According to the latest report by the Silver Institute, the demand for silver on the global market this year will reach 1.29 billion ounces for the first time since 2015 when it exceeded 1 billion ounces.

It was written in the report published on Wednesday that the demand for silver will continue to grow until the end of 2021, and industrial demand will clearly prevail.

The Metals Focus analysts who conducted the latest research on behalf of the Silver Institute said that the recovery in industrial demand is likely to lead to this segment reaching a new high of 524 million ounces. According to forecasts, the demand for photovoltaic energy will grow by 13%, which is more than 110 million ounces, and will create a new maximum that will emphasize the global role of silver in green energy.

The report also notes steady investment demand: interest in physical bullion is expected to grow by 34%, or 64 million ounces, to 263 million ounces, which represents a six-year high.

Analysts also noted that Indian demand reflects the economic recovery. In general, physical investment in India will almost triple this year after it collapsed in 2020.

Also in 2021, the demand for paper silver increased. According to forecasts, the volume of funds on exchange-traded funds backed by silver will grow by 150 million ounces by the end of this year.

According to the data, stocks increased by 83 million ounces in 2021 until November 10, resulting in a global volume of 1.15 billion ounces, which is close to the record level of 1.21 billion ounces, which was recorded on February 2.

The report says that the production of silver jewelry, as well as silver products, is expected to increase by 18% and 25%, respectively.

On the supply side, Metals Focus said that production from the mines is forecast to grow 6% to 829 million ounces.

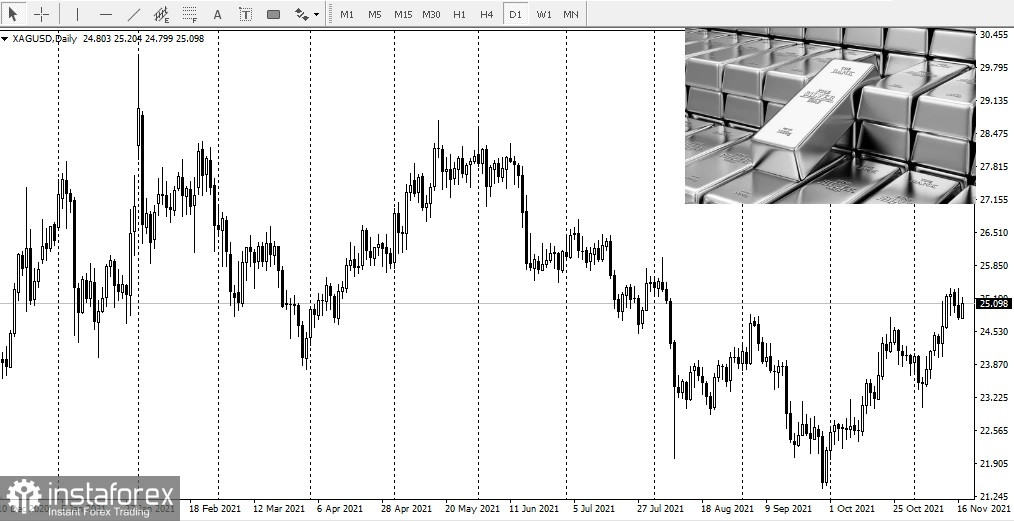

The optimistic demand forecast is due to the resumption of the upward trend in silver prices. Economists noted that precious metals received a new chance of growth after inflation reached its highest level in 31 years.

According to Philip Baker, CEO of Hecla Mining: one billion ounces is just the beginning because investors will continue their search for ways to protect against inflation. The demand for silver will continue to grow, and the market potential over the next 30 years will be 2 billion ounces.

According to Philip Baker, CEO of Hecla Mining: one billion ounces is just the beginning because investors will continue their search for ways to protect against inflation. The demand for silver will continue to grow, and the market potential over the next 30 years will be 2 billion ounces.

To put the increase in demand into perspective, Baker said the world would need seven to ten new mines equivalent to the size of his Green Creek in southeast Alaska. According to forecasts, the mine will produce about 10 million ounces of silver this year. It is one of the largest silver producers in the world.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română