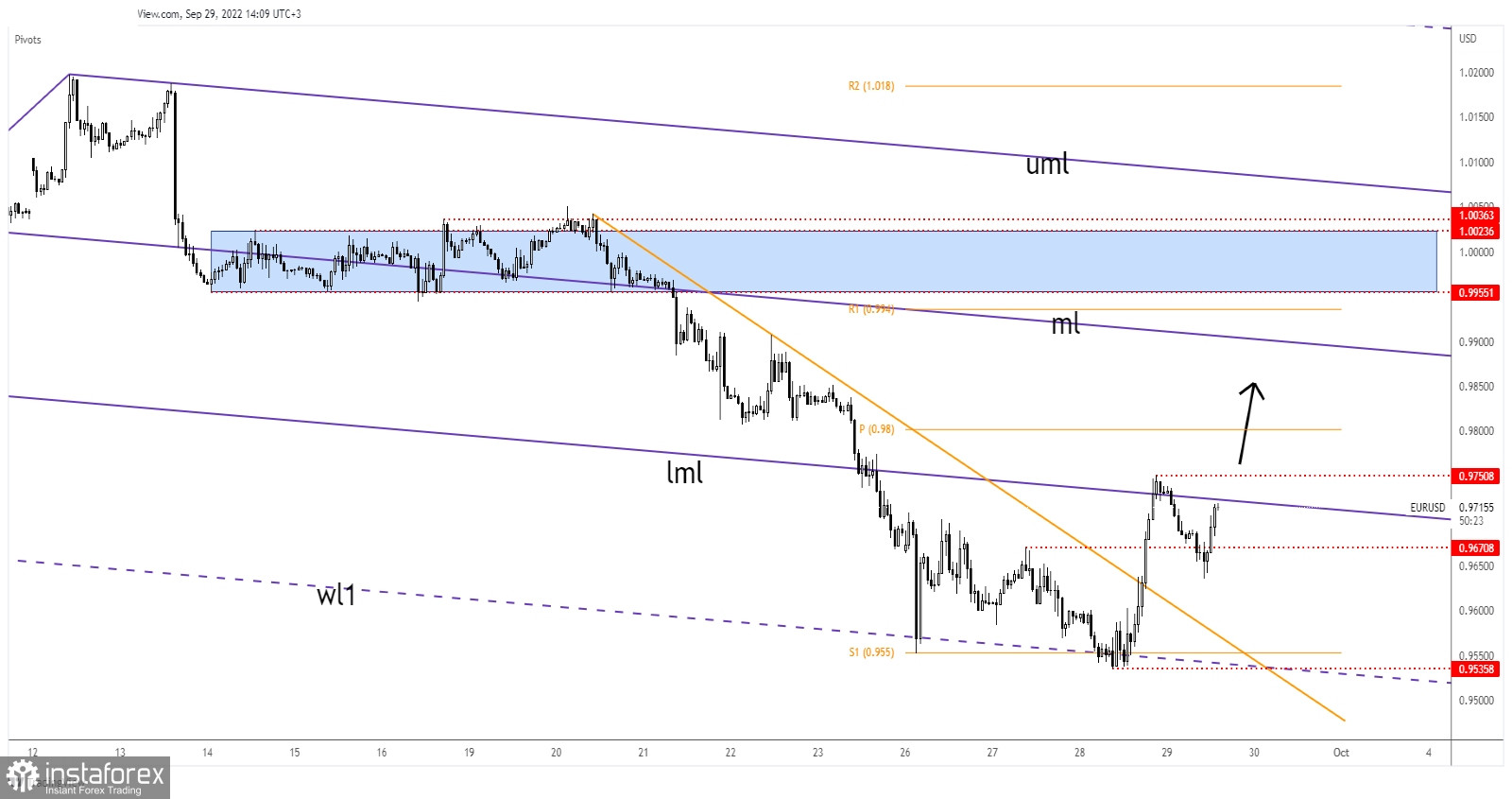

The EUR/USD pair retreated a little today after reaching 0.9750. After its strong growth, a temporary retreat was natural. Now, the rate seems strongly bullish again as the Dollar Index ended its rebound. DXY's deeper drop should push EUR/USD towards new highs in the short term.

As you already know from my analyses, the fundamentals could be decisive today. The US Final GDP may report a 0.6% drop while Unemployment Claims could come in at 215K in the last week above 213K in the previous reporting period. Furthermore, the Canadian GDP is seen as a high-impact event and it could have an impact on the USD as well.

EUR/USD Retested The Buyers!

EUR/USD came back to retest the 0.9670 former high which stands as support. Its failure to stabilize under this level signaled strong upside pressure. Now, it is challenging the lower median line (lml).

The next strong upside obstacle is represented by the 0.9750 former high. Technically, failing to take out the confluence area from around 0.9550 followed by the aggressive breakout through the downtrend line signaled a new swing higher in the short term.

EUR/USD Forecast!

Jumping and closing above 0.9750 could activate further growth and brings new long signals. If this scenario takes shape, the rate could move towards the median line (ml) again.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română