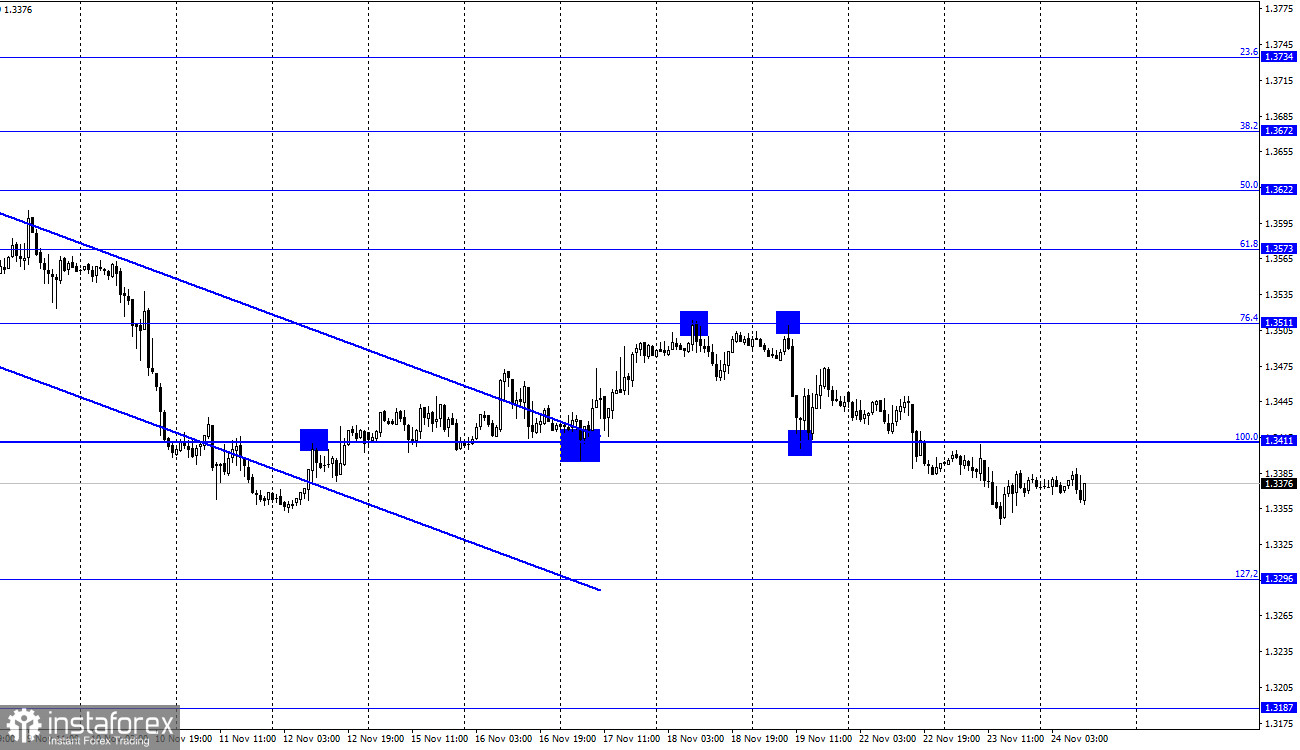

GBP/USD – 1H.

According to the hourly chart, the GBP/USD pair continued the process of falling on Tuesday in the direction of the corrective level of 127.2% (1.3296), after it closed below the level of 1.3411. Thus, the British dollar paired with the dollar also continues a gradual decline. Yesterday was not a bad day for the pound in terms of information. The business activity indices in the UK and the US came out quite contradictory, as some of them turned out to be stronger than last month's values, but at the same time worse than traders' expectations. Therefore, it was very difficult to interpret them unambiguously. Traders did not try to do this. So far, they have enough of the background that they already have at their disposal. In the near future, only the meetings of the Bank of England and the Fed will be of serious importance to them. However, they will be held only next month. The minutes of the last Fed meeting will be released today. If its essence is hawkish, then the US dollar can only strengthen its position.

What do I mean by "hawkish essence"? Any hints that the regulator may tighten monetary policy even more in December. Let me remind you that in November it was announced that the QE program would be reduced by $ 15 billion per month. Thus, in December, it should decrease in volumes to $ 90 billion per month. However, the Fed can make a decision and speed up this process, since inflation in America is growing very fast and makes traders and investors worry. If hints of an acceleration in the pace of QE curtailment are contained in the protocol, this will support the dollar. It will also be very interesting to find out how many members of the Fed support a rate hike next year. If there are more than half of them, this can also be considered a "bullish" factor for the dollar. In the current conditions, the British can only hope that the protocol will be neutral. Also today, the GDP report for the third quarter will be important, but this is not its first publication. Last time the value was +2.0%. This time it may grow to +2.2% sq/sq.

