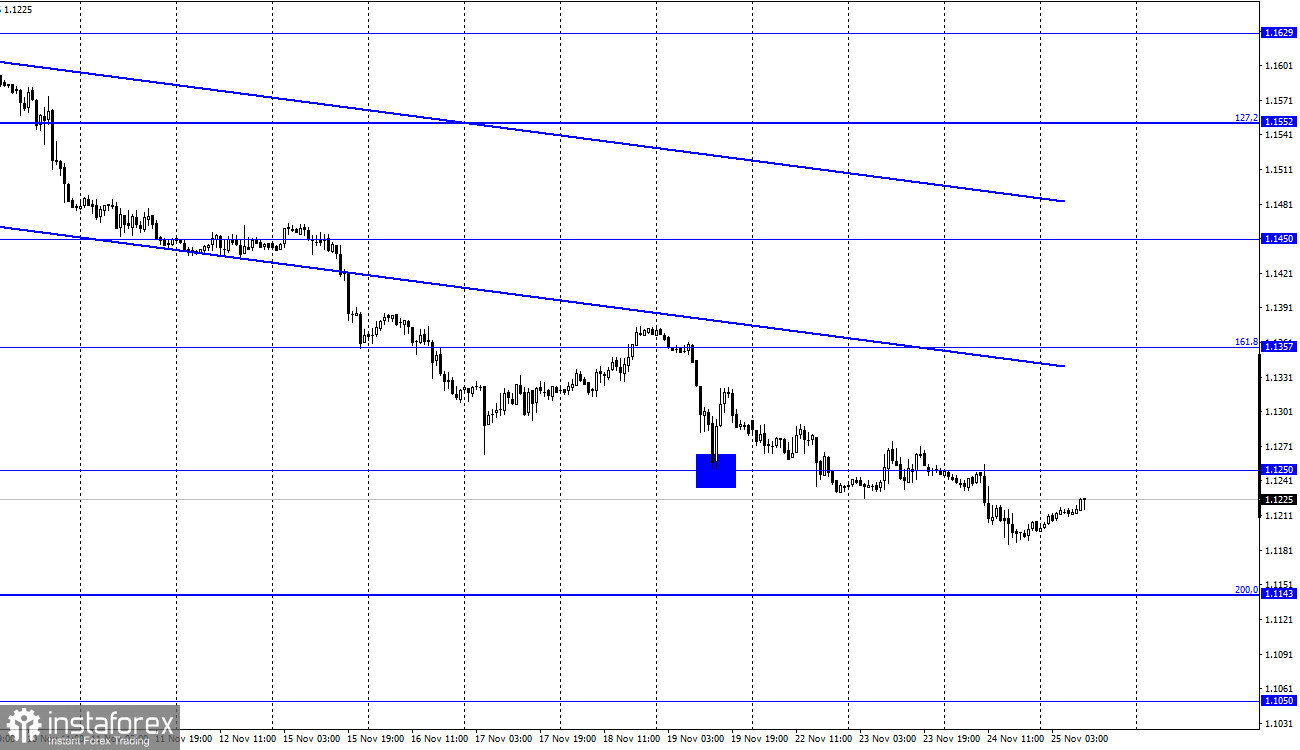

EUR/USD - 1H

On Wednesday, the EUR/USD pair declined below the level of 1.1250. So, the quotes may continue to fall towards the next level of correction at 200.0% - 1.1143. However, tonight there was a trend reversal, so the euro started to rise slightly. Yet, this hardly means that the downtrend is over. The price cannot decline nonstop without a single correction or a pullback. Thus, the current growth looks more like one of such pullbacks. A rebound from the level of 1.1250 will support the US currency and ensure that the downward movement will resume. Yesterday's news background was very strong and informative. There were several important reports in the United States, and the minutes of the FOMC meeting were published. The most important GDP report showed an improvement from 2.0% to 2.1% compared to the previous reading. However, traders expected to see a rise of 2.2% q/q.

The report on durable goods orders turned out to be below expectation as well. At the same time, initial jobless claims came out better than expected. The same was true for the report on US personal income and consumer spending in October. The University of Michigan Consumer Sentiment Index was also slightly above forecasts. In general, this set of news and reports can be described as neutral. Nevertheless, it was perceived as positive by traders. It may also be that traders simply paid no attention to it as the US dollar was still rising. These reports brought no insights to the markets. Obviously, the US economy slowed down in the third quarter, but this did not affect the greenback in any way. Thus, the downtrend in the euro may continue until the next important event. For instance, traders are now looking forward to the next Fed's meeting, especially after yesterday's minutes of the FOMC meeting.

