The markets are trying to make a correction after quite active sales on Monday. Stock indices of the ATP countries closed the trading session in the green zone. At the same time, global yields are also growing after a sharp decline amid growing concerns about the rapid spread of Omicron strain and resistance in the US Congress concerning Biden's stimulus package.

Commodity markets have not yet reacted properly to a new jump in natural gas prices in Europe. Gas has already risen by 60% in December, taking into account the low occupancy of storage facilities and presumably cold winter production in Europe may face the problem of cost growth, which will affect the pace of recovery.

Today, some growth in demand for risk is expected, which gives a chance for an upward correction of EUR/USD and a pullback up of commodity currencies, which is unlikely to be strong. There are no reasons for a full-fledged growth in demand for risk.

NZD/USD

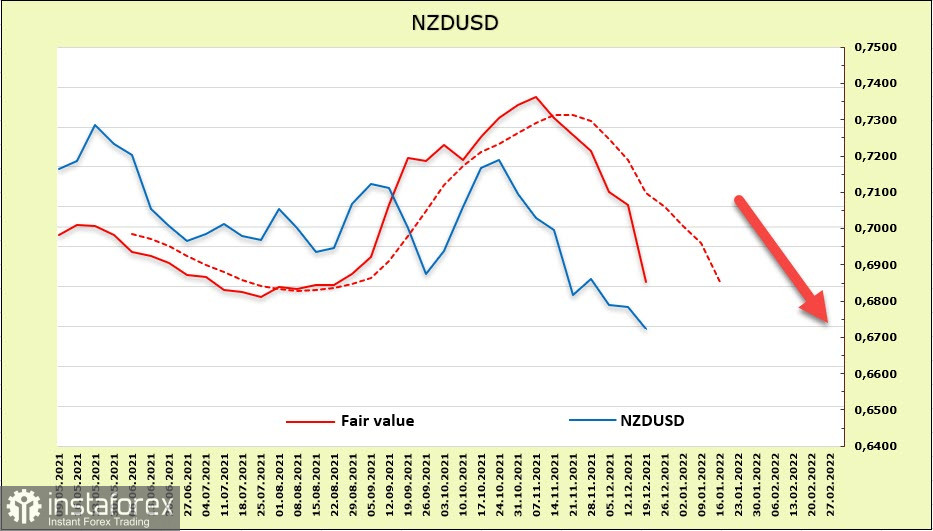

The New Zealand dollar quickly turned from a favorite in the currency market into an outsider by the end of the year, although such a scenario looked very unlikely in October. RBNZ was the first of the major banks to start a rate growth cycle. Its inflation was off the scale, and consumer demand looked very convincing.

