Bitcoin, followed by the cryptocurrency market, closed the previous trading day with a decline of 2.5% in total industry capitalization. However, the $2 trillion mark is still a support zone. The news background was unclear during the digital assets' decline. Nevertheless, it did not have a significant impact on the market.

US and Western European stock indices rose significantly on positive company reports and statistics in China. In the United States, the reporting period of major companies is about to start. Therefore, we should expect increased volatility and a favorable backdrop for cryptocurrencies in the near term.

Jack Dorsey is going to launch an important initiative to support the mining industry. The entrepreneur announced that Blok was creating an open Bitcoin mining system that will make crypto mining more decentralized and profitable in terms of efficiency, revenue sharing and maintenance. Even disregarding Dorsey's project, Bitcoin's hashrate hit a new high at around 215 EH/s. However, given the possible mining migration due to the political situation in Kazakhstan, Jack Dorsey's initiative could be a key factor in keeping bitcoin's processing power high.

Spain and Singapore follow Pakistan in planning to ban and block cryptocurrency websites within the country. Politicians cite preventing money laundering and funding of terrorist organizations as the main reason for this. The suspension of the cryptocurrency sector activity is most likely due to the need for a legal framework to regulate and tax the industry. However, regardless of the motivation, the Pakistani government has temporarily sided with opponents of digital assets.

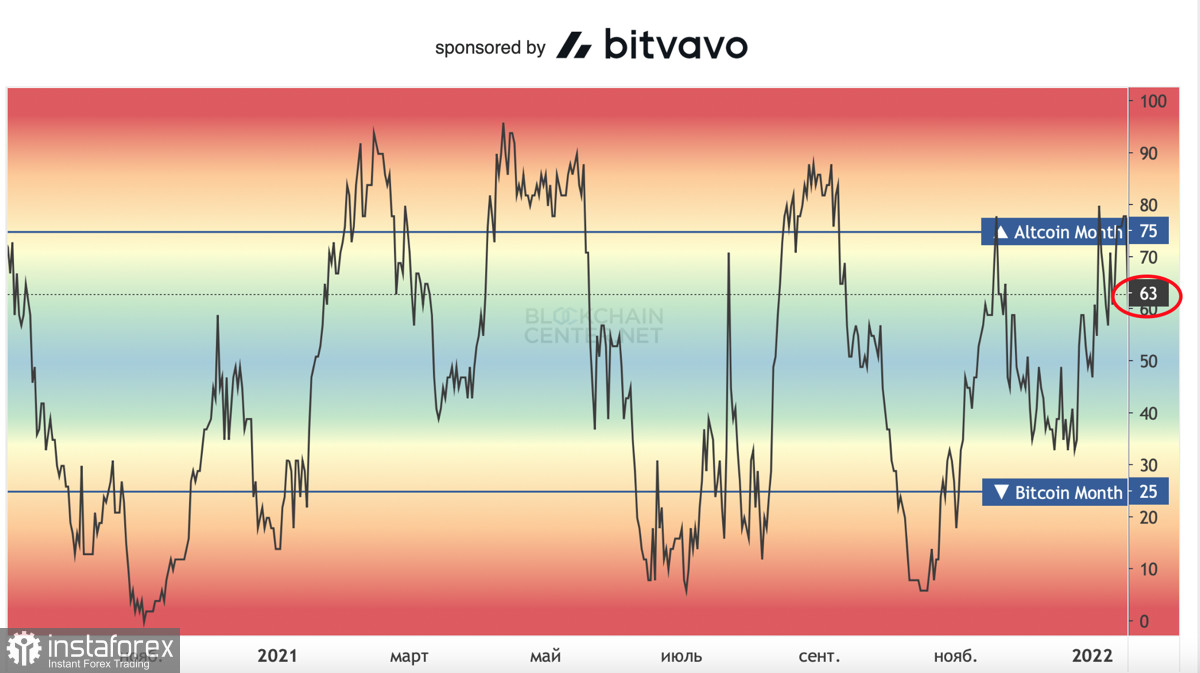

Overall, the situation in the cryptocurrency market and related sectors is becoming positive. Bitcoin is losing its dominance, resulting in an impending alt-season. The only thing that could negatively affect the market is the first cryptocurrency's position. At the end of the trading day on January 17, Bitcoin broke an important support area due to weak buying positions. Probably, it was done for additional liquidity accumulation around $41k-$42k, because there was not enough buying volume to break the downtrend line. The target was met, and the bulls sharply rebounded from the crypto's decline. But the altcoin market instantly went into the red zone, causing the market capitalization to fall by 2.5%.

Bitcoin's strong market impact raises doubts about the success of the alt-season. The asset is likely to continue falling and testing support areas as low as $40k. This negatively affects altcoin prices and causes uncertainty in the market. As a consequence, investors are withdrawing funds from risky assets, which has already led to a five-week outflow of funds from cryptocurrency projects. Therefore, the full start of the alt-season should be expected after Bitcoin prices stabilize. The zone above $44.5k, where the downtrend border passes, is considered a safe zone for altcoin investing. If Bitcoin settles above this zone in a reasonable timeframe, there will be a full-fledged alt-season with new promising projects and development of established coins.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română