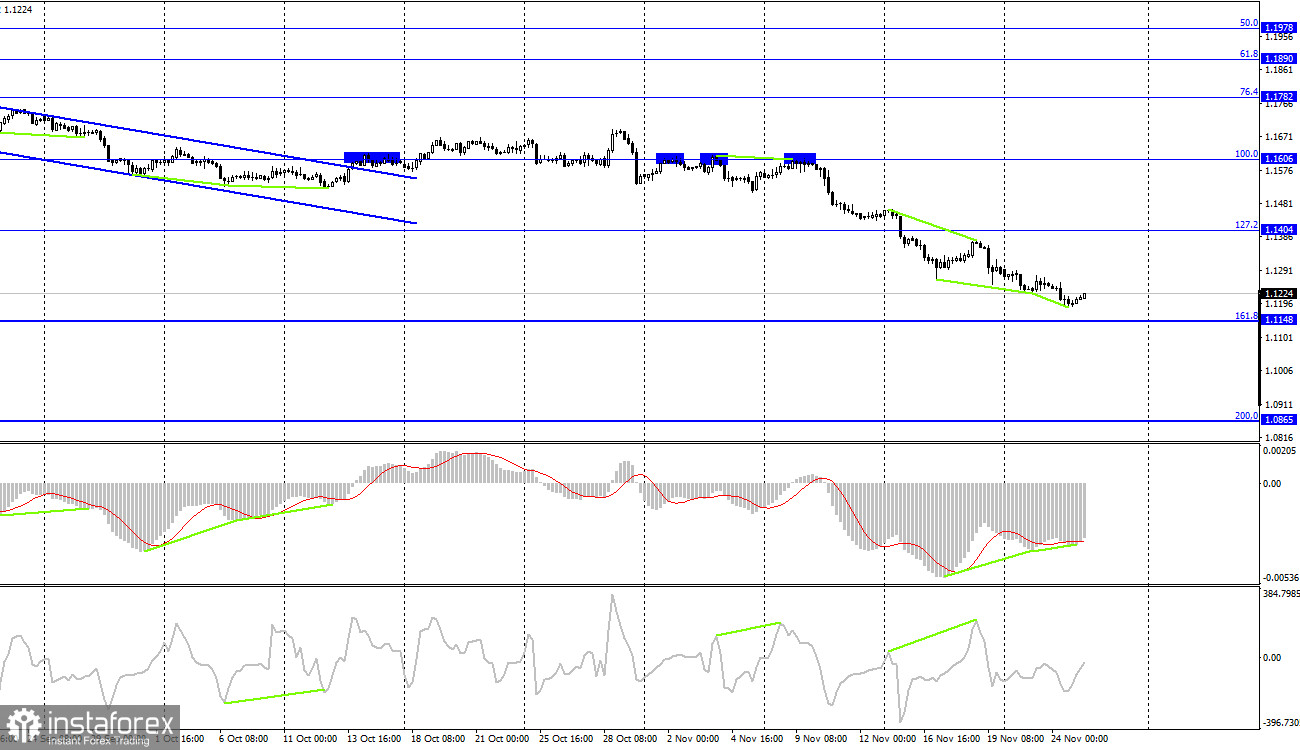

EUR/USD - 4H

On the 4-hour chart, the pair continues to fall towards the correction level of 161.8% - 1.1148. The bullish divergence of the CCI indicator suggested further growth in the direction of the correction level of 127.2% - 1.1404. Instead, the pair continues to slide to the downside, disregarding correction levels and divergences. The second bullish divergence may repeat the fate of the first one. A rebound from the level of 161.8% will validate the pair's growth. Closing below this level will indicate that the quote is more likely to decline towards the next correction level of 200.0% - 1.0865.

Economic calendar for US and EU

European Union - ECB President Christine Lagarde speaks (13-30 UTC).

On November 25, ECB President Christine Lagarde will give a speech. That is all regarding events in the EU. As for the US, its economic calendar has nothing interesting today. Thus, the information background will be weak on Thursday.

