Wave pattern

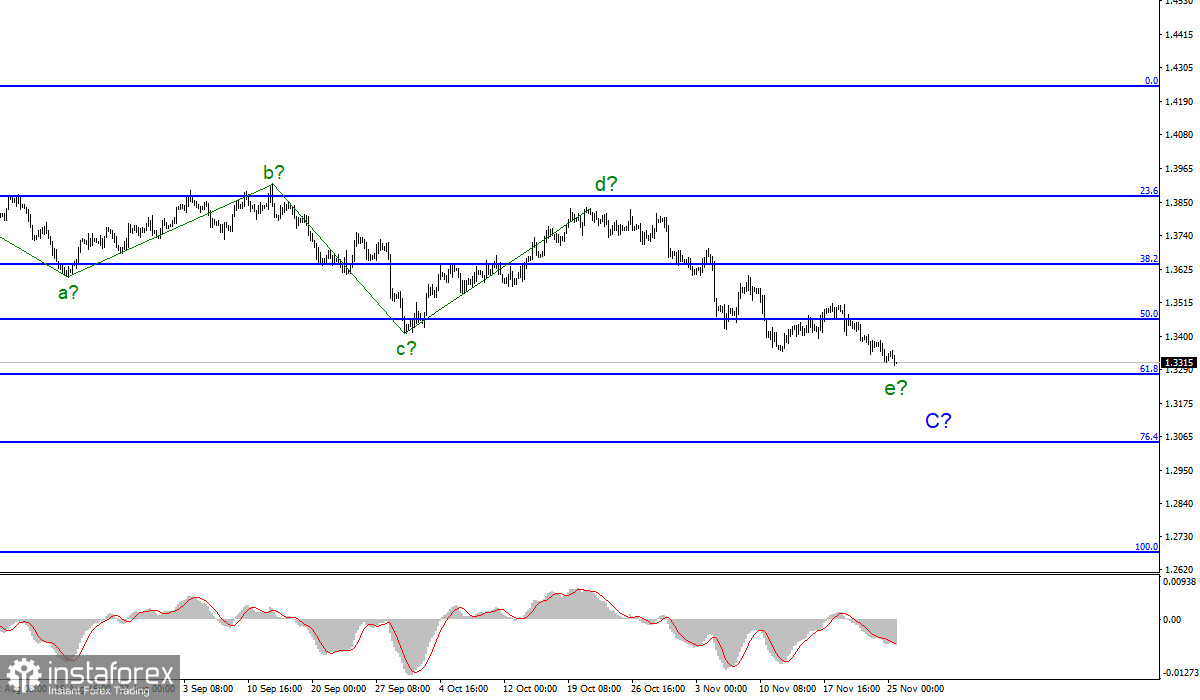

For the pound/dollar pair, the wave marking continues to look quite complicated. At the same time, it is quite comprehensive. Five internal waves are visible inside the last wave C. Each subsequent one is approximately equal in size to the previous one. However, since all the waves in the composition of C or A are almost equal in size, the last wave e may already be nearing its completion. I thought it was already completed. However, the decline in the quotes in recent days has led to a complication of its internal wave structure. Now, the pair may keep dropping to the target levels located near 1.3271, which corresponds with the Fibonacci retracement level of 61.8%. For the euro/dollar instrument, a downward wave is also nearing its completion, which may be the last in the entire downward structure. Thus, both instruments can complete the construction of the downtrend sections at the same time. This scenario will be irrelevant if some unexpected news interferes or demand for the US dollar declines.

