The GBP/USD currency pair adjusted once again to the moving average line on Thursday, but in general continues to remain above it. And this means that the upward trend continues. In principle, the pound fell yesterday quite expectedly. Despite the fact that the Fed minutes rarely cause a market reaction, yesterday was an exception – the tone of this document was too "hawkish". The Fed has made it clear that it is considering the possibility of a faster first rate hike, a faster rate hike in the future, and also admits the likelihood of the beginning of unloading the Fed's balance sheet, which has increased to $ 8.7 trillion during the pandemic. Thus, on Wednesday evening, the Americans bought the dollar, and on Thursday morning, the Europeans. However, this does not change the general state of things. The euro currency is still standing in one place, and the pound is still getting more expensive. Why is there such a correlation between the two main pairs? It's actually a mystery. We believe that the only explanation can be a technical factor. As we have already said, on the 24-hour TF, the pound/dollar pair bounced off the important 38.2% Fibonacci level. Thus, even if the downward trend of 2021 has not ended yet, a rebound from such an important level and a correction is in any case normal for any instrument. The euro currency was adjusted much less frequently last year and, in general, there is a lack of support from the European Central Bank. Recall that the Bank of England raised the key rate at the end of last year, which could also support the British currency.

The UK has only lost from Brexit. But Boris Johnson says he won.

Yesterday we already said that Boris Johnson's political ratings continue to plummet. And what are political ratings? This is the opinion of every single Briton. What are ordinary Britons guided by when assessing the actions of the authorities? Its own life and its quality. Now let's look at how the lives of Britons have changed over the past year. First, the UK has faced several crises at once. The most ambitious of them is the logistical one, which entails several other crises at once. It turned out that after the closure of the borders with the European Union, there was immediately no one in the UK to work in factories, poultry farms, bars, shops and on the roads. Suddenly, the British realized that in recent decades they had been served and performed all the menial work by immigrants from poorer European and not only countries. When the borders were closed, and all labor migrants left the UK, there was immediately a shortage of drivers, slaughterers, waiters, movers, gas stationers and so on. This list can be continued indefinitely. And the shortage of labor resulted in the fact that in the middle of autumn there was no gasoline at the gas stations, and at the beginning of winter it was necessary to import turkey for Christmas from Poland and France, because they did not have time to grow and slaughter their own. More than 50% of Britons said that they faced a shortage of certain goods and food in 2021. For comparison, among European nations, only 6-8% of respondents said this. And why be surprised if more than 50% of imports before Brexit accounted for European countries? And more than 50% of exports too? That is, the UK simply lost a huge sales market overnight, as well as sources of imports of those goods and products that it does not have itself. Accordingly, trade turnover has fallen, and the profits of British companies have fallen. According to various estimates, the country will miss 4-8% of GDP due to Brexit. The British are becoming trite poorer. Well, Boris Johnson's main slogan before the referendum, "why pay 350 billion pounds of contributions to the European Union every week if you can use this money for healthcare," now looks like an absolute dummy, because taxes will be raised for Britons from April. Of course, the coronavirus pandemic also had a negative impact on the economy. However, all of the above problems cannot be attributed only to a pandemic, since there have been no such problems in other countries or they are much less widespread.

