The Bank of England is in no hurry to tighten monetary policy

Hi everyone!

In today's review of the GBP/USD pair, we are going to discuss the BoE's stance on monetary policy as well as the possible trajectory of the pair. Like the Fed and the ECB, the Bank of England is also mulling over a possible tightening of monetary policy. The regulator wants to curb rising inflation after the beginning of economic recovery from the consequences of the COVID-19 pandemic. However, there is a big difference between taking actual steps or just considering their implementation. Earlier, investors were certain that the BoE would follow the Fed and also tighten monetary policy. However, in his recent speech in the House of Lords, BoE governor Andrew Bailey again changed his rhetoric to a more dovish one. He said that the bank would start tapering asset purchases only after the interest rate hike to 0.5%. Notably, the bond purchases amounted to £895 billion due to the COVID-19 pandemic.

Currently, the key rate in the UK is kept at the lowest level of 0.1%. The first and very slight increase is expected in December of this year. At the same time, the key rate may be raised to 0.5% in 2022. It is also unclear when exactly this may happen. some analysts believe that at the beginning, in the middle, or near the end of next year. In my opinion, the Bank of England is more inclined to stick to a softer stance on monetary policy. There are two main reasons for this. To start with, trade relations with the European Union have not yet been fully regulated after the withdrawal of the United Kingdom. The problems of fishing, as well as the movement of goods on the Northern Irish border, remain not fully resolved between the EU and the UK. Last but not least, the coronavirus is again raging across the world. A new strain of COVID-19 has appeared in Africa, which has multiple mutations. Experts fear that the new strain may be far more dangerous compared to all previous ones.

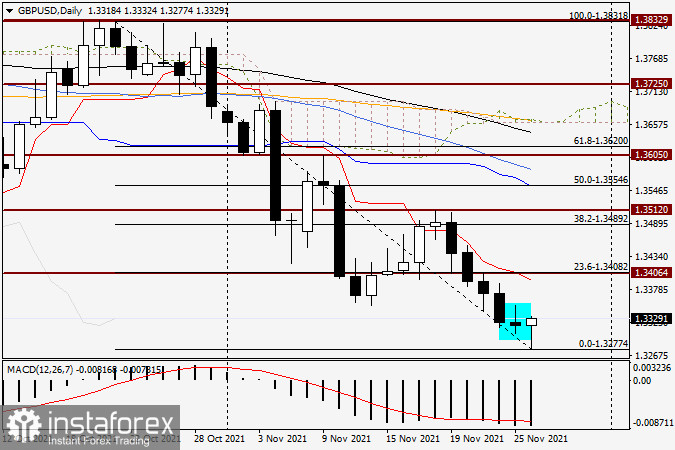

Daily

Judging by the technical indicators of the daily chart, the GBP/USD pair is trading with a bearish bias. Yesterday's Doji candlestick also confirmed a downward movement. It could also indicate an upward reversal. However, bears decided to get rid of this reversal signal of the candlestick. They have already pushed the quote below yesterday's low of 1.3304. Bear in mind that 1.3300 is a strong resistance level.

A bit later, bulls returned to the market. Demand for the pound sterling rose. When finishing this article, the daily candlestick of the pound/dollar pair has a lower shadow. So, the pair was trading in close proximity to the opening price. It even managed to climb slightly. However, today, trading floors in the US are closed on the occasion of Thanksgiving Day. The market activity is likely to be sluggish before the weekend. Apart from that, many traders are closing their positions. This is why it is not recommended to open new positions on the GBP/USD pair today. On Monday, taking into account the closing of today's and weekly trading, it will be possible to make a more precise forecast. In the meantime, wait for the formation of today's daily and weekly candlesticks.

Good luck!

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română