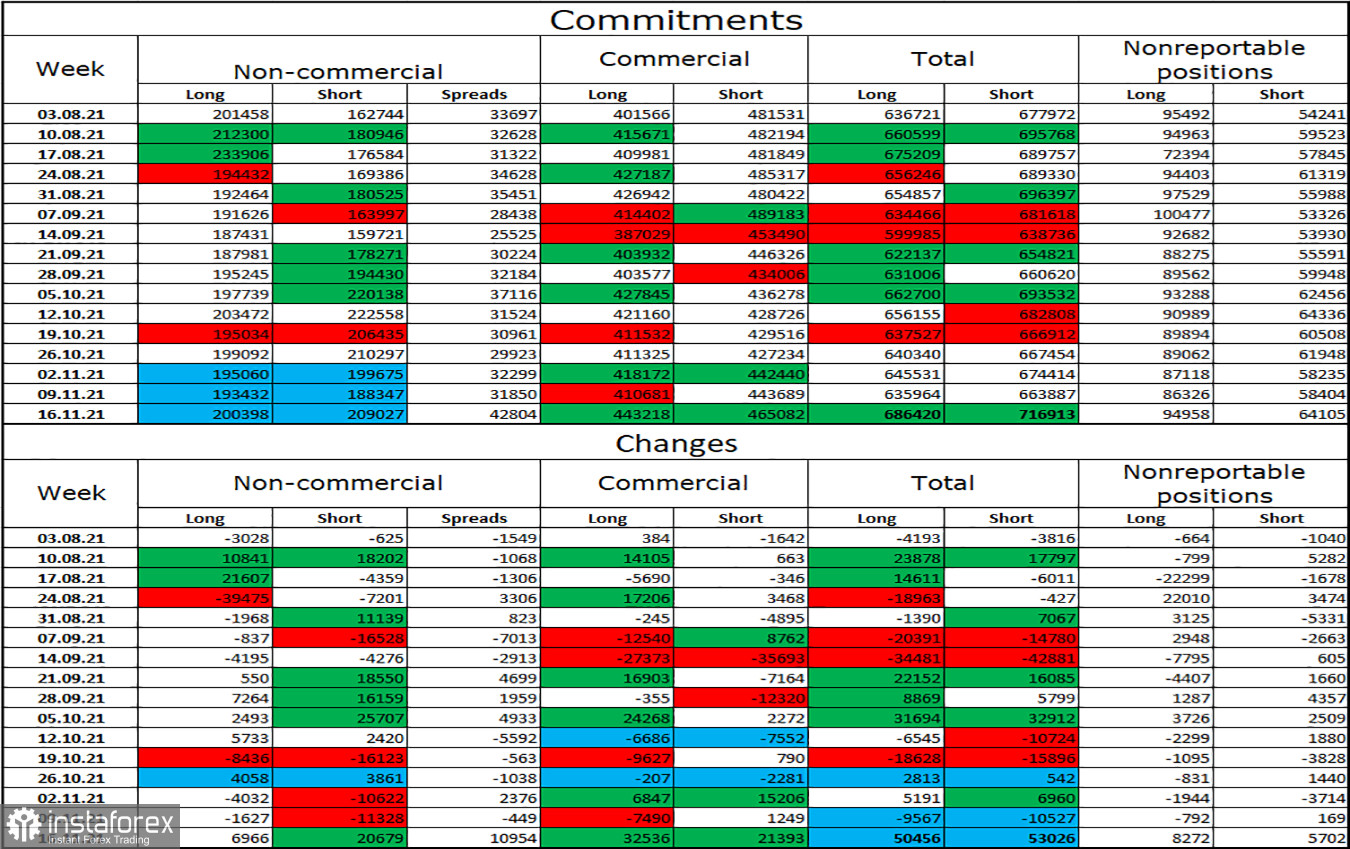

COT (Commitments of traders) report

The latest COT report showed that the non-commercial category of traders became more bearish on the pair in the reporting week. Thus, speculators opened 6,966 long contracts and 20,679 short contracts on the euro. So, the total number of long positions increased to 200,000 and 209,000 for short positions. This amount has been almost the same for the third week in a row. So we can assume that the market sentiment is not certain yet. In general, the bearish trend has been strengthening in recent months. I can conclude that neither bulls nor bears have an advantage in the market. At the same time, the European currency continues to decline. Therefore, it will be right to say that the bearish bias still prevails.

Outlook and trading tips for EUR/USD

I recommend selling the pair when the price closes below the level of 1.1250 with the target at 1.1148. Short positions should be kept open for now. I recommend buying the euro when the price rebounds from the level of 1.1148 on the 4-hour chart with the targets set 50-100 higher.

Definitions:

Non-commercial traders are large market players, including banks, hedge funds, investment funds, private, and large investors.

Commercial traders are commercial enterprises, firms, banks, corporations, companies that buy currency not to obtain quick profit, but to ensure current activities or export-import operations.

Non-reportable category of traders refers to small speculators who do not have a significant impact on the price.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română