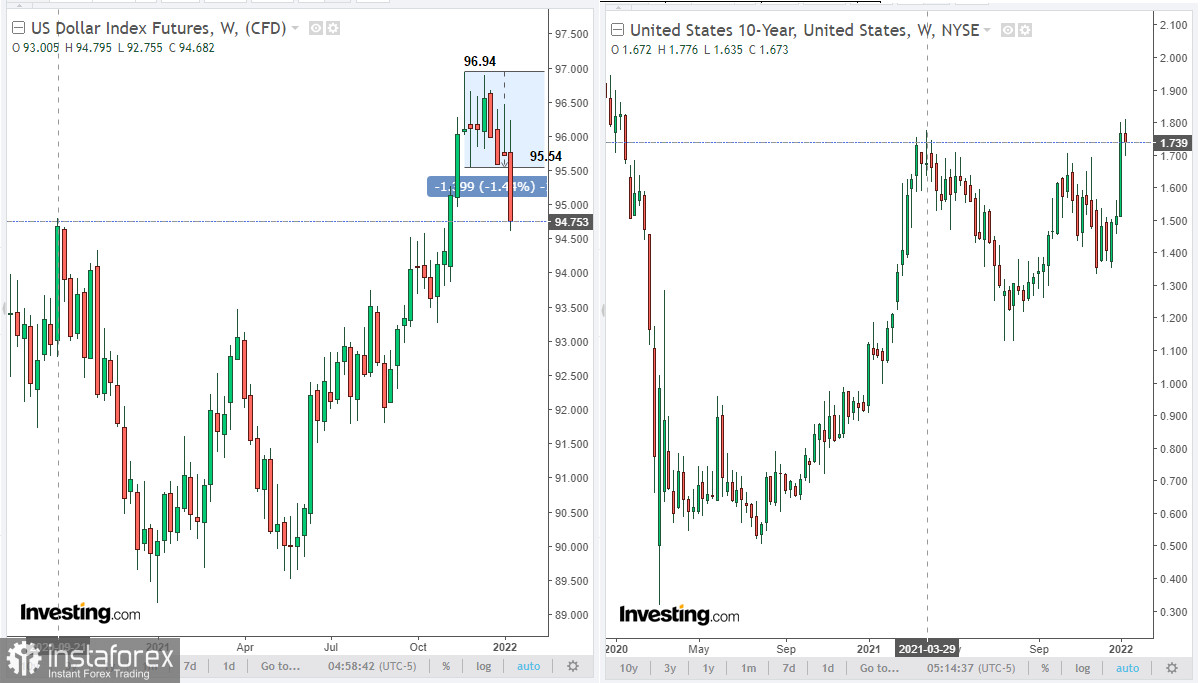

The second trading week of 2022 is coming to an end. It turned out to be just as volatile as the first one. The US dollar is set to close the session in negative territory with a considerable decline.. On Wednesday, after the US Department of Labor had published the CPI data for December, the US dollar index fell sharply and continued its downward movement during the Asian trade on Friday. At the moment of writing, DXY was trading at 94.75 which corresponds to the September highs of 2020. After breaking through the lower boundary of the channel at 95.54, the US dollar index dropped rapidly in response to accelerated inflation in the US.

According to the US Department of Labor statistics, consumer prices increased by 7.0% in December on an annual basis after rising by 6.8% in November. It is the highest inflation rate in nearly 40 years. Core inflation (excluding food and energy prices) was up by 5.5% year over year.

Therefore, inflation has been above the Fed's target of 2% for several months in a row. Such a fast pace pushes investors to take profit on long positions on the US dollar. Investors fear that the Fed may miss the right moment to take appropriate measures for policy tightening. Market participants have already priced in three rate hikes promised by the regulator this year. Apparently, markets doubt that this will be enough to curb soaring inflation in the US.

Still, the US dollar is supported by rising US Treasury yields. At the moment of publication, 10-year bond yields stood at 1.739%, having returned to the levels last seen almost a year ago. However, if Treasury yields decline, the US dollar will inevitably fall deeper unless the Fed announces emergency measures to fight inflation.

On Wednesday, President of the Federal Reserve Bank of St. Louis James Bullard supported a more aggressive approach. He believes that the central bank will have to raise the rate four times this year in order to curb surging prices. "We want to bring inflation under control in a way that does not disrupt the real economy, but we are also firm in our desire to get inflation to return to 2% over the medium term," Mr. Bullard said.

In the meantime, the US currency is rapidly depreciating against its major rivals as well as against commodity currencies. The latter are gaining strength from increased prices for commodities.

