Review:

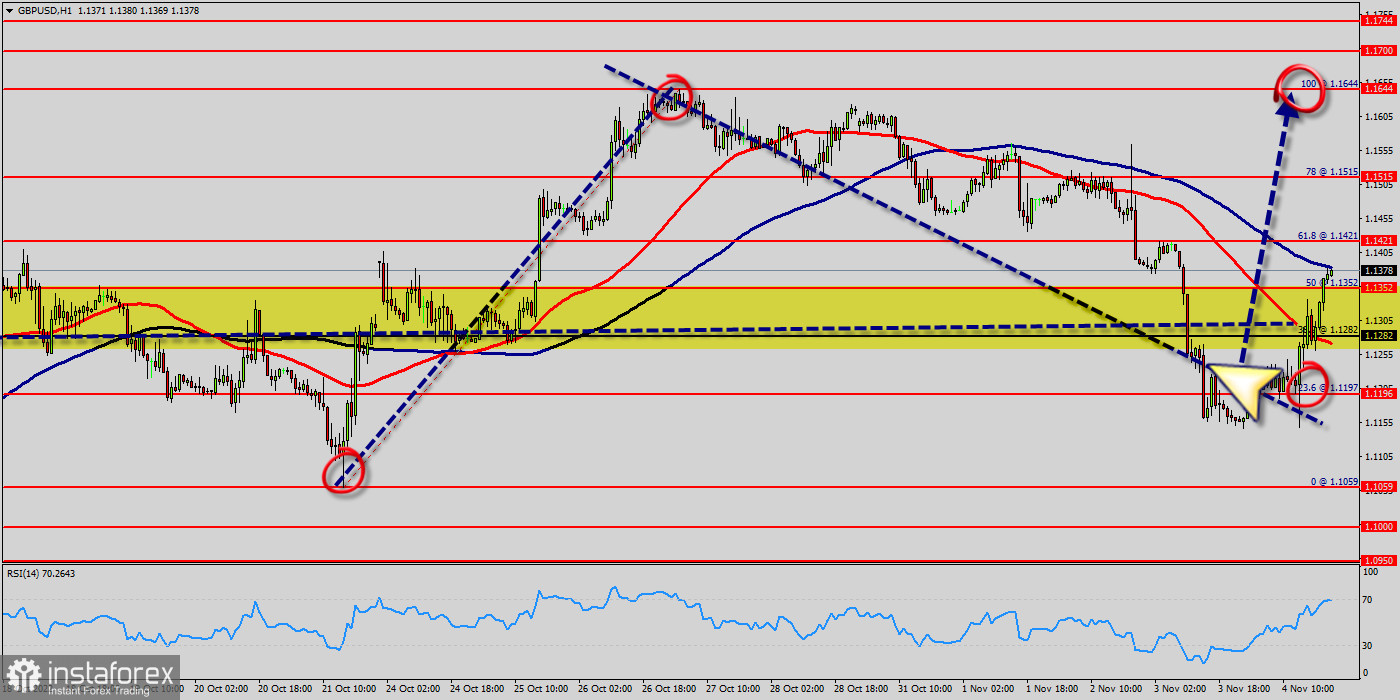

The GBP/USD pair's rise from the price of 1.1352 resumes today and accelerates to as high as 1.1644 so far. Immediate concentrate is now on 1.1421 resistance turned support, which is close to 100-day EMA (now at 1.1421). The bullish trend is currently very strong for the GBP/USD pair. As long as the price remains above the resistance at 1.1352, it could try to take advantage of the bullish rally. The GBP/USD pair has closed above the pivot point (1.1352) could assure that the GBP/USD pair will move higher towards cooling new highs. The bulls must break through 1.1420 USD in order to resume the uptrend. Decisive break their argue that such rally is at least correcting the fall from 1.1644 to set at 1.1421. Also, it should be noted that U.S. inflation was 0.35% in November, holding close to its highest annual rate in four decades despite easing energy costs. The GBP/USD pair retreated from around 1.1352, the 50% of Fibonacci retracement of the daily climb measured between 1.1352 and 1.1644, so holds above the former critical resistance, now support at 1.1352.

This week, the GBP/USD pair has broken resistance at the level of 1.1421 which acts as support now. Thus, the pair has already formed minor support at 1.1421. The strong support is seen at the level of 1.1303 because it represents the weekly support 1. Technical readings in the daily chart favor a bullish continuation, as indicators maintain their firmly bullish slopes within positive levels, while the 100 MA heads firmly higher below the current level. Equally important, the RSI and the moving average (100) are still calling for an uptrend. the GBP/USD pair is continuing rising by market cap at a range between 1.1400 and 1.1644 in coming hours. The GBP/USD pair is trading at 1.1400 after it reached 1 USD earlier. The GBP/USD pair has been set above the strong support at the prices of 1.1400 and 1.1352, which coincides with the 61.8% and 50% Fibonacci retracement level. The support at 1.1352 has been rejected three times confirming the veracity of an uptrend. The market is likely to show signs of a bullish trend around the spot of 1.1352. Buy orders are recommended above the area of 1.1352 with the first target at the price of 1.1515; and continue towards 1 USD in order to test the last bullish wave. The bullish momentum would be revived by a break in this resistance. The second bullish objective is located at 1.1550.

Crossing it would then enable buyers to target 1.1600 (buyers would then use the next resistance located at 1.1644 as an objective.). Be careful, given the powerful bearish rally underway, excesses could lead to a short-term rebound. If this is the case, remember that trading against the trend may be riskier. It would seem more convenient to wait for a signal indicating reversal of the trend. On the other hand, if the GBP/USD pair fails to break through the resistance price of 1.1644 USD today, the market will decline further to 1.1352 (return to pivot). In the very short term, the general bullish sentiment is not called into question, despite technical indicators being neutral (RSI).

On bearish outlook :

Moving averages, in the meantime, maintain their bearish slope way above the current level. Furthermore, although the news is bearish for the Pound, professional may not want to sell weakness, but rather following a rebound rally. Additionally, some aggressive counter-trend buyers may be defending parity. The price will fall into a bearish trend in order to go further towards the strong support at 1.1170 to test it again. The level of 1.1059 will form a new double bottom. According to previous events, the GBP/USD pair is still moving between the level of 1.1059 and the level 1.1282 (these levels coincided with the last bearish wave and Fibonacci retracement levels 38.2% and).

It should be noted that the 1.1282 price will act as a major resistance on Nov. 2022. Therefore, it will be too gainful to sell short below 1.1282 and look for further downside with 1.1170 and 1.1059 targets. It should also be reminded that stop loss must never exceed the maximum exposure amounts. Thus, stop loss should be placed at the 1.1352 level today.

The volatility is a statistical measure of a market's price movements in a given period of time. If prices for a currency have shown large instability over a short time period, then the market is highly volatile. If currencies are relatively stable, then volatility is low. In the very short term, the general bullish opinion of this analysis is in opposition with technical indicators. So long as the invalidation level of this analysis is not breached, the bullish direction is still favored, however the current short term bearish correction should be carefully watched.

Forecast (GBP/USD) : The volatility is very high for that the GBP/USD is still moving between 1.1282 and 1.1421 in coming hours. Consequently, the market is likely to show signs of a bullish trend again. Hence, it will be good to buy above the level of 1.1300 with the first target at 1.1352 and further to 1.1421 in order to test the daily resistance. However, if the GBP/USD is able to break out the daily support at 1.1196, the market will rise further to 1.1059 to approach support 2 next week.

Next week:

Range: 1.1200 - 1.1515.

Resistance levels: 1.1200 - 1.1352 - 1.1421 - 1.1515

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română