Outlook for the pound sterling remains the same. FOMC meeting minutes may only intensify bearish momentum. Conclusion

On Thursday, the pound/dollar pair rose by 30 pips and then decreased by 50. Traders continue to sell off the pound sterling, which ensures the construction of a downward wave. Today, the economic calendar for both currencies is empty. Trading floors in the US are closed on the occasion of Thanksgiving Day. Andrew Bailey will give a speech but traders will be focused on the Fed's minutes, which was released a day earlier in the evening. In the minutes, several members of the FOMC said that it is necessary to accelerate the pace of QE tapering and start raising the interest rate faster than planned. It is not reported exactly how many Fed members chose a hawkish approach. If it is the majority, the US dollar may grow even higher. There was nothing else interesting in the protocol. This document is quite formal and it rarely contains some facts. On Friday, the economic calendar will also be uneventful. The pound sterling may reach the level of 1.3271. At this level, the construction of a descending wave can be completed.

Conclusion

The wave pattern of the pound/dollar pair looks quite comprehensive now. The wave e may be nearing its completion but it has not yet been completed. Now, traders are anticipating the completion of this wave near the 61.8% Fibonacci retracement level. An unsuccessful attempt to break through this level may lead to the construction of a new upward wave or even a new upward section of the trend. Until then, it is recommended to stick to short trades. The breakout of 1.3271 will offer an opportunity to open short positions.

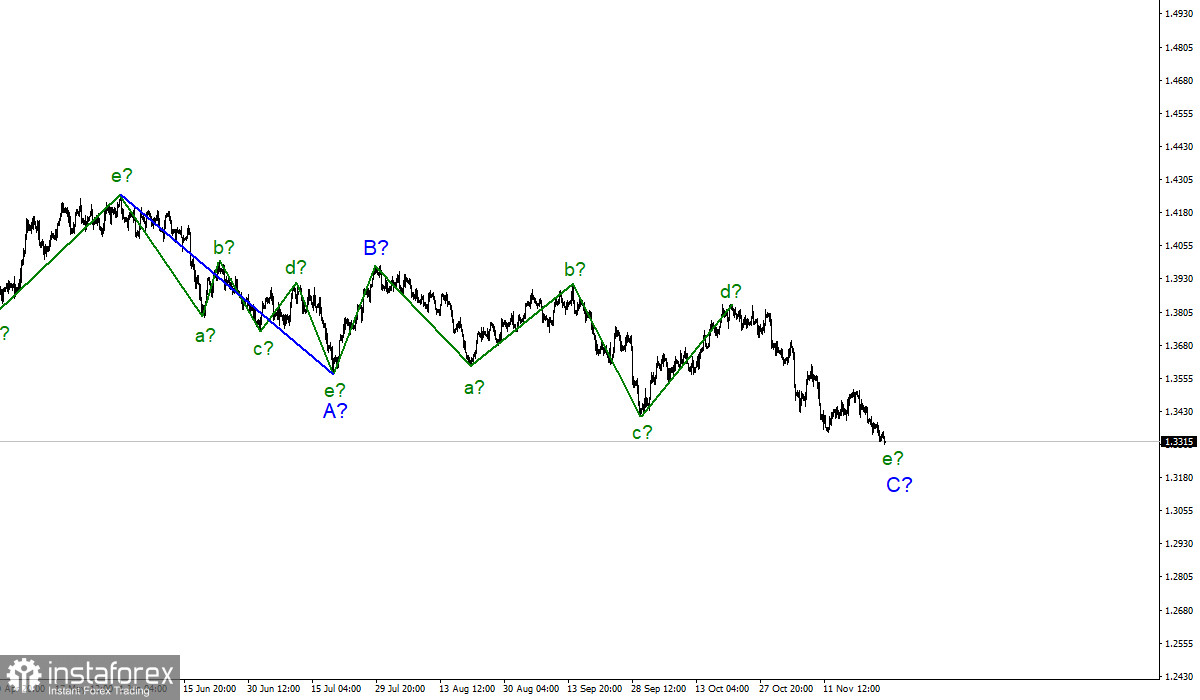

Large timeframe

Starting from January 6, the construction of a new downward trend section began, which may turn out to be almost any size and any length. Wave C may be nearing its completion but there is no confirmation of this yet. The entire downward section of the trend may be extended but there are also no signals about this.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română