After a significant decline in the middle of last week against the background of the publication of fresh data on inflation in the United States last Friday, the dollar was able to regain some of the lost positions.

Moreover, the dollar was able to recover, despite weak statistics from the U.S., published at the beginning of the American trading session. According to published data, prices for U.S. exports and imports decreased by 1.8% and 0.2%, respectively, and the core retail sales index unexpectedly decreased by -2.3% (against the forecast of growth in December by +0.2%). Industrial production in the U.S. also declined in December, by -0.1% (against the forecast of +0.4%), and the consumer confidence index from the University of Michigan in January fell to 68.8 (against the forecast of 70.0 and the previous value of 70.6).

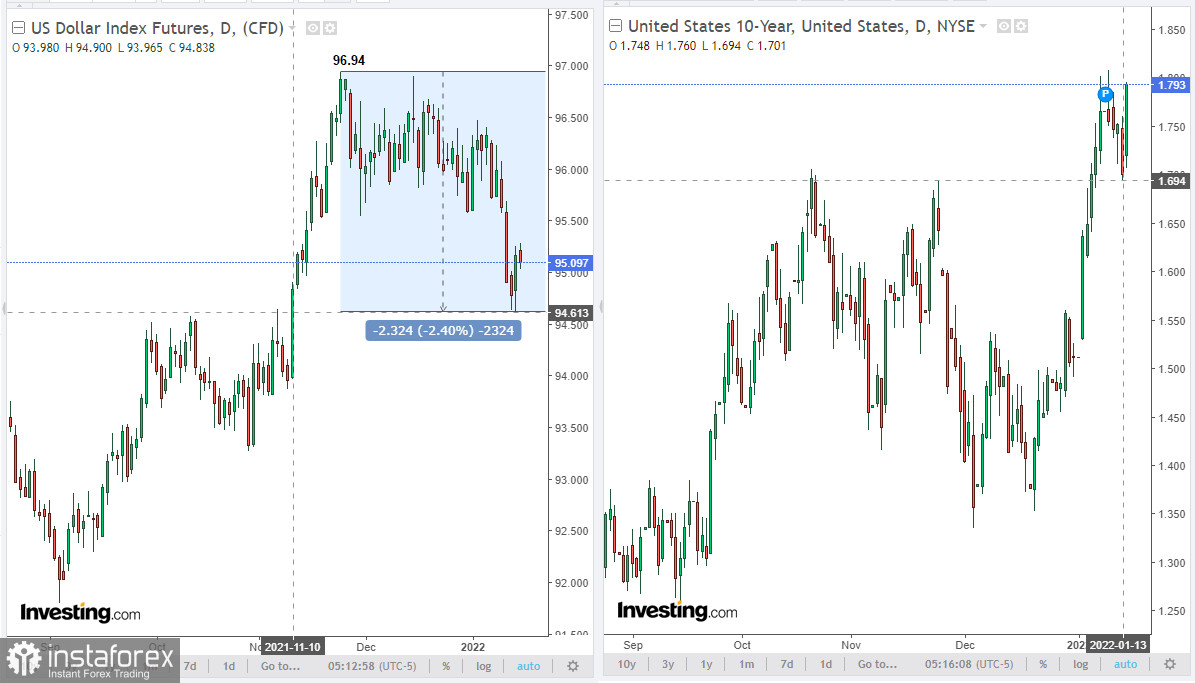

However, Friday's strengthening was not enough for the dollar to close the past week in positive territory. It turned out to be negative for the DXY dollar index. Since the opening of today's trading day, DXY futures have been declining again. At the time of writing, DXY futures are trading near 95.10, 6 pips below Friday's close.

The dollar is being held back from a stronger decline today by the sharply increased yield of U.S. government bonds. The yield on U.S. 10-year bonds jumped to 1.793% today from Friday's low of 1.694%. Moreover, it has been actively growing for the past 3 weeks, after the Fed meeting ended in mid-December, at which its leaders expressed a tendency to conduct a more active tapering of the stimulus program.

This suggests that investors are actively selling protective government bonds, counting on the growth of the dollar. Perhaps they are right, since the Fed's interest rate hike (which is planned to be done 3 times in 2022) should (in theory) contribute to the appreciation of the dollar. But there is also one significant point of uncertainty here. The Fed may simply not keep up with the pace of inflation.

