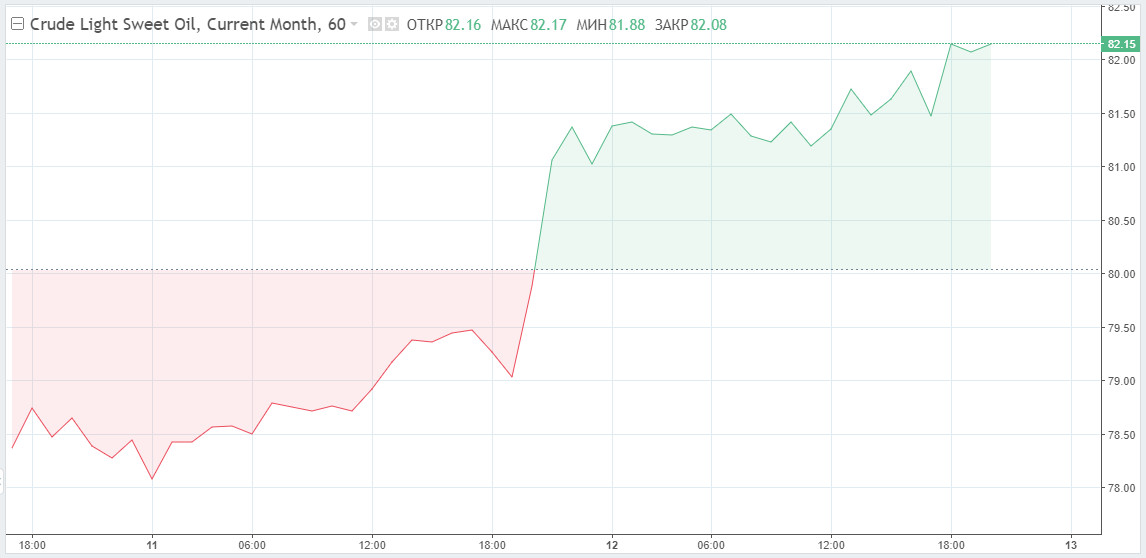

WTI crude oil was trading above $80 in late Tuesday trading. Today, on Wednesday, US light crude oil continues its rise. Thus, at the moment of writing the article, futures for WTI oil are at $82.08 per barrel, while futures for Brent traded at $84.37 per barrel.

Notably, during yesterday's trading the news reports were full of messages, which in any other situation would have created a bearish sentiment in the market. For example, the WHO noted again that the Omicron variant is rapidly spreading around the world. Moreover, the Oil Minister of Oman was quoted as saying that OPEC+ was not willing to push prices up to $100 and overheat the market.

Despite this news, the price of oil rose significantly on Tuesday according to the traders' forecast. Therefore, the rapid rise in Omicron cases does not indicate that demand for fuel and other petroleum products may be falling, but that herd immunity is close. That is to say, the more people encounter this new strain, the more likely it is that the virus will finally begin to recede by the summer season. Besdes, the overall number of travel could reach pre-pandemic coronavirus levels.

However, the Minister of Oman's comments initially had a negative impact on the quotations, although later it became clear to traders that this news is not new. The Alliance maintains its plans to increase production by 400,000 barrels per day. It is obvious that with implementation of these plans the market balance will be transformed into surplus. However, the market will not be overheated by such an increase in production, as well as the new shale boom in the USA and other countries.

Oil producing companies complain that banks are not willing to finance new projects and determine new requirements. Oil producers must transform into more environmentally friendly companies. These new trends in the oil sector are raising the breakeven price of production projects, giving OPEC+ a head start.

Oil received strong support after Jerome Powell's speeches, who is confident in the US economic recovery despite the spreading Omicron variant. Powell finally confirmed the analysts' forecasts that the US economy was ready to accept tightening of the monetary policy. He said that the regulator was able to maintain high rates of economic growth. Powell added that it would contribute to the demand for oil, which was highly sensitive to growth. After these optimistic statements the price of oil jumped yesterday.

The oil quotations growth was caused by yesterday's released updated forecast of the US Energy Information Administration (EIA) about the oil demand. Thus, this year total demand in the USA is expected to increase by 840,000 barrels a day instead of 700,000 barrels as a year ago.

At the same time, the EIA lowered its production forecast for 2022. Currently, it is forecasted that oil production in the USA will rise by 640,000 barrels a day instead of 670,000 barrels.

According to the American Petroleum Institute (API), US crude inventories slumped again, while gasoline and distillate inventories, on the other hand, rose last week. Market participants are positive about overall growth in the first quarter, however the latest inventory data from API show subdued demand for crude. This is the reason why some analysts believe there is no strong grounds to predict the coming price rally.

Currently, experts believe that if the risky sentiment on the stock market will remain acute for a long time, then during 2022 the oil quotes have chances to reach $100 and to consolidate in the range of $80-100. However, when planning transactions, it is recommended to take into account that this optimism about oil may fade as the US Federal Reserve takes a tougher stance on its economy.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română