To open long positions on GBP/USD, you need:

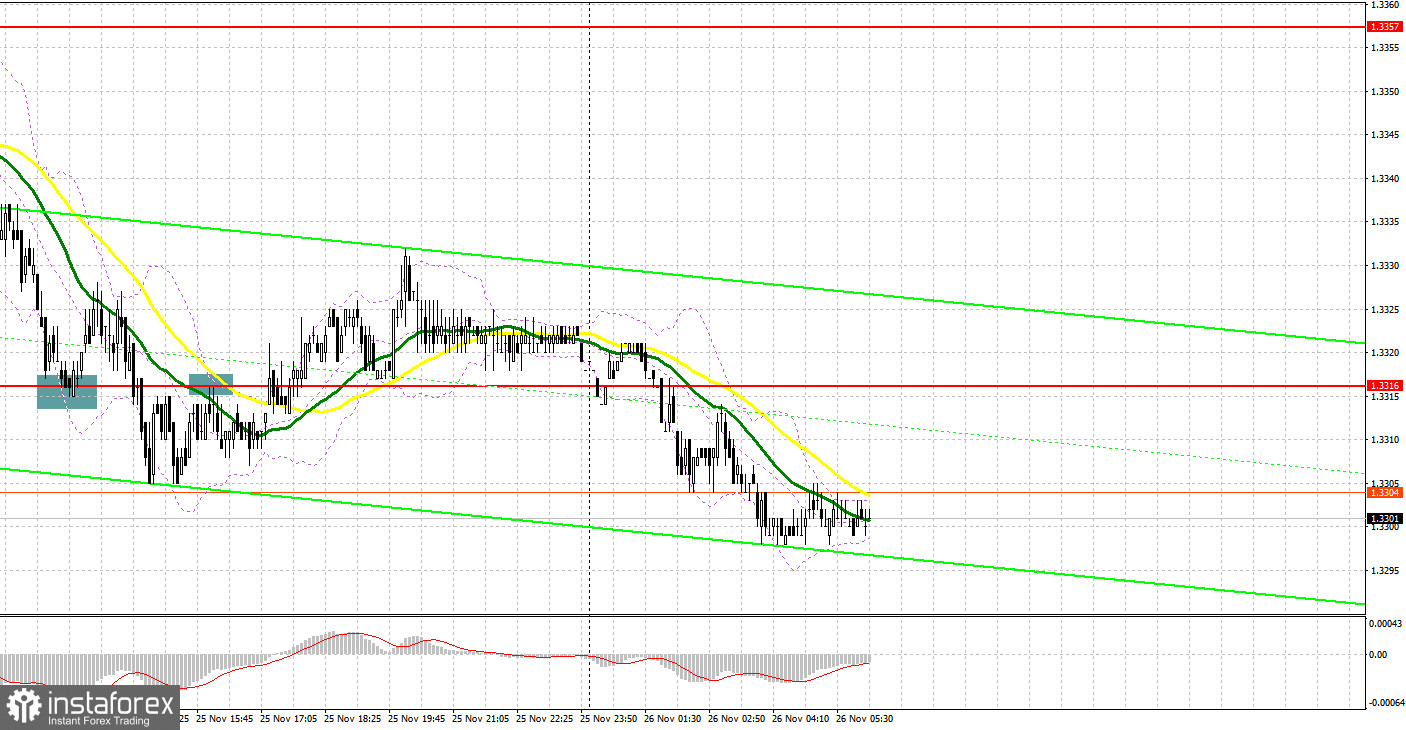

Even in spite of the low volatility and trading volume, several signals to enter the market were formed yesterday. However, they can hardly be called profitable, since I did not wait for a special movement towards entering the market. The formation of a false breakout at 1.3316 led to long positions on the British pound, but after moving up by 15 points, the growth slowed down, and after a while the bears achieved a breakdown and consolidation below 1.3316. This scenario led to the formation of a good point to sell the pound, but people were not willing to open short positions on the pair during Thanksgiving in the US.

