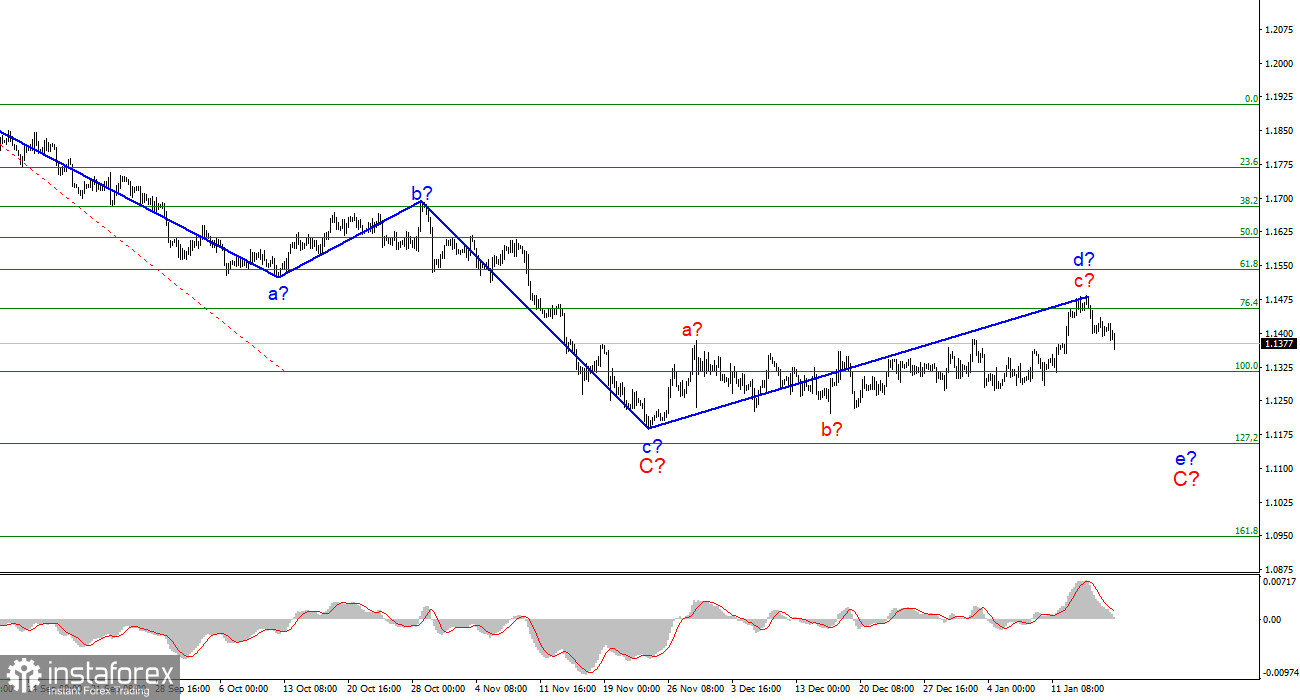

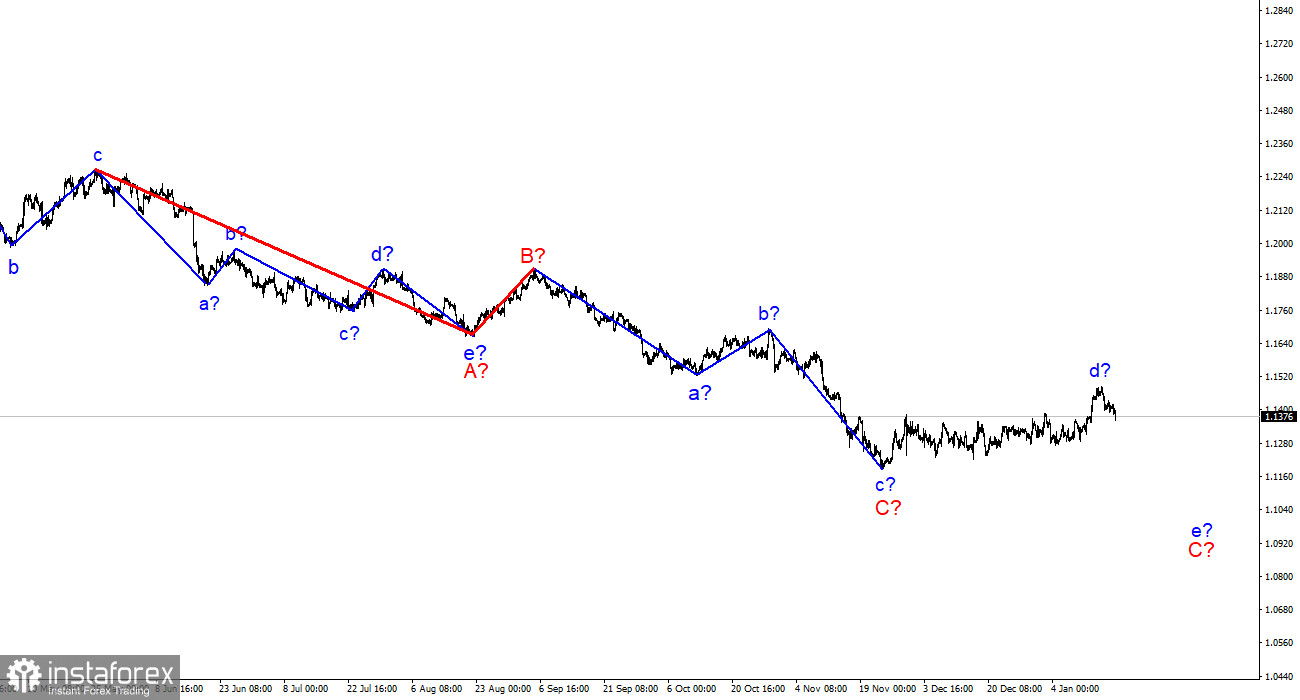

The wave marking of the 4-hour chart for the euro/dollar instrument still does not require additions and clarifications. Wave d turned out to be longer than I originally expected, but this does not change the essence of the wave marking. I still believe that this wave is corrective, not impulsive, as evidenced by its complex internal wave structure. Therefore, it cannot be wave 1 of a new upward trend segment. If so, the decline in quotes will resume (or has already resumed) within the framework of the expected wave e-C. At the same time, the resumption of the increase in the quotes of the European currency may lead to the need to make adjustments to the current wave marking, since wave d will turn out in this case to be the longest wave in the composition of the downward trend section. An unsuccessful attempt to break through the 1.1455 mark indicates that the market is not ready for further purchases of the instrument.

Powell waited too long. Now inflation is not so easy to stop.

The euro/dollar instrument declined by another 30-40 basis points on Tuesday. Thus, wave d took a completely completed, three-wave form. The departure of quotes from the reached highs may be the beginning of the wave e-C, which can also take a rather extended form. There was no news background on Tuesday, but this does not mean that there are no interesting topics on the market right now. American inflation has been bothering analysts and markets ever since it became the highest in the last 30 years. Now it is the highest in the last 40 years, and the latest report showed that it is too early to talk about its