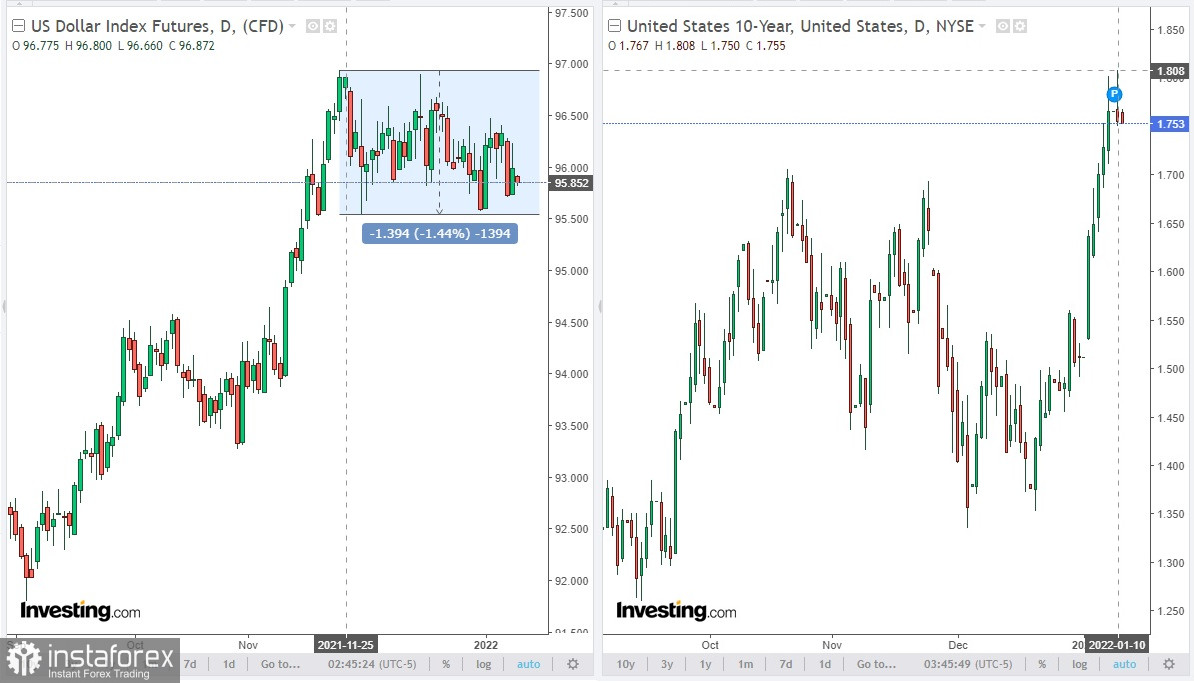

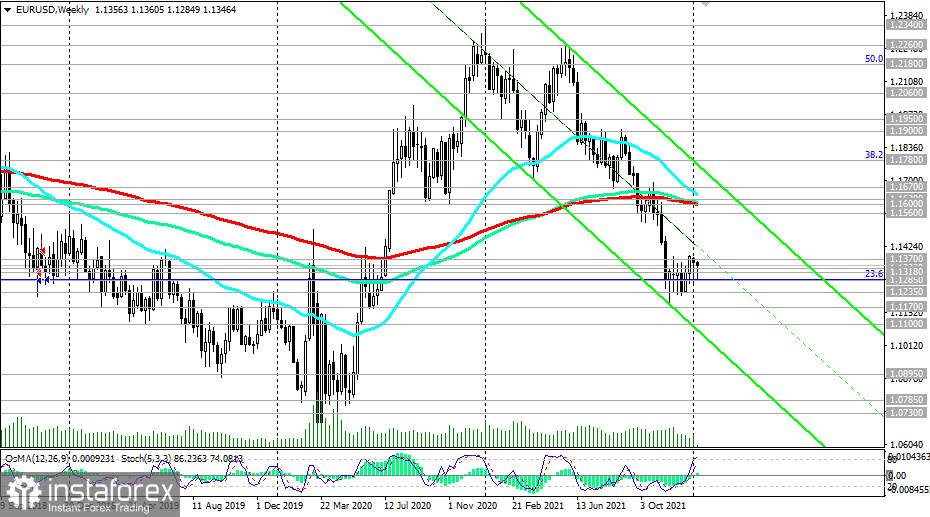

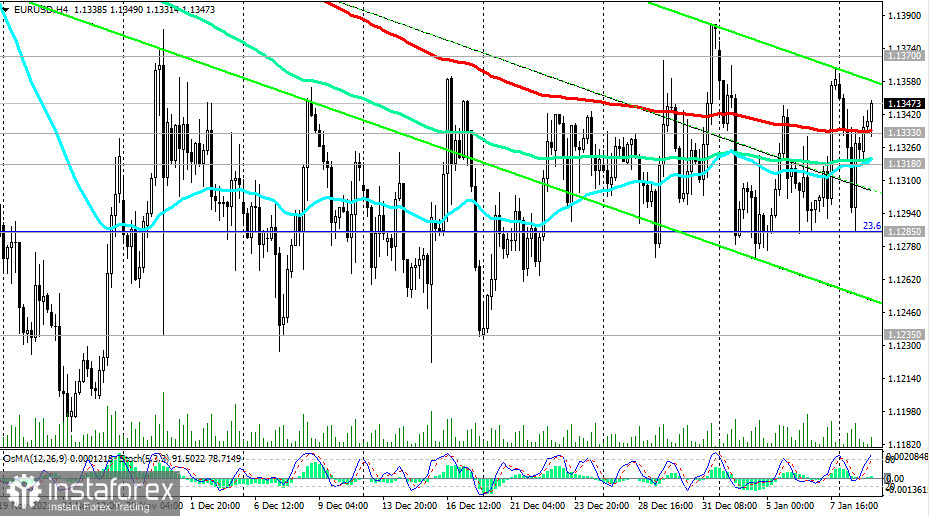

The EUR/USD pair has been demonstrating flat dynamics for two consecutive months, trading in the range limited by the support levels of 1.1285 and 1.1235 and the resistance level of 1.1370. The main tone in the pair's dynamics is set by the US dollar. So, looking at the DXY dollar index chart, it can be seen that its dynamics are similar to the dynamics of EUR/USD in many ways. This is not surprising, since over 55% of the basket of 6 major currencies of the DXY dollar index is occupied by the euro.

Eurozone's macro statistics published yesterday failed to give the euro any significant support – the unemployment data here declined by 0.1%, reporting to 7.2% in November, and the Sentix investor confidence indicator in January rose from 13.5 to 14.9. But yesterday's EUR/USD volatility was almost 75 points (in a 4-digit quote) and was about the same as last Friday when the key monthly data from the US labor market was published for the Fed. The US dollar fell sharply at the end of last week, as the NFP did not meet the expectations of the market and was well below the forecast. As already known, the number of new jobs created outside agriculture amounted to 199,000 in December, against the expected increase of +400,000.

Nevertheless, other data from the Ministry of Labor's report turned out to be very positive. The unemployment rate fell to a new pandemic low, namely to 3.9% in December from 4.2% in November. At the same time, the average hourly wage increased by 0.6% with a forecast of +0.4%. The growth of Americans' salaries was +4.7% in annual terms. The data indicate a shortage of employees, and in order to keep them, employers are more willing to increase their salaries, which leads to an acceleration of inflation.

As a rule, excessive acceleration of inflation growth leads to a tightening of the monetary policy of the central bank of the country. According to Fed Chairman Jerome Powell, the increase in US inflation is no longer temporary. At the same time, it shows that the situation in the US labor market continues to improve. If the number of jobs in the US economy is still 3.6 million jobs less than before the pandemic, then the number of initial applications for unemployment benefits in the US remains at the lowest level in several decades, that is, about 200 thousand.

At the same time, despite the increase in coronavirus cases and high inflation rates, consumer sentiment in the US remains generally positive. The final consumer sentiment index in December was 70.6, which is higher than the preliminary value of 70.4 and the November value of 67.4.

