more hawkish course from the currently passive Federal Reserve. The annual inflation rate reached the highest level since 1990. The CPI rose by 6.2% year-on-year in October compared to 5.9% in September, surpassing market expectations. Recent economic news suggest prices may rise even further.

US bond yields went up as investors sell treasuries, expecting the Fed to raise the interest rate earlier than expected next year to tackle the "transitory" high inflation.

This week, the markets eye the data on US retail sales, which could decrease by the end of the year due to the high inflation rate. Reports on building permits and housing starts are set to be released on Wednesday. The Fed's QE policy has significantly boosted real estate prices, which could affect these indicators. Furthermore, several speeches by the Federal Reserve's officials could influence the market trend.

US president Joe Biden is expected to sign the bipartisan social spending and infrastructure package, which may serve as a bullish signal for investors.

Shares of Tesla fell by 2% during the Monday's premarket, following a Twitter argument between Elon Musk and US Democrat senator Bernie Sanders. The CEO of Tesla replied to a Sanders's post calling for higher taxes for the rich, asking if Musk should sell more of his stock. Last week, Elon Musk sold 10% of his stake in Tesla after asking the opinion of his followers in a Twitter poll.

Shares of ExxonMobil and other commodity companies went down during the premarket after West Texas Intermediate prices had decreased by more than 1% during morning trading. Traders await Biden's measures to reduce prices of gasoline and other commodities. Earlier, the White House attracted criticism from the public due to the current high inflation.

The S&P 500 is gradually rebounding upward towards its all-time high of $4,718, as investors expect economic improvement by the end of the year, as well a continuing dovish course by the Fed. $4,660 remains the current support level. A breakout of this level would put additional pressure on the index, sending it down towards $4,609 and $4,551. A breakout of the $4,718 level would propel the S&P 500 upward towards $4,750 and $4,775.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română