According to data published last week, consumer prices in the United States rose by 7.0% in December compared to the same period of the previous year, which was the highest since June 1982 (annual price growth in November was 6.8%), and if inflation continues to grow at the same pace, the Fed may not keep up with it, steadily raising interest rates, which creates a threat of hyperinflation, and this directly affects the value of the dollar.

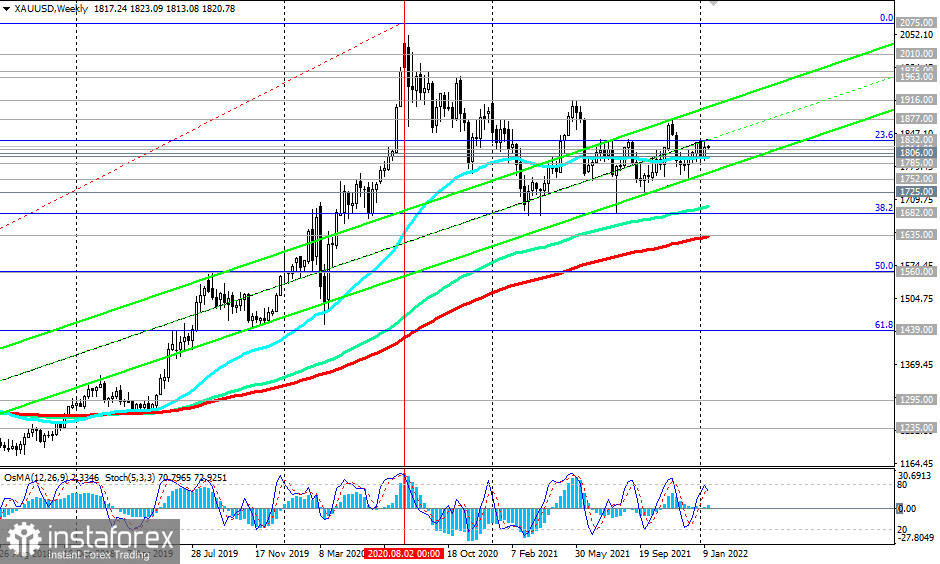

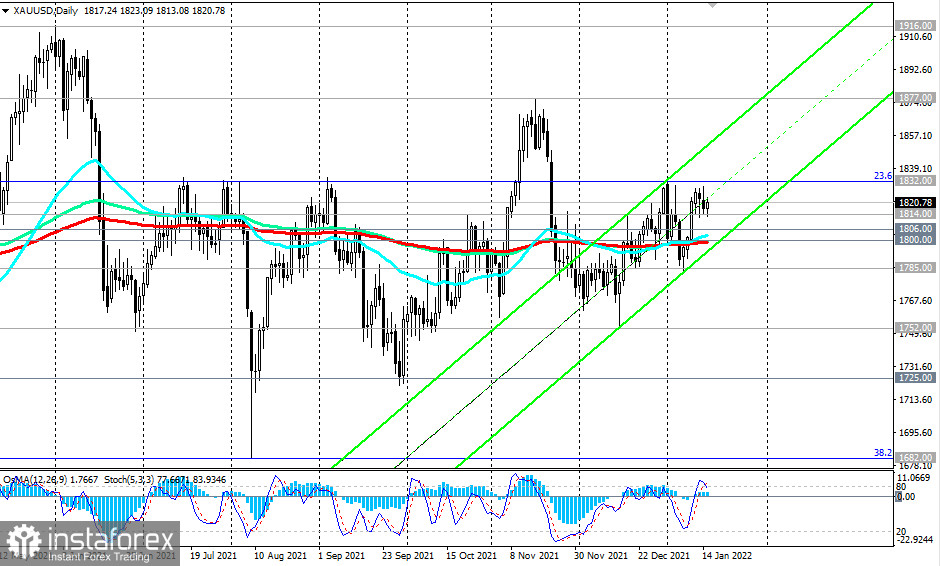

The traditional protective asset in times of uncertainty and rising inflation is gold, and its dynamics perfectly demonstrates this uncertainty. Since the beginning of 2021, XAU/USD has been trading in the range between the levels of 1,916.00 and 1,682.00. A narrower range is located between the levels of 1,832.00 and 1,752.00.

Statements by the Fed leaders do not allow the XAU/USD pair to develop a more confident upward trend. Some of them, such as the head of the St. Louis Fed, James Bullard, advocate a more aggressive tightening of monetary policy. Last week, Bullard said that in order to contain high inflation now, apparently, it will be necessary to raise interest rates 4 times this year.

