This week may become important from the viewpoint of the Fed's future actions on the monetary policy issue. In other words, the US consumer inflation data for December released on Wednesday may have a strong impact on the mood of investors and contribute to both the resumption of demand for risky assets and its fall.

It can be recalled that after the Fed clearly stated last fall that it was preparing to raise interest rates due to strong inflation growth this 2022, the currency markets fully focused on the released data on inflation indicators, trying to understand how they could affect the regulator's decision on the timing start of this process. No one in the market doubts that rates will rise, but everyone worries when.

According to the consensus forecast, inflation in annual terms should increase by 7.0% in December against 6.8% in the previous period under review. As for the monthly terms, it should show a sharp decline in growth from 0.8% to 0.4%. Meanwhile, core inflation in December should maintain the growth rate of 0.5%, but at the same time, surge from 4.9% to 5.4% year-on-year.

There is no doubt that investors will be primarily interested in monthly inflation in order to understand the dynamics of this macroeconomic indicator since it will be taken into account by the Fed in deciding on the timing of the start of the process of raising interest rates.

How will the market react if inflation data (both general and basic) is seen either in line with expectations or slightly lower?

The stock markets will undoubtedly get support and this will lead to their rally. At the same time, the US dollar will be under pressure, but the demand for commodity assets will noticeably grow. In this case, gold may also receive support.

Why would the market react this way to such a scenario?

This is due to the fact that according to investors, the deceleration of the inflation growth process will allow the Fed not to rush with the increase in the cost of borrowing and thereby maintain economic growth in the country. Earlier, the Central Bank gave a signal that it continues to hope for this, and if such a scenario happens, it can really postpone the first rate hike from the current probable date in March to mid-summer.

Now, what should be expected if the inflation data show higher values than predicted? In this case, the market's expectation that the first rate hike will take place in March will clearly increase. Demand for stocks will be under pressure, the US dollar will receive support, and the prices of gold and other commodity assets will decrease. As a result, it will be possible to observe a deeper downward correction than it was before.

In conclusion, it should be noted that it is necessary to monitor the publication of US inflation data since their dynamics can shock the currency markets.

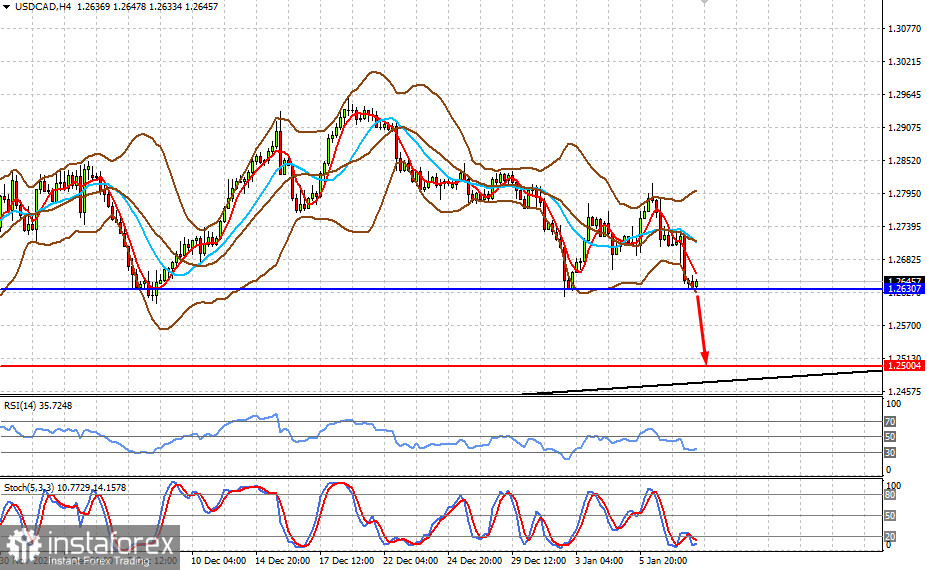

Forecast for the day:

The USD/CAD pair is trading near a strong support level. If this is broken amid rising oil prices and expectations of a decline in inflationary pressures in the US, the pair may continue to decline to the level of 1.2500.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română