EUR/USD

Analysis:

Since late November, an upward shifting plane has been forming on the sideways chart of the euro. It takes the place of a retracement in the larger wave pattern. The structure is missing a final section.

Outlook:

A general upward vector of price movement is expected today. In the first half of the day, descending flat is possible from the resistance zone. Resumption of price growth and a break of the upper boundary of the nearest resistance is likely at the end of the day or tomorrow.

Potential reversal zones

Resistance:

- 1.1450/1.1480

- 1.1370/1.1400

Support:

- 1.1320/1.1290

Recommendations:

Opening short positions in the euro market today could lead to losses and is not recommended. It is better to wait for the completion of the price pullback, with tracking signals for opening long positions at the end of it.

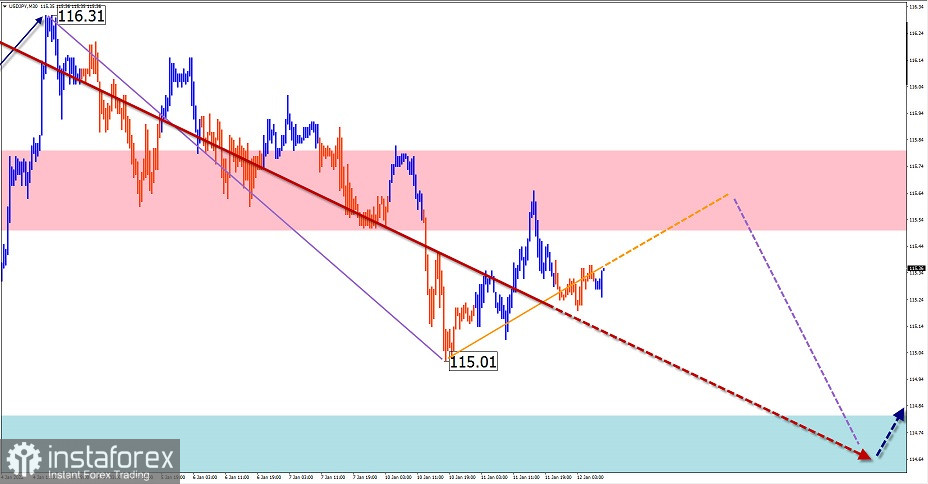

USD/JPY

Analysis:

On the yen major chart, the price has reached a large scale reversal zone as a result of the uptrend. The price has been correcting downwards since January 4. The former resistance level is the preliminary target area for the retracement.

Outlook:

During the upcoming sessions, a flat price movement from the resistance zone to the settlement support levels is expected. In the coming hours, we can expect an attempted pressure on the resistance zone.

Potential reversal zones

Resistance:

- 115.50/115.80

Support:

- 114.80/114.50

Recommendations:

Trading of the yen today is possible in intraday. When open short positions, it is preferable to use a fractional lot. Opening long positions will be possible after the emergence of confirmed reversal signals in the support area.

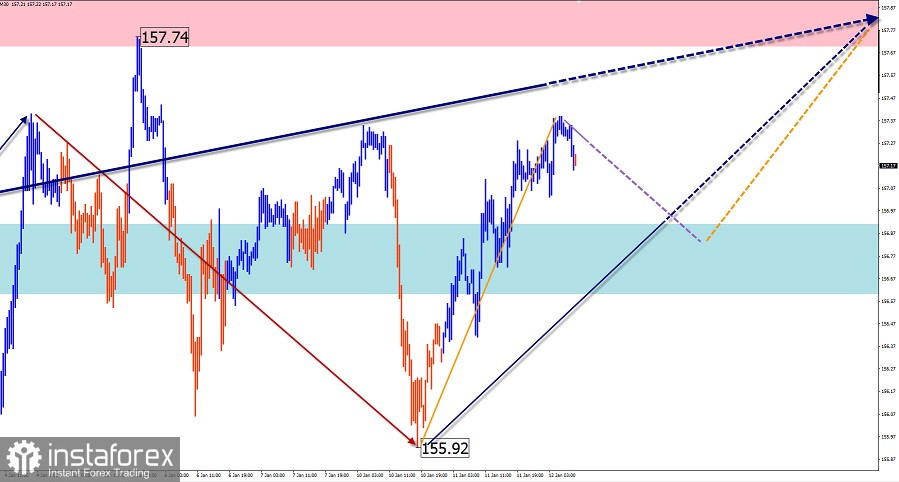

GBP/JPY

Analysis:

The incomplete upward price movement from November 26 last year in the GBP/JPY cross chart has exceeded the retracement level of the previous bearish section. Accordingly, in the wave pattern, the current surge refers to the last part of the uptrend. The price has reached a large scale resistance zone.

Outlook:

Today, we can expect a continuation of the general upward vector of price movement. On the European session a short-term decline, not beyond the estimated support, can be expected. An upside trend is more likely at the end of the day.

Potential reversal zones

Resistance:

- 157.70/158.00

Support:

- 156.90/156.60

Recommendations:

Conditions are not suitable for opening short positions in the cross market today. It is recommended to monitor emerging reversal signals for opening long positions in the area of estimated support.

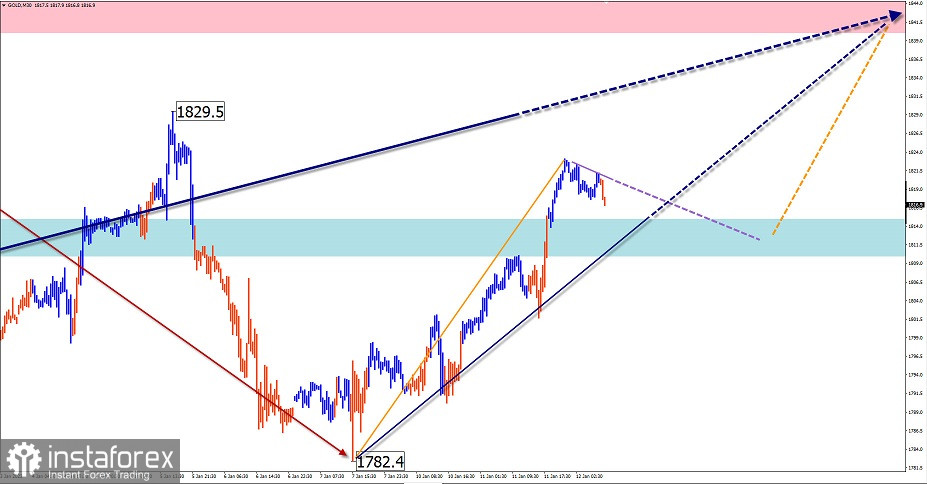

GOLD

Analysis:

For most of last year, gold prices formed an ascending horizontal plane. The structure of its incomplete section from November 23 is missing the final part. The ascending section from January 6 has reversal potential.

Outlook:

In the next 24 hours, we can expect gold to continue rising. A possible decline in the coming hours should not break the lower boundary of the estimated support. An active upward trend is more likely at the end of the day or tomorrow.

Potential reversal zones

Resistance:

- 1840.0/1845.0

Support:

- 1815.0/1810.0

Recommendations:

There are no conditions for opening short positions in the gold market today. Around the support area, it is recommended to monitor emerging reversal signals of your trading system for opening long positions.

Explanation: In simplified wave analysis (SVA), waves consist of 3 parts (A-B-C). The last unfinished wave is analyzed. The solid arrow background shows the structure formed. The dotted arrow shows the expected movements.

Attention: The wave algorithm does not take into account the duration of the instrument movements over time!

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română