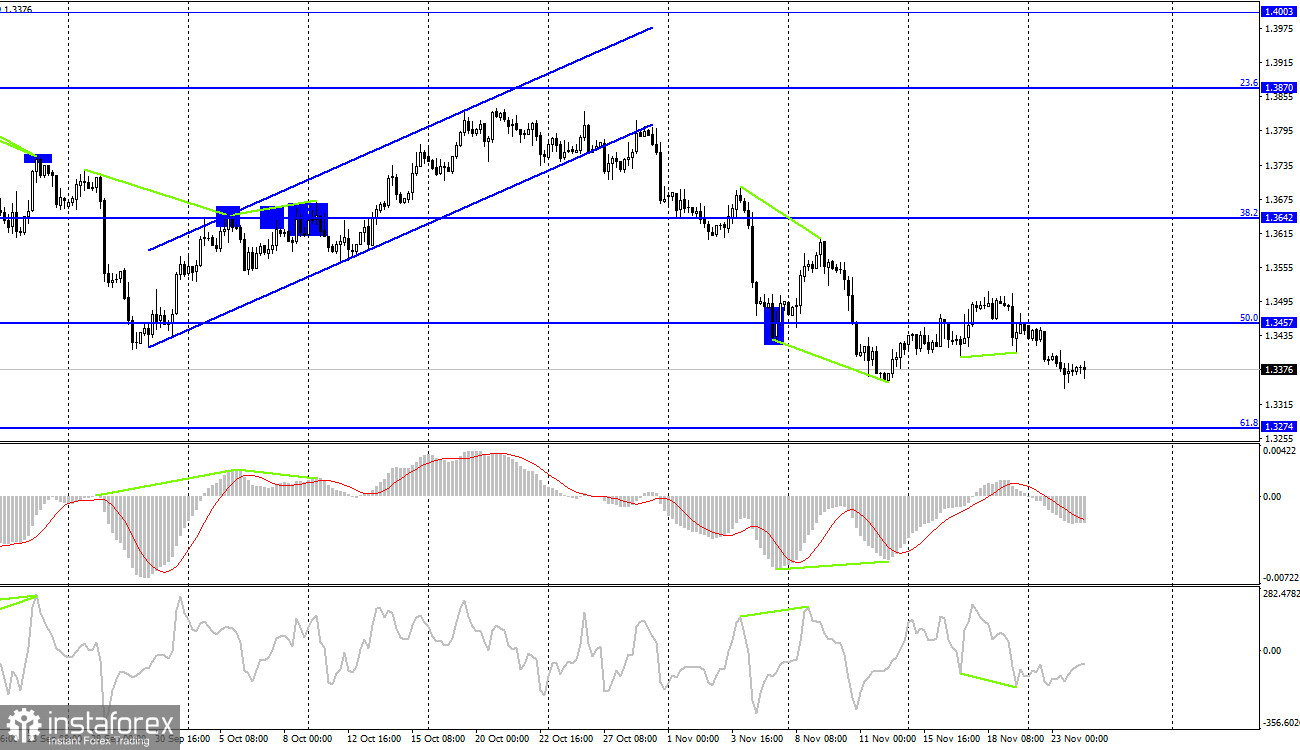

GBP/USD – 4H.

On the 4-hour chart, the quotes of the British performed a reversal in favor of the US currency and closed under the corrective level of 50.0% (1.3457. Thus, the process of falling continues in the direction of the next Fibo level of 61.8% (1.3274). The bullish divergence of the CCI indicator allowed us to count on some growth, but it was canceled. No new emerging divergences are observed in any indicator today.

News calendar for the US and the UK:

US - change in the volume of orders for long-term goods (13:30 UTC).

US - change in GDP volume for the quarter (13:30 UTC).

US - main index of personal consumption expenditures (15:00 UTC).

US - change in the level of spending of the population (15:00 UTC).

US - publication of the minutes of the Fed meeting (19:00 UTC).

On Wednesday, the calendar of economic events in the UK is empty, and in a few hours, important reports will begin to be published in America. Thus, in the afternoon, the activity of traders may increase, and the information background may be strong today.

