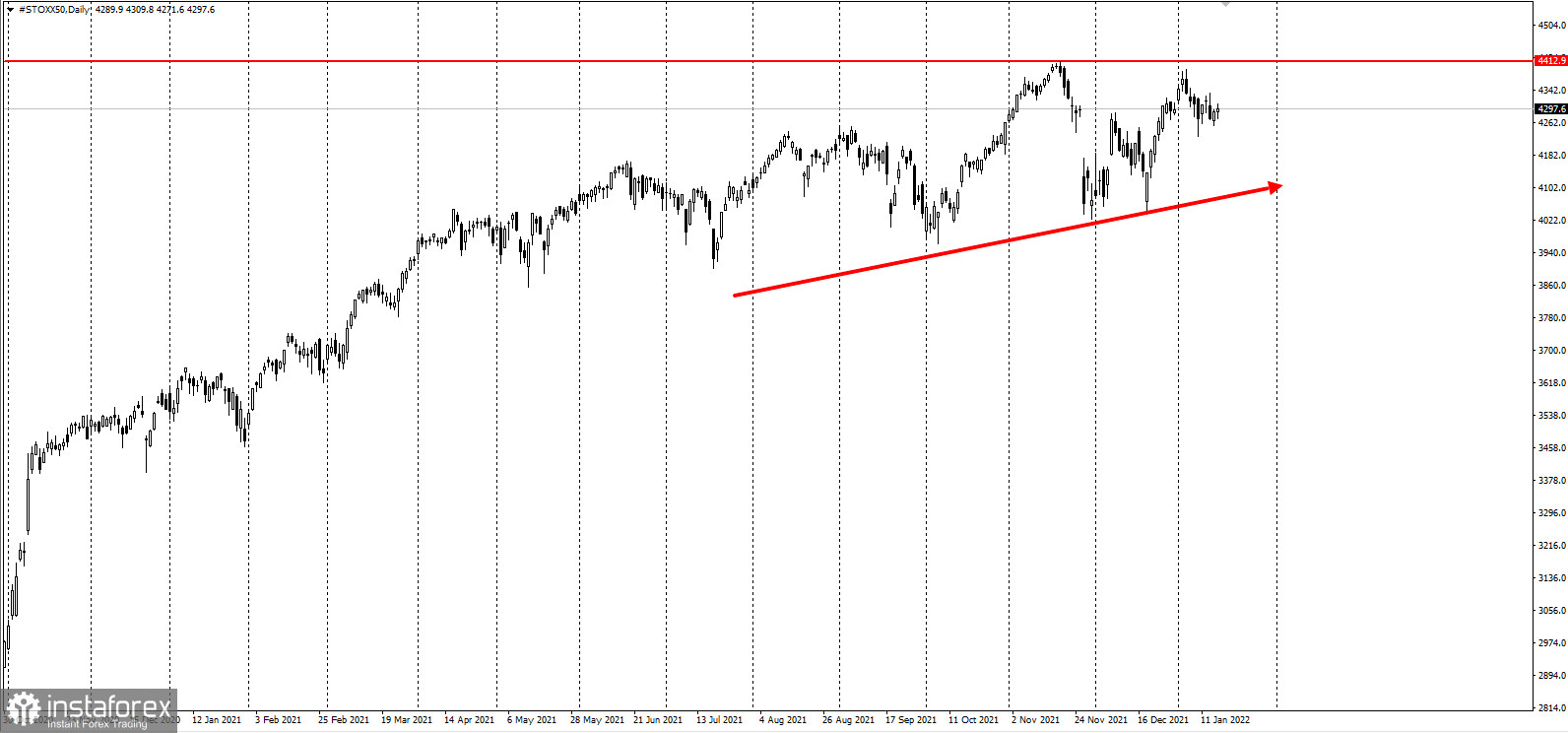

Stocks were mixed on Monday as traders weighed in the global rise in sovereign yields and corporate events. Euro Stoxx 50 posted gains, while US futures were mixed. Dollar also showed some increase in price.

On the other hand, the US stock and bond markets were closed on Monday due to the celebration of Martin Luther King Day.

Bond yields rose globally after US Treasury bonds collapsed on Friday amid concerns over the Fed's plan on monetary policy. JPMorgan CEO Jamie Dimon even said the central bank could increase rates up to seven times this year. Some traders also believe that the European Central Bank will raise rates by the end of the year.

The rapid spread of omicron, start of reporting season and the boom in M&A are also affecting mood. Investors are looking for signs that companies can sustain growth despite rising risks from inflation, rates, supply chain bottlenecks and economic slowdown. Wall Street banks already started their earnings season with mixed results last week, disappointing investors and lowering some earnings expectations for this year.

Given the record inflation backdrop and historically tight labor market, investor focus is on margins -- demonstrating pricing power, passing on rising costs to the customer," said Julian Emanuel, chief strategist at Evercore ISI.

Among individual players, Unilever posted a drop, while GlaxoSmithKline Plc showed gains. BE Semiconductor also grew, hitting its highest since 1995.

In China, the central bank cut interest rates on Monday in order to counter the economic slowdown. The slump in real estate market, as well as shutdowns due to Covid, are some of the problems of the country.

"The PBOC really has started the New Year in a different position to, let's say, other global banks and we do expect to see further easing or supportive measures, both monetary-wise as well as from a fiscal stance," said Catherine Yeung, investment director at Fidelity International.

Other reports to watch out for this week are:

- US manufacturing data (Tuesday);

- monetary policy decision of the Bank of Japan (Tuesday);

- US housing starts and jobless claims (Thursday);

- monetary policy decision of Indonesia, Malaysia, Norway, Turkey and Ukraine (Thursday).

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română