Despite a continuous rise of new COVID-19 cases around the world, investors maintain an optimistic outlook, while global stock indices develop an upside dynamic. In addition, countries with the most developed economies have been displaying rather upbeat economic data lately.

Among major commodity currencies, the Canadian dollar has been the strongest so far. Rallying oil prices considerably contributed to its rise against the US dollar. Canada is one of the largest oil exporting countries, with oil and petroleum products making up approximately 22% of its export. Despite some uncertainty in the crude market due to coronavirus, many leading experts project a further rise in energy prices (for coal, gas, and oil). Notably, gas prices resumed their uptrend after a slight decline in late 2021, while oil stockpiles in the US have been decreasing for several weeks in a row. By the way, gas prices in Europe on January 14 exceeded $1,100 per 1,000 cubic meters. On December 21, 2021, they reached a record high of $2,190.4 per 1,000 cubic meters and then declined to $1,020 by the end of December.

The recent report on weekly crude inventories from the US Energy Information Administration showed that oil reserves fell by 4.553 million barrels in the week to January 7. This was the seventh week of decline in crude stockpiles. Currently, US strategic oil reserves stand at 593.4 million barrels, down by 300,000 barrels.

Trading recommendations and forecast

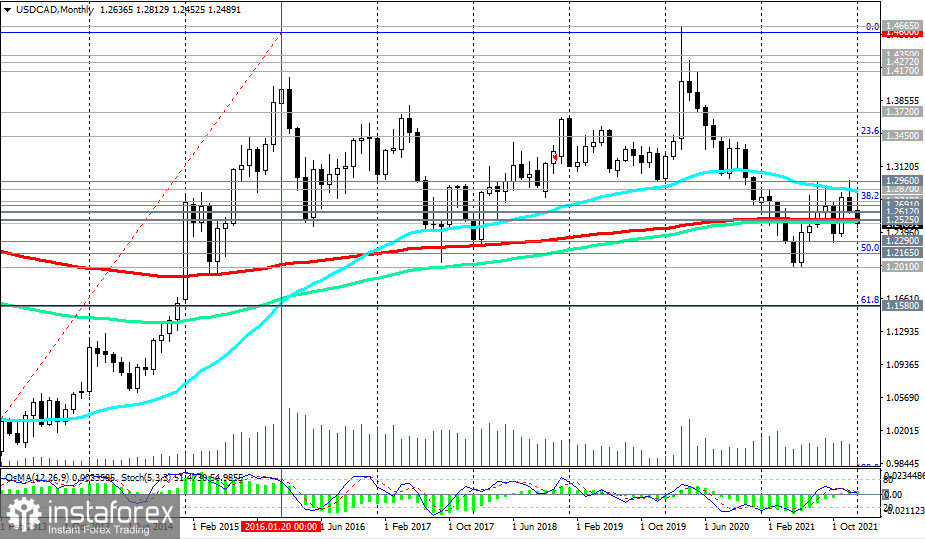

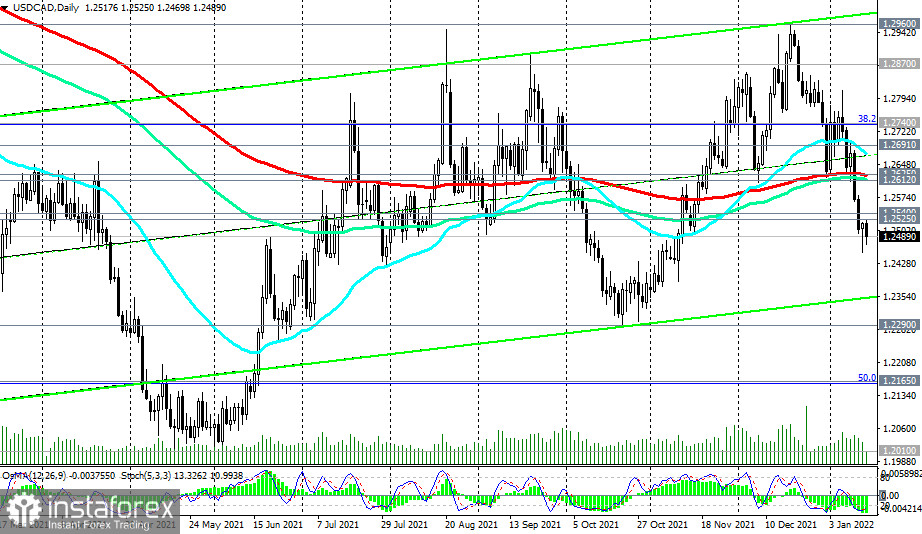

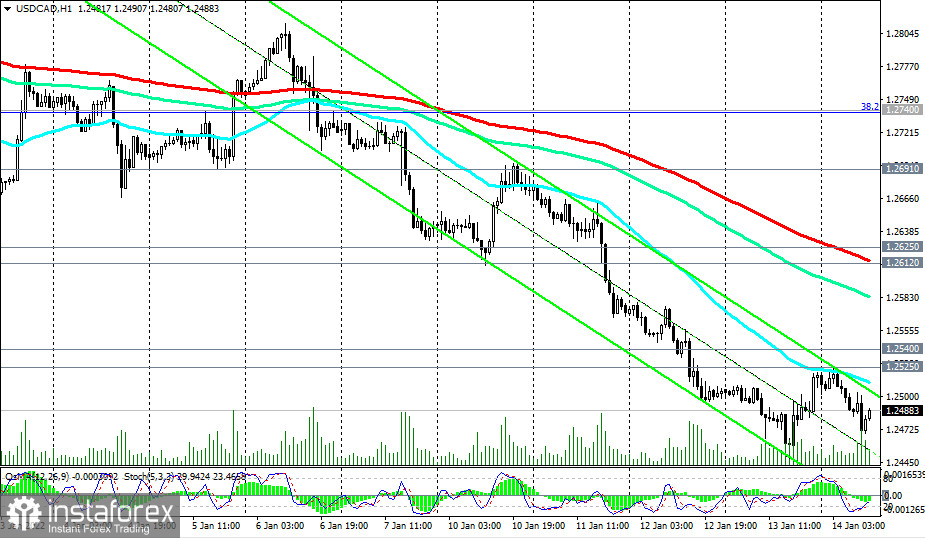

As for the USD/CAD pair, it extends losses today in an effort to settle below the key support level of 1.2540 (200-period moving average on the monthly chart). In case of its further decline, the following levels will become the next targets: support at 1.2290 (October lows of 2021), 1.2165 (50% Fibonacci as part of the downward correction of the USD/CAD ascending wave between 0.9700 and 1.4600), and 1.2010 (2021 lows). This scenario seems most likely as oil and gas prices are rising while the US dollar is declining, with 3 rate hikes being priced in.

