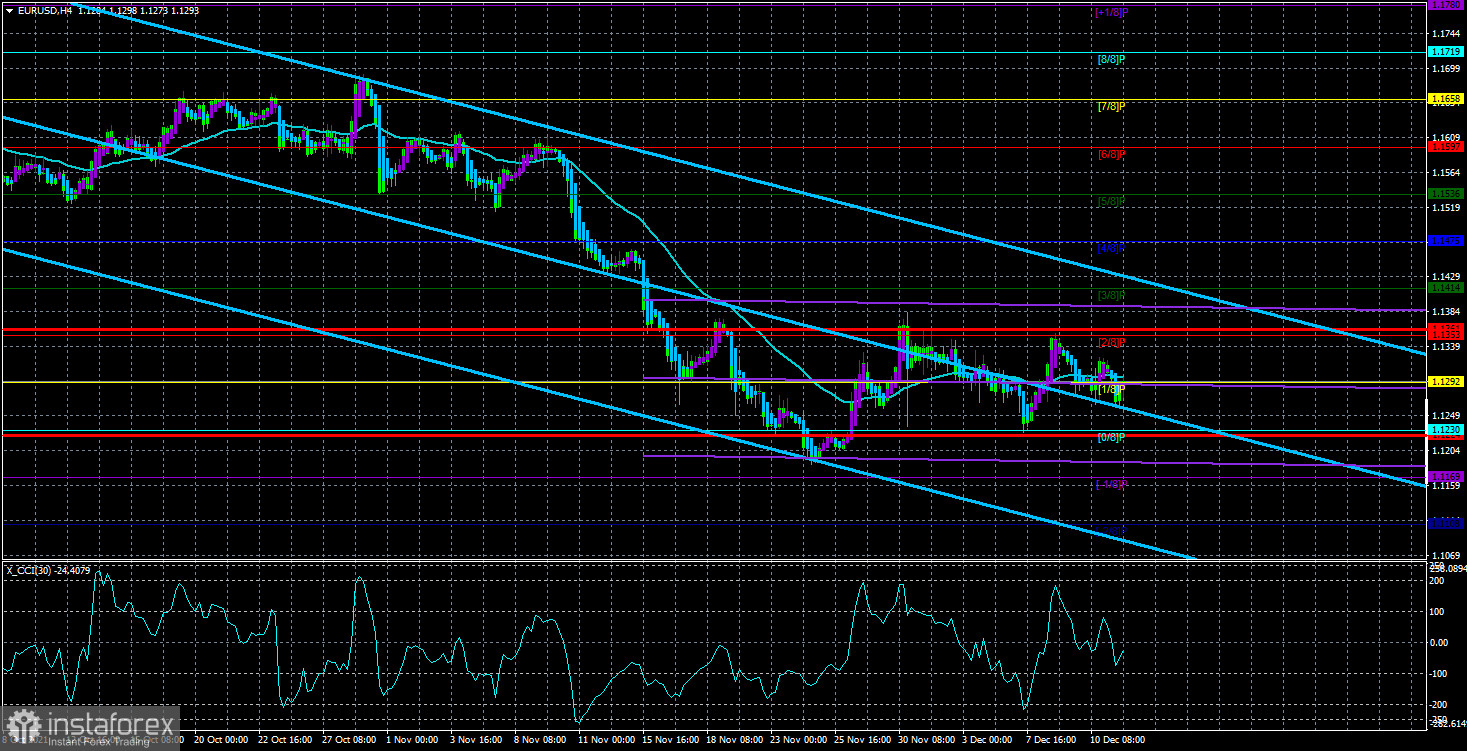

4-hour timeframe

Technical details:

Higher linear regression channel: direction - downward.

Lower linear regression channel: direction - downward.

Moving average (20; smoothed) - sideways.

The EUR/USD currency pair traded quite calmly on Monday. In principle, we talked about this in our articles over the weekend: it is unlikely to expect high volatility and active movements of the pair until Wednesday evening when the Fed will announce the results of its meeting. Especially because on Monday and Tuesday, the calendar of macroeconomic events in the United States and the European Union is almost empty. Thus, during the first trading day of the week, the euro/dollar pair continued to slowly slide down, being inside the side channel of 1.1230-1.1353, which we also discussed earlier. Consequently, now there is not only weak activity for the euro/dollar pair but also a flat. And to see this flat, you don't even need to look closely at the movement of the pair. Thus, it is not possible to draw any new conclusions about the technical picture after Monday. Therefore, we need to wait for the results of the meetings of the ECB and the Fed, and after them analyze the overall fundamental and technical picture. By the way, the closer both meetings are, the more experts begin to expect that there will be surprises. The fact is that the markets have already decided for themselves what exactly the ECB and the Fed will report, as well as what decisions they will make. Of course, no one is talking about it with a hundred percent probability, but nevertheless. The probability that the Fed will reduce the QE program by 20-30 billion dollars, and the ECB will take a wait-and-see position is high. If so, then the US dollar has excellent chances to continue its growth against the European currency this week. As we can see, over the past few weeks, the bulls have not been able to find the strength for the pair to start growing. There was a slight pullback of 130 points up and that's it. If the Fed takes a "hawkish" position, and the ECB takes a "dovish" or neutral position, then it is unlikely that the pair will grow.

Will the Fed surprise you and raise the rate in December?