"We want to bring inflation under control in a way that does not disrupt the real economy, but we are also firm in our desire to get inflation to return to 2% over the medium term," Bullard said.

As you know, gold does not bring investment income, but its quotes are very sensitive to changes in the monetary policy of world central banks, especially the Fed. And now, when investors' confidence that the Fed will start actively raising interest rates (at least 3 times in 2022) is growing, the upward trend of gold risks being broken.

However, if the Fed remains inactive, and inflation in the United States continues to grow at the same pace, then the demand for gold as a protective asset may push its quotes towards the upper limits above the indicated ranges.

By the way, the upper limit of the ascending channel on the weekly chart of XAU/USD also passes between the marks of 1,877.00 and 1,916.00. In the event of its breakdown, XAU/USD has a chance to grow towards multi-year highs near the 2,000.00 mark. We also note that at the height of the pandemic crisis in August 2020, XAU/USD quotes rose to the 2,074.00 mark. Perhaps this is too negative a scenario. But it can also be realized if there are any negative events of a global geopolitical scale, for example, military clashes in a wide theater of military operations.

In an alternative scenario, and after retesting the key long-term and psychologically important support level of 1,800.00, XAU/USD will head towards the lower limit of a wide range passing through the mark of 1,682.00 (Fibonacci level of 38.2% correction to the growth wave since December 2015 and the mark of 1,050.00). A break of the support levels of 1,635.00 (200-day MA on the weekly chart), 1,560.00 (50% Fibonacci level) will increase the risks of breaking the long-term bullish trend of XAU/USD.

In our opinion, XAU/USD will remain upside for the time being, remaining mostly in the zone above 1,800.00, while investors will assess the prospects for the Fed's policy and the threat from the risks of hyperinflation and the strengthening of the coronavirus pandemic.

Support levels: 1814.00, 1806.00, 1800.00, 1785.00, 1752.00, 1725.00, 1682.00, 1635.00, 1560.00

Resistance levels: 1832.00, 1877.00, 1900.00, 1916.00, 1963.00, 1976.00, 2000.00, 2010.00

Trading recommendations

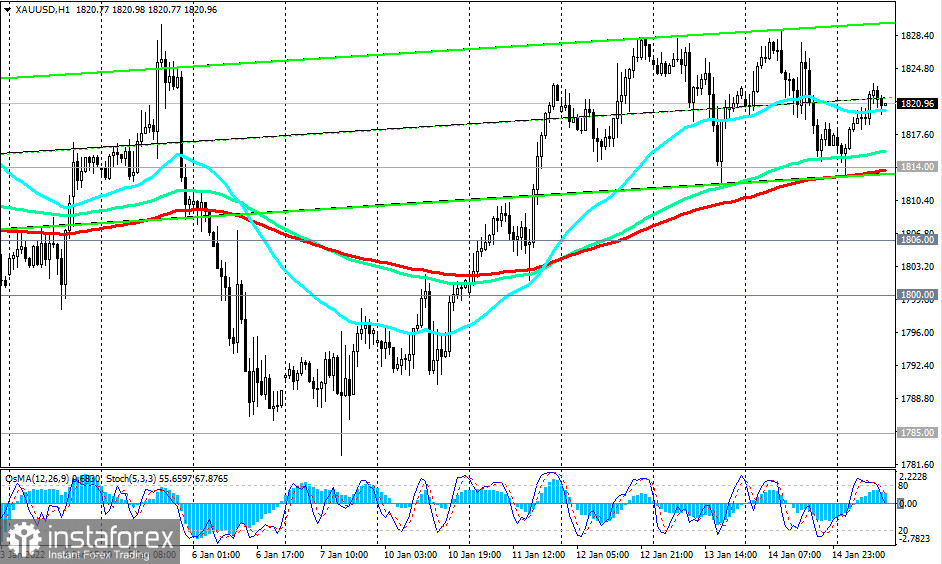

XAU/USD: Sell Stop 1811.00. Stop-Loss 1830.00. Take-Profit 1806.00, 1800.00, 1785.00, 1752.00, 1725.00, 1682.00, 1635.00, 1560.00

Buy Stop 1830.00. Stop-Loss 1811.00. Take-Profit 1832.00, 1877.00, 1900.00, 1916.00, 1963.00, 1976.00, 2000.00, 2010.00

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română