In a different scenario, the first signal to buy USD/CAD will be a breakout of the resistance levels of 1.2525 (local high) and 1.2540. A return above long-term resistance at 1.2625 (200-period moving average on the daily chart) will pave the way for further growth towards the resistance level of 1.2870 (200-period moving average on the weekly chart). Its breakout will send USD/CAD back to the bulls' territory.

In the meantime, short positions are more relevant now. A breakout of yesterday's low at 1.2453 will serve as a signal to add more short positions on USD/CAD.

Today, some fundamental factors are likely to cause volatility in the market and especially in the USD quotes. In particular, traders will focus on retail sales data in the US which is due at 13:30 (GMT) and the University of Michigan consumer sentiment index due at 15:00 (GMT).

The change in retail sales is the main indicator of consumer spending and is one of the main components for calculating the country's GDP. In the previous month (November), the indicator stood at +0.3% (after a +1.8% increase in October, +0.8% in September, and +0.9% in August). This means that the recovery in this sector of the American economy is still unstable. The report is expected to show zero growth in December despite the period of Christmas shopping, which is a disappointing factor for USD.

The University of Michigan consumer confidence index, in turn, reflects the confidence of American consumers in the economic development of the country. A high level indicates economic growth, while a low level indicates stagnation. These are the previous readings in 2021: 70.6 in December, 67.4 in November, 71.7 in October, and 72.8 in September. The data shows an uneven recovery of this indicator which is also negative for the US dollar. If the fresh data turns out to be weaker than the current values, the US dollar may come under pressure in the short term. The January reading is expected to be 70.

Levels of support: 1.2453, 1.2290, 1.2165, 1.2010

Levels of resistance: 1.2525, 1.2540, 1.2612, 1.2625, 1.2691, 1.2740, 1.2870, 1.2900, 1.2960

Trading scenarios:

Sell Stop 1.2450. Stop-Loss 1.2550. Take-Profit 1.2400, 1.2290, 1.2165, 1.2010

Buy Stop 1.2550. Stop-Loss 1.2450. Take-Profit 1.2600, 1.2612, 1.2625, 1.2691, 1.2740, 1.2870, 1.2900, 1.2960

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română