The number of employees leaving their jobs, as well as the emerging trend towards a slowdown in hiring at large US enterprises in December may indicate that the current wave of coronavirus has still affected employers, experts say.

December analytics showed a mass migration of workers to the United States

Although the conclusions about the reasons are quite controversial, such a point of view on the labor market may prompt the Federal Reserve to conclude that lawmakers have squeezed the highest number of jobs out of the labor market. Further growth may slow down, especially against the background of the failure of the vote on the Biden infrastructure package, which promised about 200,000 more jobs. However, back to the numbers.

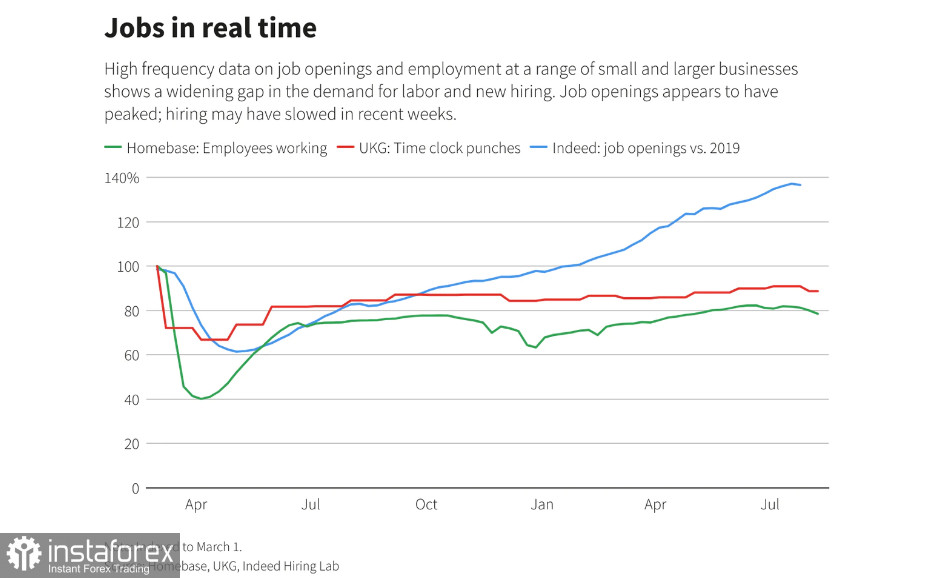

Hiring data tracked by hiring managers at Homebase and UKG showed a decline in the vacancy market over the last month of 2021. The reversal coincided with a record outbreak of coronavirus infection caused by the Omicron variant raging in most states.

Data from both companies showed stronger seasonal declines last year, even compared to the difficult 2020. It is worth noting that employment in Homebase's sample of small businesses fell by about 15% in the last days of 2021, compared with about a 10% drop in 2021.

In UKG, the number of shift jobs in various industries decreased by 1.7% over the past month, compared with a drop of 0.3% over the same period last year and 0.8% in December 2019.

"The data shows a strong downward shift that began in mid-December," wrote Dave Gilbertson, vice president of UKG.

At the same time, new government data for November showed that workers are leaving positions on their own, especially low-paid ones. Also, the outflow is shown by positions related to contacts (administrative, representative, service) in the service sector, where health risks are considered more serious, and work options at home are less accessible.

At the same time, the number of vacancies is still close to record levels, and consumer demand is breaking all records, despite, and perhaps even thanks to a wave of infections.

Economists argue that this may reflect increased market pressure on companies to raise wages. And at the same time, it is a marker of increasing pressure on the Fed, in an attempt to ensure "the task of providing jobs to the population as close to completion as possible."

Recall that the achievement of this goal is one of the factors that preceded the increase in interest rates by the US central bank.

But in my opinion, it can rather be assumed that the Fed itself is putting pressure on the employment authorities in order to improve the indicators in all possible ways, so that it will make it possible to move to raising rates faster.

So, at the Fed meeting on December 14-15, politicians indicated that, in their opinion, the key benchmark is already close. The minutes of this meeting are set to be released today. It will contain more detailed information about the meeting at which the Fed began a targeted fight against inflation. Inflation is almost three times higher than the target rate of 2% per year, reaching an annual mark of 5.6%, so the legislators can understand.

Even the president of the Minneapolis Fed, Neel Kashkari, who is known for his negative attitude to raising interest rates in the hope of stimulating job growth, admitted that at a meeting last month he outlined two rate hikes for 2022, partly because of doubts about how many people will want to return to work soon.

"Wages are currently growing rapidly across different income categories," Kashkari wrote, explaining the dramatic change in his views on politics. "The labor market has not fully recovered from the COVID-19 shock... But it is unclear how long it will take for all previous workers to return. At least now it seems that the demand for workers exceeds the supply."

Salaries are rising... while

But not everything is so obvious. In 2020, it was the wave of coronavirus that forced the Fed to lower rates and create favorable conditions for business. Now the appeal to the new wave as the main reason for the migration of workers looks weak. It is more likely that workers leave their homes for higher salaries, which they are forced to do by the madness of inflation.

And yet, the wave of Omicron infections is affecting the economy and the Fed, forcing manufacturers to reduce production volumes.

For example, some analysts have cut their economic growth forecasts for 2022 as a result of the latest turn of the pandemic. However, not much has been cut, even considering the scale of infections, which now overshadow previous outbreaks. Probably, the reason is the increased demand for goods, noted at the end of November and since then only gaining momentum.

The fact also plays a role that while the new option seems less dangerous - the number of deaths and hospitalizations does not increase as much as the number of cases. And, for example, data on air travel for December show that consumers are eager to get rid of restrictions and have more freedom.

As a result, as of the end of November, there were more than 1.5 open jobs for every person who declared themselves unemployed - another record reflecting the labor market, where wage growth seems likely to continue, since workers are in short supply for various reasons. Either they quit because of better conditions, or because of higher wages, or due to illness, although there are sick days in case of illness.

"A large number of layoffs means a stronger bargaining position for workers, which is likely to lead to a significant increase in wages," said Nick Bunker, director of economic research at Indeed Hiring Lab, a division of the employment and recruitment website. "Wage growth was very strong in 2021... We may see even more in 2022."

It probably is. At least because workers will want to compensate for the increase in inflation, which means that wages will nominally rise. However, this does not mean that real wages will also grow, especially since inflation is not uniform everywhere – it is higher in large cities.

It is not necessary that American manufacturers will be more loyal to employees, especially against the background of the growth in the cost of raw materials and production costs.

This is also indirectly indicated by the decline in real estate, which began in the United States in the second decade of December.

As a result, we can conclude that most of the world's population will probably become poorer next year. And this means that sooner or later the labor market will reverse the trend, and competition for good jobs will intensify, and the workers' dictate regarding wages will disappear, which will further worsen the situation.

However, this is a pessimistic scenario. It is also possible that the economy will traditionally recover in the spring and optimism will support the markets.

In the meantime, we are monitoring the dynamics: on Friday, the US Department of Labor will publish a report on employment for December.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română