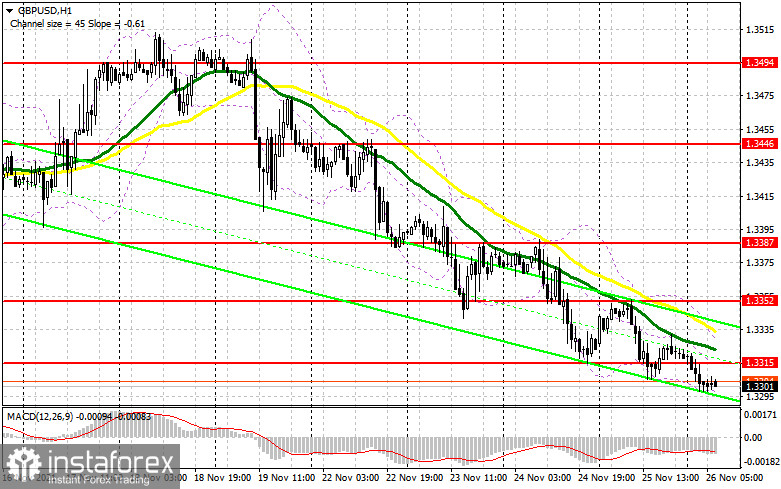

Today again there are no fundamental statistics on the UK and most likely the bulls will try to take advantage of this, although yesterday it did not benefit the pound. Much will depend on the bulls' behavior at 1.3315, where the moving averages, playing on the side of the bears, pass. Only a breakthrough of this area and a test from top to bottom will lead to the formation of a good entry point into long positions with the prospect of stopping the bearish trend and restoring GBP/USD to the 1.3352 area. The statements of the Bank of England representatives, who are speaking today, are unlikely to have a positive effect on the pair, however, in case of hints of a more active reduction of the bond buying program, the bulls could quickly deal with 1.3352, taking the path to a high of 1.3387. I recommend taking profit there. In case the pound falls during the European session, I advise you to open new long positions only on a rebound from the large support at 1.3264, since in my opinion there is "emptiness" to this level, and it is unlikely that someone serious will come out in defense of the British pound at the end of this week. From 1.3264 we can count on an upward correction of 20-25 points within the day.

To open short positions on GBP/USD, you need:

So far, the bears are doing an excellent job with their tasks, updating lows every day - this keeps the pair's downward trend, not allowing the bulls to offer anything in return. The best option to sell GBP/USD today would be to protect and form a false breakout at 1.3315, to which bulls are now trying to return the pound after a slight decline in the pair during the Asian session. There are moving averages that play on the bears' side, which will obviously benefit them. All this will lead to the formation of a new entry point into short positions with a subsequent decline to the area of the next low of 1.3264, where I recommend taking profits. It is hardly possible to count on a larger drop in the pound today. The next target will be the low of 1.3227. In case the pair grows during the European session and the bears' activity is weak at 1.3315, and it is quite possible that the bulls will take advantage of the lack of fundamental statistics and low trading volume, it is best to postpone selling to a larger resistance at 1.3352. I advise you to open short positions immediately on a rebound from 1.3387, or even higher - from a new high in the 1.3446 area, counting on the pair's rebound down by 20-25 points within the day.

I recommend for review:

The Commitment of Traders (COT) reports for November 16 revealed that short positions sharply increased and long positions decreased, which led to an increase in the negative delta. Good data on the recovery of the UK labor market, increased inflationary pressures and higher retail sales - all this saved the British pound last week and gave the bulls a chance for the pair to continue to rise. However, the aggravation of the situation with the coronavirus in the European part of the continent and the statements of representatives of the Bank of England that no one would rush to change the course of monetary policy in the current conditions - all this very quickly returned the pressure on the pair by the end of the week. An important point is the unresolved issue around the protocol on Northern Ireland, which the UK authorities are planning to suspend in the near future. To this, the European Union is preparing to introduce certain countermeasures - which does not add confidence to the bulls of the British pound. At the same time, in the United States of America, we are witnessing a rise in inflation and increased talk about the need for an earlier increase in interest rates next year, which is providing significant support to the US dollar. However, I recommend sticking to the strategy of buying the pair in case of very large declines, which will occur against the background of uncertainty in the central bank's policy. The COT report indicated that long non-commercial positions declined from 54,004 to 50,443, while short non-commercials rose from 66,097 to 82,042. This led to an increase in the negative non-commercial net position: delta was -31 599 against -12,093 against a week earlier. The weekly closing price collapsed as a result of the Bank of England's policy from 1.3563 to 1.3410.

Indicator signals:

Moving averages

Trading is carried out below 30 and 50 moving averages, which indicates a downward trend for the pair.

Note: The period and prices of moving averages are considered by the author on the H1 hourly chart and differs from the general definition of the classic daily moving averages on the daily D1 chart.

Bollinger Bands

In case of growth, the upper border of the indicator at 1.3325 will act as a resistance.

Description of indicators

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 50. It is marked in yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 30. It is marked in green on the chart.

- MACD indicator (Moving Average Convergence/Divergence — convergence/divergence of moving averages) Quick EMA period 12. Slow EMA period to 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-commercial speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between short and long positions of non-commercial traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română