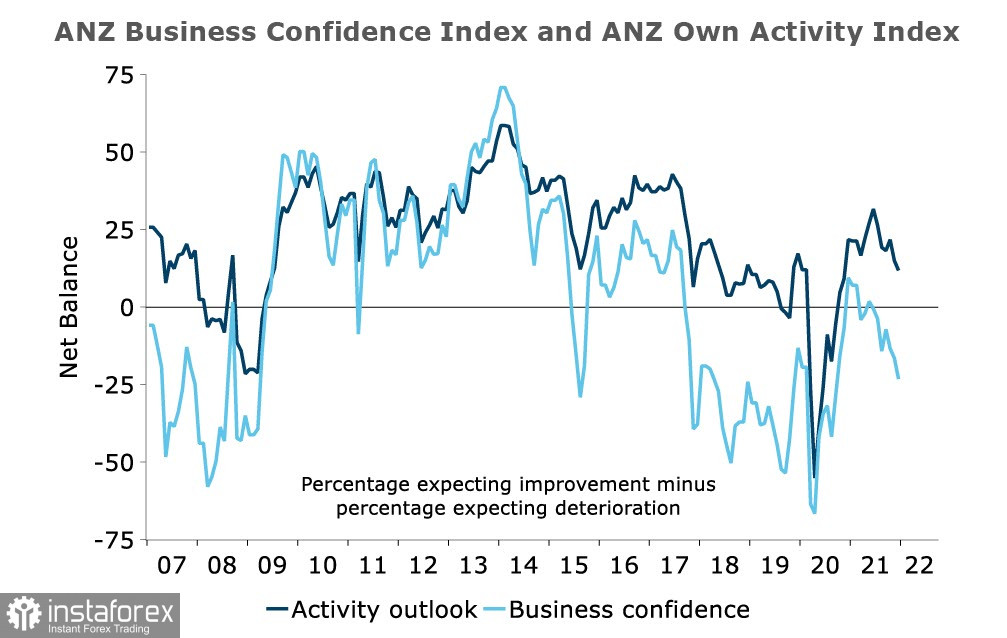

However, everything changed with the beginning of winter. ANZ's December business review showed a noticeable decline in business activity indicators. The only thing that is still growing is inflation expectations, while expected exports, investment intentions, plans for commercial construction, labor search, and profit expectations are all declining quickly.

Stats NZ also published data on GDP for the 3rd quarter. The economy declined by 3.7% due to the last COVID-19 lockdown, and it is expected that the pullback upward in Q4 and Q1 next year will be lower than predicted until recently.

In general, the situation remains quite positive, and the reasons for the refusal of the RBNZ to reduce incentives are still not enough to assume such an outcome, but the rate growth rate may be revised. Apparently, large players are preparing for just such a scenario – according to the latest CFTC report, there was a turn in the futures market in favor of bears. A weekly change of -1.123 billion and a net short position of -395 million was formed. The estimated price is falling, so there is no reason to wait for a bullish reversal yet.

The breakdown of the support level of 0.6695 looks inevitable. The main target is set at 0.6450.

AUD/USD

The Australian dollar is still under strong pressure, despite some positive signals that may indicate the end of the economic downturn. A strong pullback in GDP is expected in the 4th quarter. In November, the labor market experienced a full recovery of the jobs lost in June, household consumption is stable, and investments in business and housing construction are growing. NAB Bank expects the unemployment rate to fall to 3.8% by 2023, that is, to a minimum in 10 years, which indicates a strong optimistic mood.

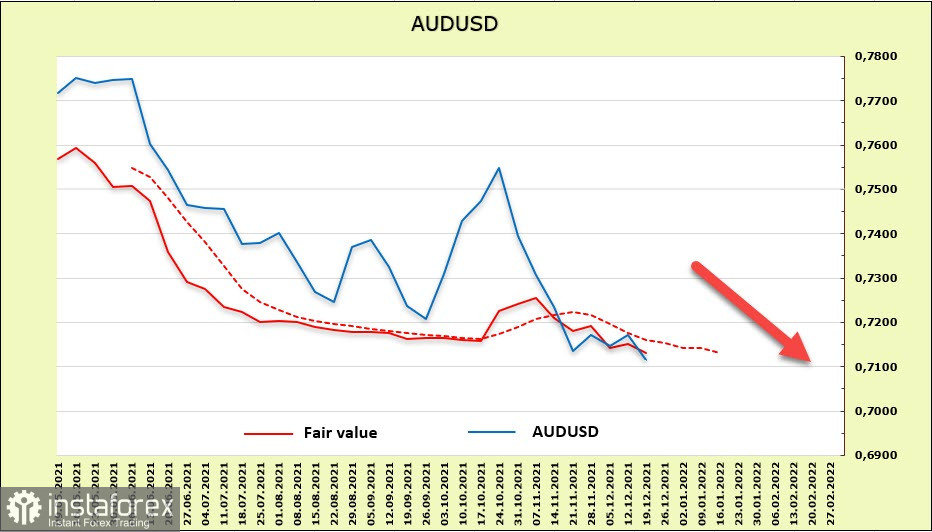

However, this optimism can only be expected in the future. Energy futures are currently under pressure and speculative positioning for oil and a number of other commodities is bearish. Markets need to assess the consequences of central banks' withdrawal from stimulus programs, which inevitably leads to a reduction in available liquidity and, as a result, to a drop in the demand for risk. Therefore, demand for AUD will be primarily driven by external factors.

As follows from the CFTC report, the bearish advantage in the futures market remains very strong, despite a slight correction (+218 million). According to the results of the reporting week,

There is no reason for the sudden growth of the Australian dollar. And although signs of improvement in the economic situation will not disappear anywhere, and at least corrective growth can be implemented, the long-term trend is undoubtedly bearish. In case of correction, resistance levels of 0.7240 and 0.7310/20 can be noted. A return to the support level of 0.6990 and further to 0.6760 is more likely.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română