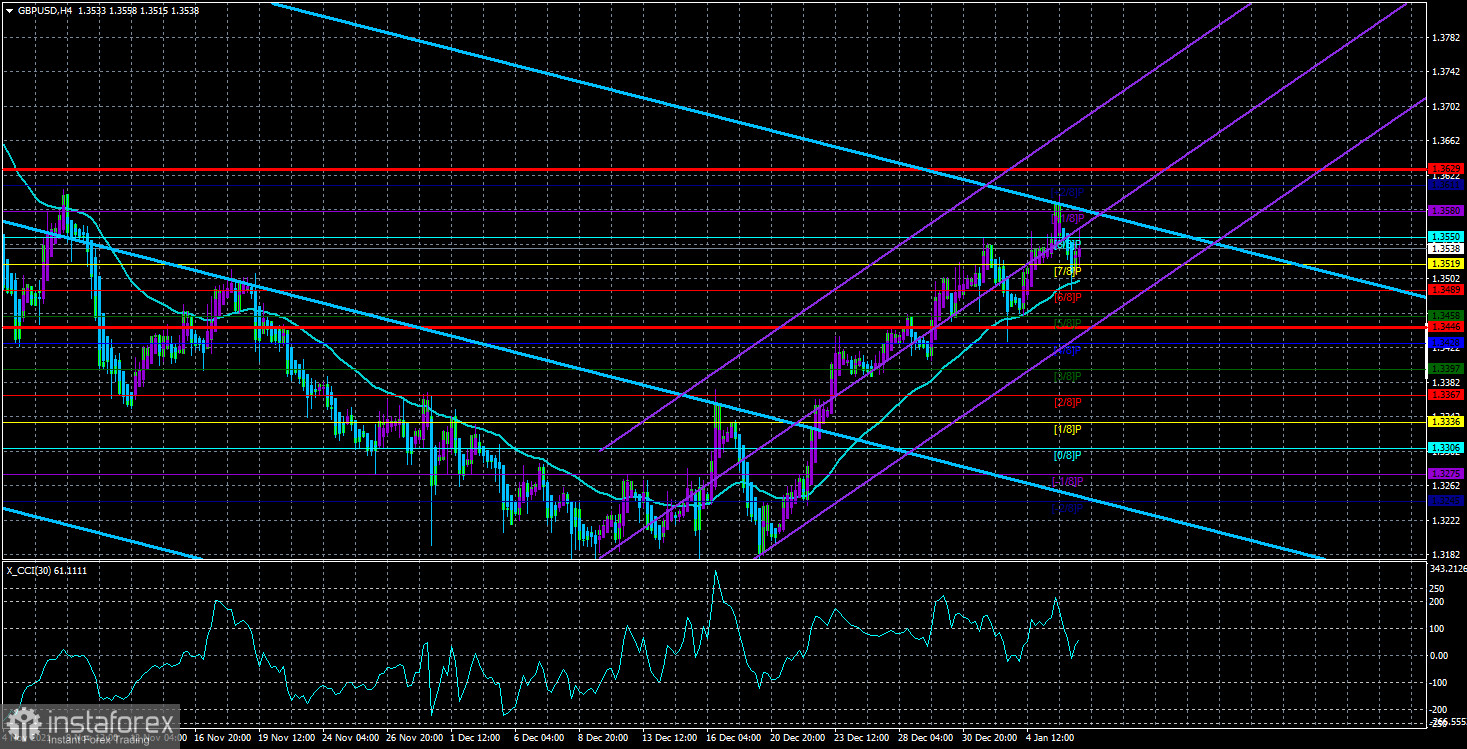

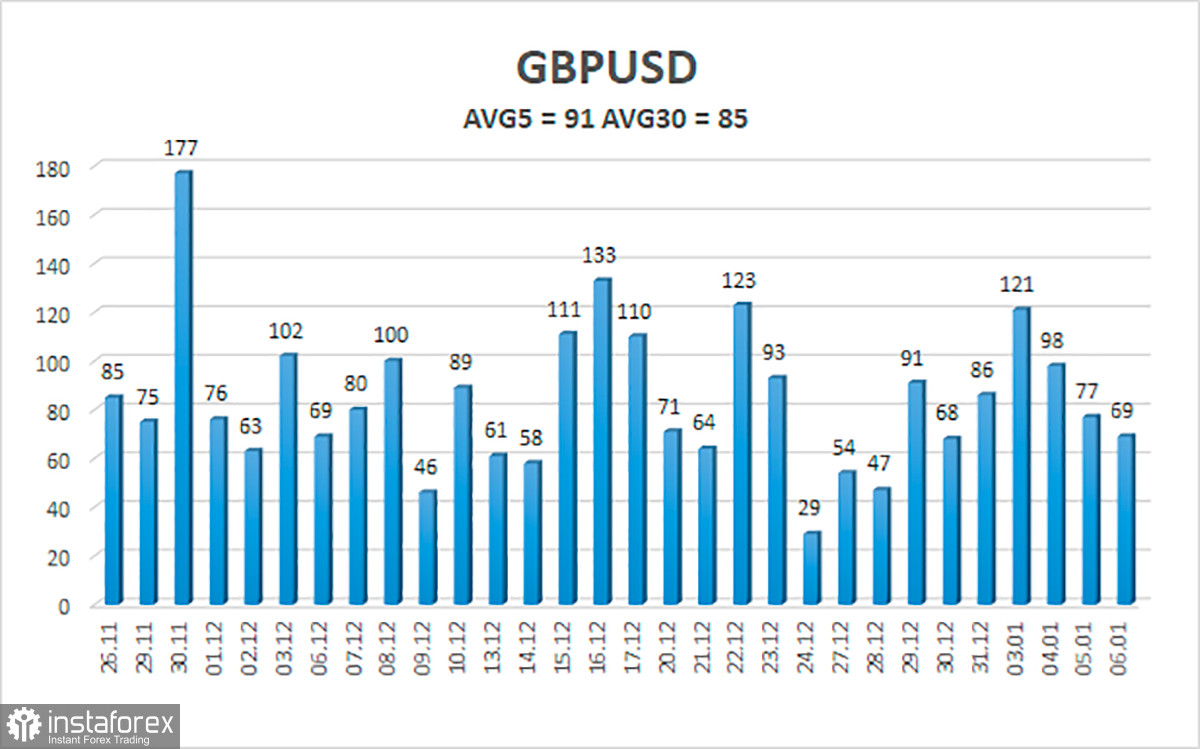

The average volatility of the GBP/USD pair is currently 91 points per day. For the pound/dollar pair, this value is "average". On Friday, January 7, thus, we expect movement inside the channel, limited by the levels of 1.3446 and 1.3629. The reversal of the Heiken Ashi indicator downwards signals a new round of downward correction.

Nearest support levels:

S1 – 1.3519

S2 – 1.3489

S3 – 1.3458

Nearest resistance levels:

R1 – 1.3550

R2 – 1.3580

R3 – 1.3611

Trading recommendations:

The GBP/USD pair continues a strong upward movement on the 4-hour timeframe. Thus, at this time it is recommended to stay in the longs with targets of 1.3580 and 1.3611 after the rebound from the moving and keep them open until the Heiken Ashi indicator turns down. It is recommended to consider short positions if the pair is fixed below the moving average with targets of 1.3458 and 1.3428, and keep them open until the Heiken Ashi indicator turns upwards.

Explanations to the illustrations:

Linear regression channels - help determine the current trend. If both are directed in the same direction, then the trend is strong now.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which trading should be conducted now.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română