Against the backdrop of today's meager economic calendar, the dollar strengthened during today's Asian trading session. At the time of publication of this article, the DXY dollar index futures are trading near the 95.94 mark, 22 points above the closing price last Friday, when the dollar sharply declined due to an unjustified forecast for the NFP.

According to a report by the US Department of Labor published last Friday, the number of new jobs created outside agriculture in December was 199,000, almost twice as high as expected. At the same time, the report reported a decrease in the unemployment rate to 3.9%, a new low of the pandemic period, from the previous level of 4.2%. Hourly earnings rose 0.6% to $30.31. Nevertheless, the dollar declined on Friday, because the report of the Ministry of Labor with December data introduced some uncertainty that the Fed will start raising interest rates in March, although market participants still expect a three-fold increase in interest rates in 2022. Taking into account the jobs created in December, the US economy is now 6.4 million more jobs than it was at the end of 2020, but still 3.6 million fewer jobs than before the pandemic.

Meanwhile, the minutes of the Fed's December meeting released last Wednesday contained hints of a tendency to a sharper reduction in the central bank's asset balance and the possibility of an earlier start to the cycle of interest rate hikes. Given this, the dollar remains the potential for further strengthening, also receiving support from the growing yield of government bonds. As you know, the yield of government bonds is growing against the background of an increase in their sales volume. Accordingly, the sale of government bonds leads to an increase in demand for the national currency and its strengthening.

Thus, the yield of US 10-year Treasury bonds at the time of publication of this article is 1.794% and has been holding near the maximum since February 2020, just before the March emergency meetings of the Fed, when the interest rate was sharply reduced from 1.75%, first to 1.25%, and then to the current 0.25%.

Most likely, on expectations of the imminent start of the Fed's interest rate hike cycle, the yield on US government bonds will continue to grow, and the dollar, accordingly, will strengthen.

As for today's economic calendar, market volatility still increased at the beginning of today's Asian trading session, just after the Australian Bureau of Statistics published fresh inflation indicators and data on construction permits.

As a rule, this indicator causes the volatility of the AUD rate, since the calculation of this indicator takes into account the statistics of the movement of corporate investments, i.e. it reflects the economic dynamics of Australia. The higher the number of permits, the more positive (or bullish) this factor is for AUD. As follows from the report, in November the number of building permits increased by +3.6%, which turned out to be higher than the zero forecasts after a decrease in the previous months by -13.6% and -4.3%.

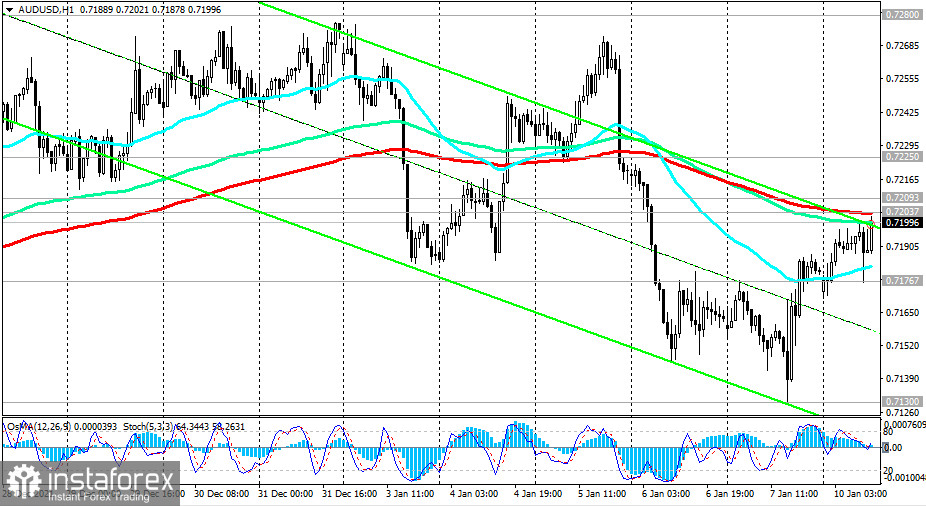

In response to the publication of these data, the Australian dollar strengthened, and the AUD/USD pair rose, heading towards the first important resistance level of 0.7225 (EMA50 and the upper limit of the descending channel on the daily chart).

In general, the long-term negative dynamics of AUD/USD remain, including against the background of different directions of the monetary policy rates of the Fed and the RB of Australia. If the Fed has indicated its commitment to accelerating the curtailment of stimulus policy, the RBA so far prefers to take a wait-and-see position. Thus, the growing divergence in the direction of the exchange rates of the monetary policies of the Fed and the RBA comes to the fore, creating prerequisites for a further fall in AUD/USD. Although, as always, an unexpected scenario is not excluded. In this case, even after the breakdown of the resistance level of 0.7225, the pair's corrective growth may continue towards local highs at the resistance level of 0.7280. The more distant correction target is at the key resistance levels of 0.7320, 0.7345. Nevertheless, and in any case, below the resistance levels of 0.7320, 0.7345, the AUD/USD is in the bear market zone, which makes short positions preferable. A breakdown of the local support level of 0.7130 will confirm this opinion and send AUD/USD inside the descending channel on the daily chart. And its lower limit is near the 0.6800 mark. So - there is a place to fall.

Volatility in the AUD/USD pair will rise again tomorrow morning when the Australian Bureau of Statistics will publish fresh data on retail sales and the country's trade balance. The retail sales index is often considered an indicator of consumer confidence and reflects the state of the retail sector in the near future. An increase in the index is usually a positive factor for AUD; a decrease in the indicator will harm AUD. The previous index value (for October) was +4.9% (after an increase of +1.3% in September and a decrease of -1.7% in August). If the data turns out to be weaker than the previous value, then AUD may decline sharply in the short term, above the previous values, then AUD is likely to strengthen. Forecast for November: +3.9%.

Support levels: 0.7170, 0.7130, 0.7085, 0.7037, 0.7000, 0.6900, 0.6800

Resistance levels: 0.7230, 0.7300, 0.7320, 0.7360

Trading Recommendations

AUD/USD: Sell by market, Sell Stop 0.7170. Stop-Loss 0.7230. Take-Profit 0.7130, 0.7085, 0.7037, 0.7000, 0.6900, 0.6800

Buy Stop 0.7230. Stop-Loss 0.7170. Take-Profit 0.7280, 0.7300, 0.7320, 0.7340

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română