:: Daily ::

The GBP / JPY currency pair showed an obvious hummer candlestick at testing the support level 125.47 which is a historical low

this candlestick indicates upside movemet confirmed further

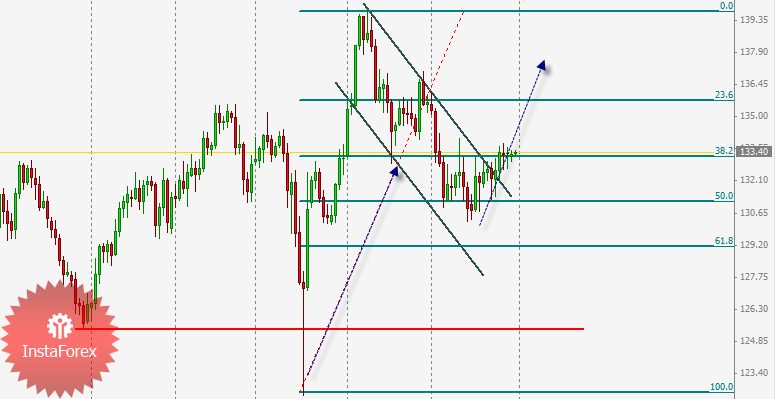

the upside movement was contained at the resistance level 139.75 which stopped the upside swing of the pair leading to correction forming a flag pattern

The support level 131.20 which is 50% fibonatcci of the last swing up held the price above preventing further decline

The 25 May's daily candle closed outside the upper limit of the flag indicating continuation of the upside movement technically .

Now the price is consolidating around the 38.2% Fibonatcci level waiting for its break to resume the upside movement .

:: 4H ::

on the 4H chart the price is consolidating in a triangle pattern at 28.2% Fibonatcci level

We recommended going long on the pair since it broke the channel ( Flag ) at 25 May

For those who missed the trade can join it as soon as the pair closes outside the upper side of the triangle for more confirmation

Long position has potential target at 134.80 then 135.55 ( 23% fibonatcci ) with further targets to be mentioned later

It's important to mention that SL for long position should be below the last buttom ( 130.22 ) as break of this level allow the pair to reach 129.32

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română