The opinion that the Fed may raise the rate this Wednesday was voiced by expert Michael Hartnett from Bank of America. He said that as soon as the Fed raises the rate, the US stock market will immediately collapse down by analogy with the dot-com crash in 2000. He urged investors to sell stocks before the Fed raises the rate, and not after it. According to Hartnett, the Fed should start raising the key rate not in March-April next year, but right now. He drew attention to the fact that the data on unemployment benefits, which were released last week, turned out to be the weakest since 1969. In other words, the labor market is recovering at an excellent pace and is approaching the "overheating" state. And if so, then its recovery no longer needs to be stimulated, which, coupled with rising inflation, suggests the need for an immediate increase in rates.

If Michael Hartnett is right, then there is no doubt that the markets will experience a severe shock this Wednesday. The fact is that the minimum period in which the markets are waiting for a rate increase is March 2022. This has been repeatedly stated by some members of the Fed. Thus, an increase in the key rate in December may even cause panic in the markets. Of course, it is far from a fact that Hartnett's forecast will come true. After all, he is not the only analyst and expert in the world. But only he expresses such an opinion. Thus, we believe that the Bank of America expert is partly right, but the Fed and its monetary policy are like a Titanic in the economy. It is impossible to deploy it very quickly in the right direction. And it doesn't make any sense. After all, one of the tasks of the Fed is also to calm the markets, and not to create panic and a "storm".

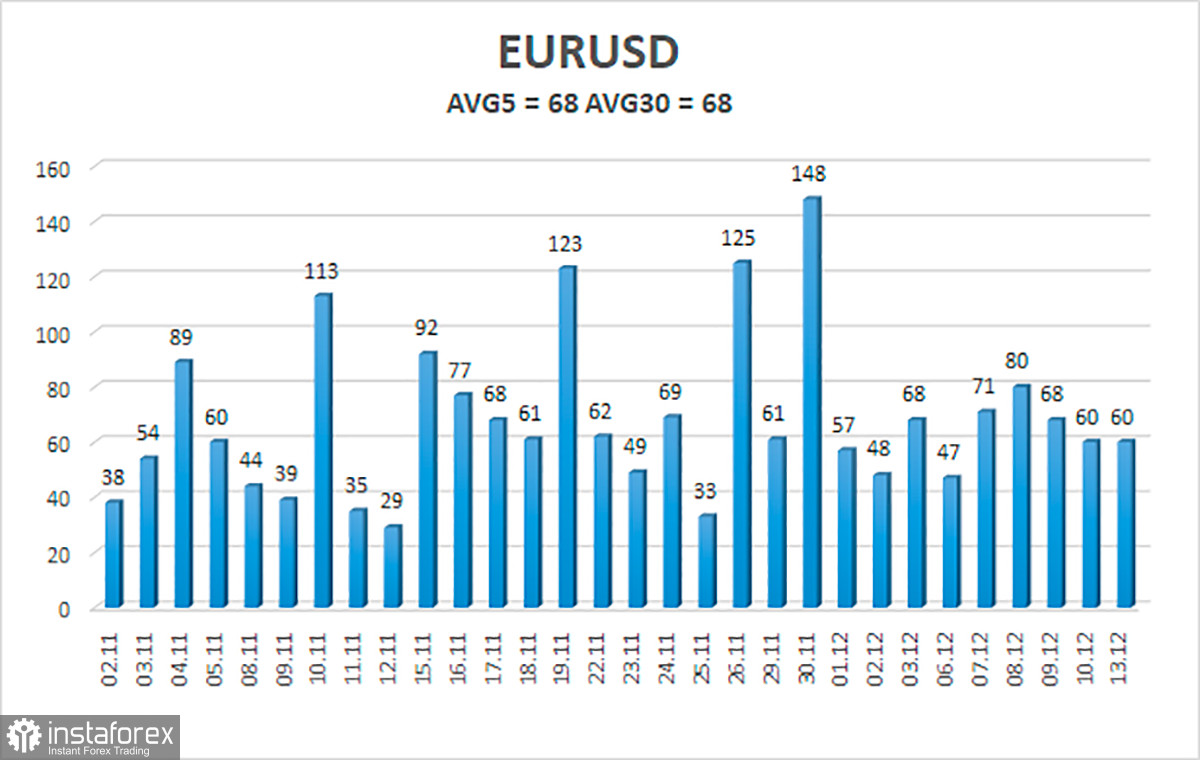

The volatility of the euro/dollar currency pair as of December 14 is 68 points and is characterized as "average". Thus, we expect the pair to move today between the levels of 1.1224 and 1.1361. A reversal of the Heiken Ashi indicator upwards will signal a new round of upward movement inside the side channel.

Nearest support levels:

S1 – 1.1292

S2 – 1.1230

S3 – 1.1169

Nearest resistance levels:

R1 – 1.1353

R2 – 1.1414

R3 – 1.1475

Trading recommendations:

The EUR/USD pair has consolidated back below the moving average. Thus, today it is necessary to remain in the sell orders with a target of 1.1230. Purchases of the pair should be considered if the price is fixed back above the moving average, with targets of 1.1353 and 1.1361. You should also take into account the fact that the pair is in the side channel. It may end this week, but it is unlikely before Wednesday and Thursday.

Explanations to the illustrations:

Linear regression channels - help to determine the current trend. If both are directed in the same direction, then the trend is strong now.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which trading should be conducted now.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română