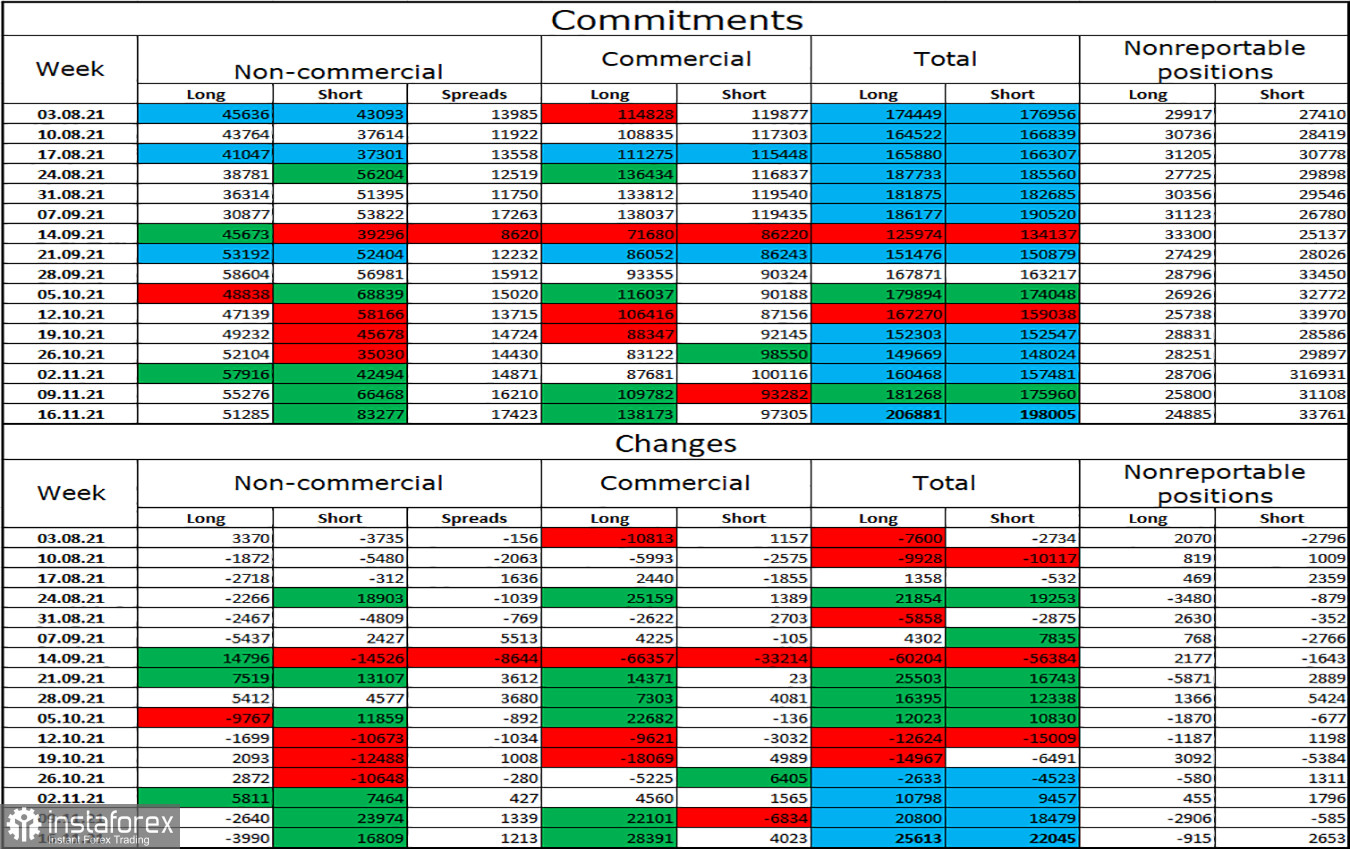

COT (Commitments of Traders) report:

The latest COT report from November 16 on the pound showed that the mood of the major players has become much more "bearish". In the reporting week, speculators closed 3,990 long contracts and opened 16,809 short contracts. I note that this is the second week in a row when the number of short contracts is growing strongly. In total, in two weeks, speculators opened about 40 thousand such contracts. But a week ago, the advantage of long contracts was 17 thousand. However, in recent weeks, speculators do not have any clear mood and then increase purchases, then increase sales, and the total number of long and short contracts for all categories of traders remains approximately the same (206K - 198K). Thus, after several weeks of an active buildup of shorts, a period of increasing longs may come.

GBP/USD forecast and recommendations to traders:

I recommended selling the British dollar if a close is made under the level of 1.3411 with a target of 1.3296. Now, these deals should be kept open. I recommend buying the British when closing above the 1.3411 level on the hourly chart with a target of 1.3511.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy foreign currency not to make speculative profits, but to ensure current activities or export-import operations.

"Non-reportable positions" are small traders who do not have a significant impact on the price.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română