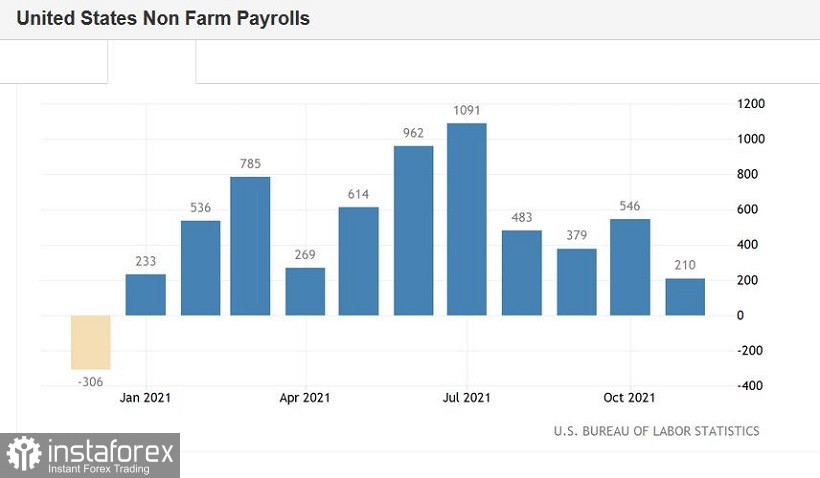

The November Nonfarm Payrolls report turned out to be not as rosy as the October or September ones. Many components (almost all) came out in the red zone, falling short of the forecast values. This is not to say that the U.S. labor market "let down" dollar bulls, but traders definitely expected to see a stronger result.

And yet, market participants have come to the conclusion that the "glass is half full," and not vice versa. After some fluctuations, the EUR/USD bears increased pressure on the pair, trying to gain a foothold in the area of the 12th figure. Greenback demonstrated similar ambitions in other currency pairs of the "major group." In general, it must be recognized that Friday's data has both strengths and weaknesses. Let's sort out the most important macroeconomic report "on the shelves."

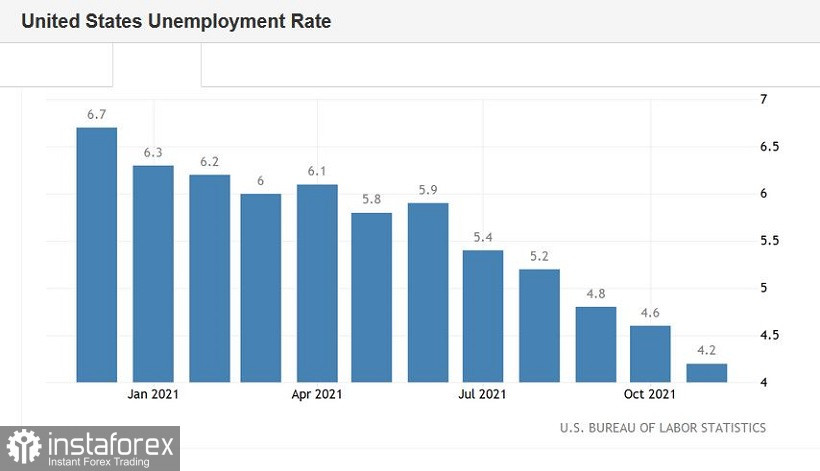

The strong point of the released data lies in the reduction in the unemployment rate. This indicator has been gradually, but consistently and quite steadily declining for almost a year and a half, since June last year. There were small (literally by 0.1%-0.2%) pullbacks up, but in general, the downward dynamics is visible to the naked eye. And on Friday, this indicator also supported the U.S. currency, falling to 4.2% (with a decline forecast to 4.5%). This is the best result since March 2020.

Some other components of the data were also released in the "green zone." In particular, the share of the economically active population has increased – the indicator has reached 61.8% (the annual maximum). The average length of the working week for all employed also increased (34.8).

However, the growth rate in the number of people employed in the non-agricultural sector was disappointing. With the forecast of growth up to 550,000, it grew by only 210,000. A similar dynamics was demonstrated by the growth rate of the number of employed in the private sector of the economy, which in November "issued" 235,000 (with the forecast of growth up to 530,000).

In the manufacturing sector of the economy, 30,000 jobs were created, while most experts expected to see an increase of up to 50,000. Wages were also somewhat disappointing, although in this case, the issue is controversial: in annual terms, the average hourly wages rose to 4.8% in November (that is, the same as in October).

In other words, the released data showed an ambiguous picture, and it could be interpreted in different ways - both in favor of the greenback and against it. But, as we can see, the scales tipped towards the U.S. currency.

According to some experts, the November decline in the unemployment rate to 4.2% allows the Federal Reserve to accept the proposal voiced by Chairman Jerome Powell to accelerate the pace of reducing asset purchases. The American regulator may make the corresponding announcement by its next meeting, which will be held on December 15-16.

Note that the representatives of the Fed at their meeting last September stated that the unemployment rate, in their opinion, in the period from October to December will fluctuate in the range of 4.5% - 5.1%. But in reality, this indicator continued to decline systematically, thereby "untying" the hands of the Fed members.

Other macroeconomic reports also provided additional support to the greenback on Friday. The index of business activity in the service sector from ISM in the States jumped to 69.1. This, for a moment, is the strongest result in the history of this indicator. Dollar bulls were also pleased with the indicator of the volume of production orders, which came out in the "green zone," reaching a 1 percent mark in October with a growth forecast of up to 0.5%. Excluding transport, production orders immediately increased by 1.6% over the month (with a growth forecast of only 0.5%), which also indicates a significant acceleration in the growth rate of the indicator.

The "cherry on the cake" was the head of the St. Louis Fed, James Bullard, who occupies the most "hawkish" position among the members of the Federal Reserve System. On Friday, he said that the regulator should finish reducing QE by March. This, according to Bullard, will allow the Central Bank to raise the rate "if necessary." Earlier, he stated that the regulator needs to raise the rate "at least twice" within 2022.

It is worth noting that next year, the head of the St. Louis Federal Reserve Bank will have the right to vote in the Committee, so his position should be considered through the prism of this fact. Moreover, he is not alone in his opinion: according to the latest "point forecast" (which was published in September), 9 members of the Fed allowed the option of tightening monetary policy next year.

Thus, contradictory Nonfarm Payrolls did not break the dollar bulls on Friday. The market remains confident that the Fed will accelerate the pace of asset purchases at the December meeting, ending QE in March or April. Awareness of this fact keeps the dollar "afloat", allowing the bears to count on the further development of the downside trend of EUR/USD.

In my opinion, the pair's sales are still a priority: any more or less large-scale upside pullbacks can be used to open short positions. The first target is located close enough – at 1.1250 (the lower line of the Bollinger Bands indicator on the W1 timeframe). The main target is 50 points lower – this is a psychologically important target of 1.1200.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română