And based on the report of the US Bureau of Economic Analysis, published at the end of December, the country's GDP in the 3rd quarter of 2021 grew by 2.3%, which is 0.2% better than previous preliminary estimates.

Investors remain confident in the market that the Fed will raise the interest rate at least three times this year and will be ahead of other major banks in the world in this process. This continues to be one of the main drivers of the US dollar's strengthening against its main competitors in the currency market, including against the euro.

In view of this, a further decline in the EUR/USD pair should be expected, and the breakdown of the support level of 1.1285 will be a signal for this. At the same time, the breakout of the lower border of the range at 1.1235 will confirm the pair's sales.

In an alternative scenario, the EUR/USD pair will break through the upper limit of the range and the resistance level of 1.1370 (the 50-period moving average on the daily chart also passes through this level), and the upward correction will continue towards the zone of strong resistance levels of 1.1560, 1.1600 (EMA200 on the weekly chart), and 1.1620 (EMA200 on the daily chart). The breakdown of the long-term resistance level of 1.1760 (EMA200 on the monthly chart) will return EUR/USD to the long-term bull market zone.

In the meantime, short positions remain preferable. The first signal for short-term sales (until EUR/USD breaks out of the above range) will be a breakdown of the important short-term support level of 1.1333.

Now, let's go back to the macro statistics in the Eurozone. There will be very little of it this week. At the same time, although one should follow the speech of the ECB President Christine Lagarde (today at 10:20 GMT and Friday at 13:15 GMT), it is likely that her speech will only have a small effect on the dynamics of the euro and the EUR/USD pair. There is a possibility that she confirm the ECB leadership's inclination to continue conducting a soft monetary policy.

On the other hand, today's speech by Jerome Powell (15:00 GMT) may significantly shake the markets again if he mentions the Fed's monetary policy and makes unexpected statements. Market participants are waiting for additional signals from him regarding the Fed's plans for this year.

Support levels: 1.1333, 1.1318, 1.1300, 1.1285, 1.1235, 1.1200, 1.1170, 1.1100, 1.0900, 1.0800, 1.0700

Resistance levels: 1.1370, 1.1500, 1.1560, 1.1600, 1.1620, 1.1670, 1.1700

Trading scenarios

Sell Stop 1.1330. Stop-Loss 1.1380. Take-Profit 1.1318, 1.1300, 1.1285, 1.1235, 1.1200, 1.1170, 1.1100, 1.0900, 1.0800, 1.0700

Buy Stop 1.1380. Stop-Loss 1.1330. Take-Profit 1.1500, 1.1560, 1.1600, 1.1620, 1.1670, 1.1700

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română