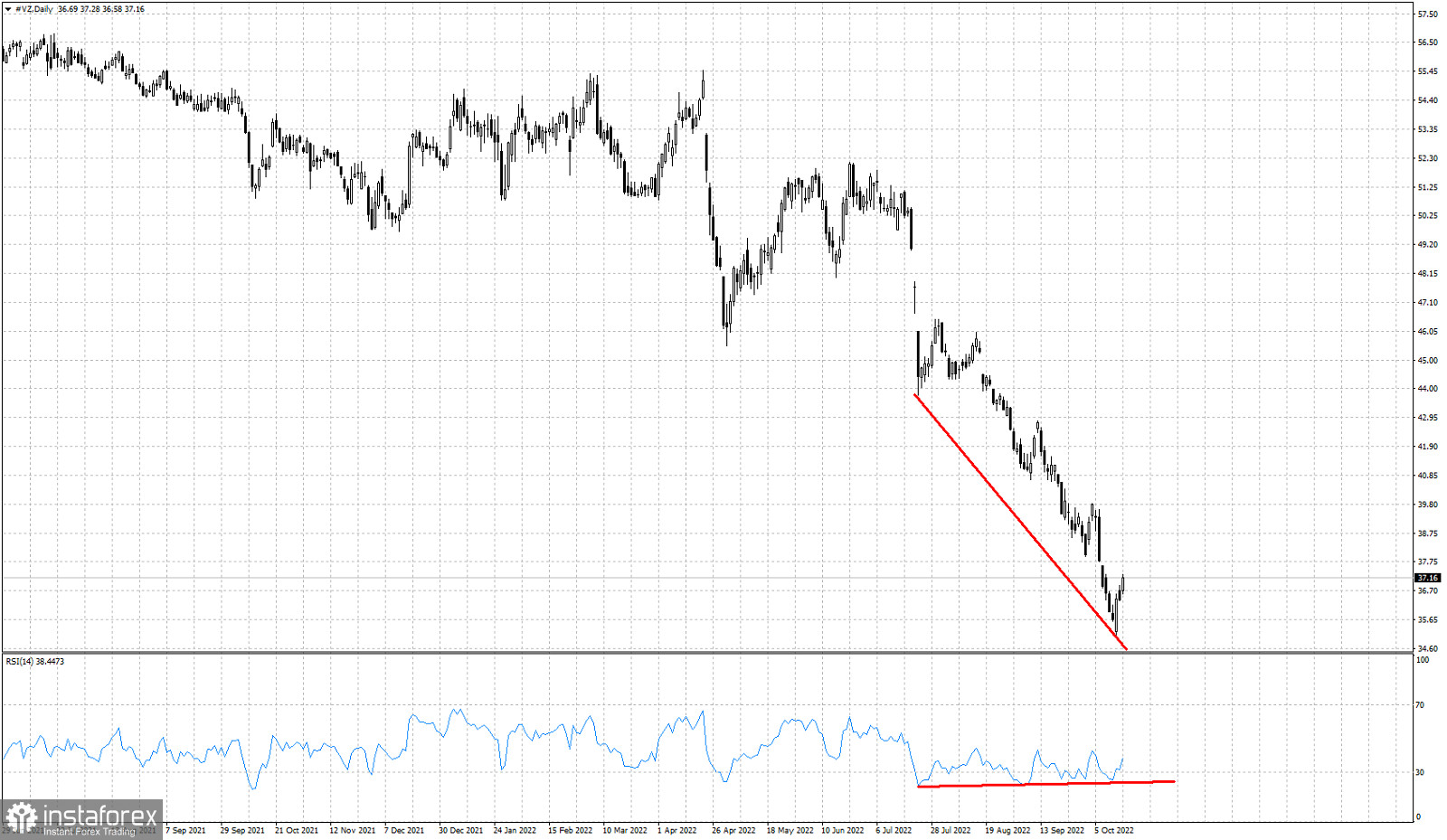

Red lines- bullish RSI divergence

Verizon (VZ) stock price is in a bearish trend making lower lows and lower highs. However recent lows in price were not followed by lower lows in the RSI suggesting that the downtrend is weakening. VZ stock price has the potential of a strong bounce towards at least $44. The RSI has been providing us with bullish divergence signals that traders should not ignore. Bears need to be cautious and protect their gains. A reversal is highly probable and justified from current levels. The RSI bullish divergence pattern is very commonly seen and we usually see trend reversals after a couple of bullish divergence lows. This is not a reversal signal, only a warning.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română