The topic of the new strain of coronavirus, Omicron, continues to dominate the markets. It could not be pushed into the background by the strong ADP data on the number of new jobs in the US, America's strong values of production indicators, and so far cautious statements by doctors that the new strain may not be as dangerous as it is assumed now.

On Wednesday, it was known that Caixin's business activity indices in China's manufacturing sector in November turned out to be lower than expected – 49.9 points against the forecast of 50.5 points and the October value of 50.6 points. The values of this indicator were also worse for Germany and the Eurozone, respectively 57.4 points and 58.4 points against 57.6 points and 58.6 points. But in the States, this indicator has grown, albeit not much. It only rose to 61.1 points against 60.8 points and expectations of 61.0 points.

The presented data clearly indicate that the COVID-19 pandemic is still having a strong impact on the world's largest Chinese economy, which is experiencing problems amid falling demand and the disruption of so-called supply chains. In this situation, it is also not necessary to say that the American economy feels at least satisfactory. Despite the positive data from the index of business activity in the manufacturing sector, problems still remain and are significant. In addition to the virus, there is high inflation, which has already forced the Fed to make a decision to start reducing the QE program.

Moreover, J. Powell stated that the previously envisaged reduction in the volume of repurchases of $ 15 billion per month may be revised upwards, which may lead to an automatic earlier increase in interest rates.

That's why even the data on the number of new jobs from ADP published on Wednesday could not keep the US stock market from falling, despite the fact that they exceeded the consensus forecast of 525,000, showing an increase to 534,000 in November.

The fear of a new strain turned out to be so strong that investors continue to buy US Treasuries as a protective asset, despite the high probability of a rate increase in the first quarter of next year. This condition in the markets has a comprehensive binding effect on investors. Negative sentiment dominates the markets, resulting in broad sales.

The crude oil market is trying to recover amid the demand for it. However, a not so significant decrease in the reserves of oil in America does not allow quotes to grow noticeably, and the presence of a number of contradictory factors – high demand, fear of Omicron, the picture with oil reserves in the States, and the expectation of an OPEC+ meeting only lead to an increase in volatility.

As for the currency market, the ICE dollar index is consolidating for the third day in a row around 96.00 points, remaining under pressure from all the same factors – COVID-19, Powell's statements, general despondency in the markets.

Considering the general situation on the markets, we believe that this state of affairs will continue until it becomes clear what the new Omicron strain really threatens humanity with. Thus, it will only be possible to really assume something and hope for something after that.

Forecast of the day:

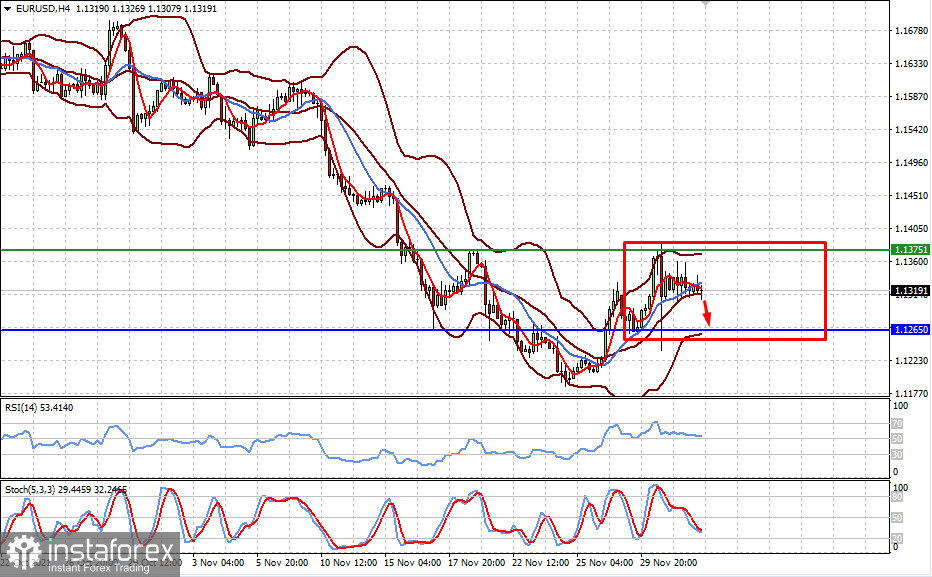

The EUR/USD pair may try to decline again if the production inflation data shows a larger than expected growth, and unemployment in the euro area does not decrease. On this wave, the pair may adjust to the level of 1.1265, still remaining in the range of 1.1265-1.1375 before the publication of US employment data, which will be released tomorrow.

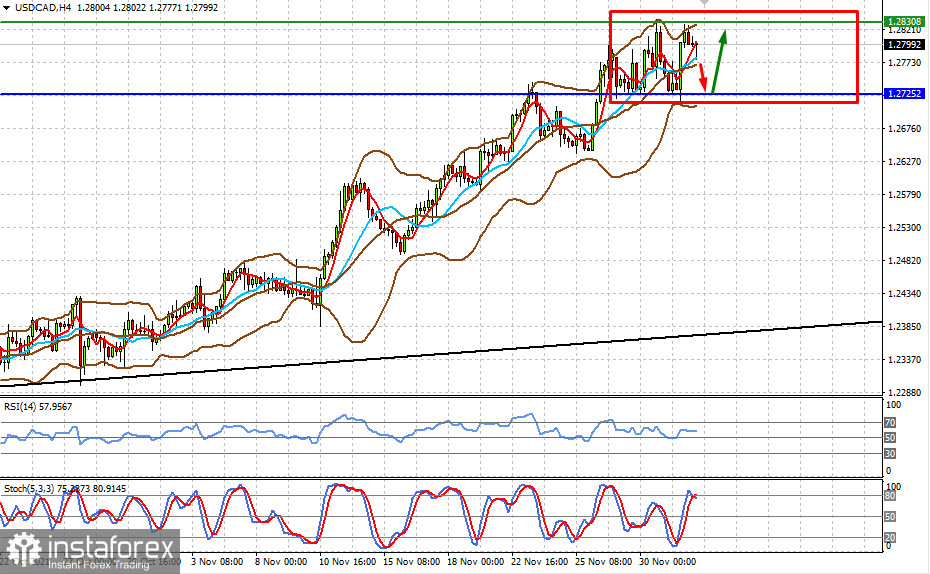

The USD/CAD pair may also consolidate laterally in the range of 1.2725-1.2830 ahead of the release of US employment data.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română