The speech of Fed Chairman, Mr. Powell, is expected today at 15:00 Universal time. It will be followed by the publication of a short-term forecast on the energy carriers from the EIA at 20:00 UTC +00.

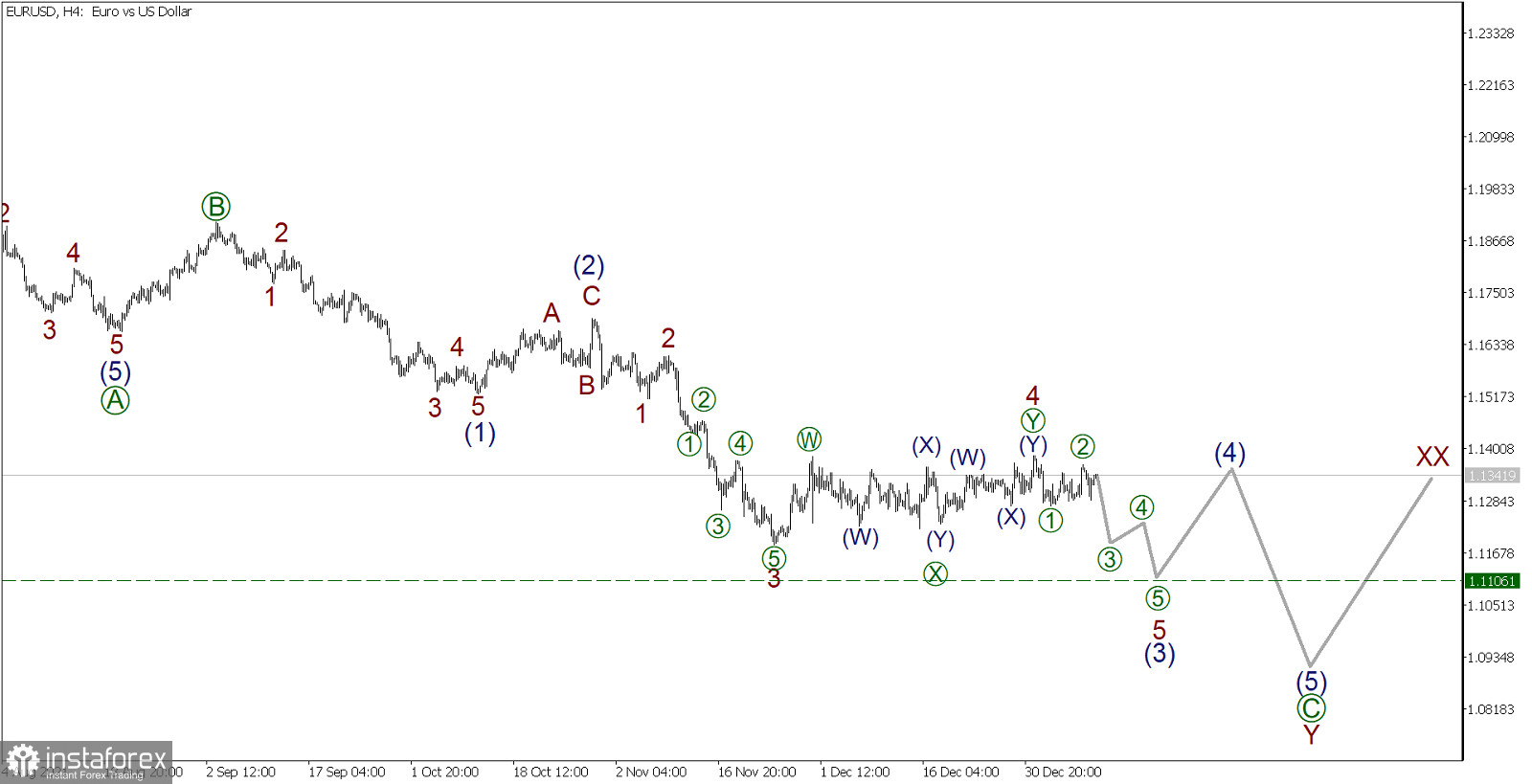

EUR/USD, H4 timeframe:

The formation of a global corrective trend can be seen in the four-hour timeframe, which most likely takes the form of a triple zigzag WXY-XX-Z.

We are currently in a downward wave Y, which will possibly acquire a standard zigzag [A]-[B]-[C] form. The first two parts of this zigzag have already been built, that is, impulse [A] and correction [B], while the last wave [C] is still under development.

It is assumed that wave [C] will be a five-wave impulse (1)-(2)-(3)-(4)-(5). So far, only sub-waves (1) and (2) have been completed. A descending impulse wave (3), or rather its fifth part, is still developing.

Perhaps, sub-wave 5, which is part of the wave (3), will take the form of an impulse [1]-[2]-[3]-[4]-[5] of a lower wave level, as shown in the chart. It is expected to end at the level of 1.1106. An approximate scheme of possible future movement is shown on the graph.

Currently, one can consider opening sell deals in order to take profit at the end of the impulse (3).

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română