slowdown. Thus, more and more questioning eyes turn to Jerome Powell, who has long said that "inflation will begin to slow down in 2022." And initially, the interpretation was "it will begin to slow down at the end of 2021." However, this did not happen, and inflation is already 7.0%. Jerome Powell said in the Senate that he does not want to rush to sell bonds from the Fed's balance sheet. The QE program will be completed in March, but the Fed will still reinvest the funds received from expired bonds. Republican Senator Richard Shelby replied that the Fed was already late with measures against inflation, and the organization itself, which performs the function of the central bank, lost some of its credibility due to the slowness of its leaders. Now the majority of FOMC members are ready to vote for both three rate hikes and four in 2022. But will it stop inflation now? And how much longer will it grow? The good news is that rising inflation does not cause any discomfort to the US currency. It continues to rise in the long term about the British and European. And raising rates and ending the QE program could further boost demand for the dollar. Thus, all the confusion with the Fed plays into the hands of the US currency.

General conclusions.

Based on the analysis, I conclude that the construction of the ascending wave d can be completed. If this assumption is correct, then now it is necessary to sell the instrument based on the construction of the wave e-C with targets located near the calculated marks of 1.1315 and 1.1154, which equates to 100.0% and 127.2% by Fibonacci. So far, there is no reason to assume the execution of an alternative option, which involves the resumption of an increase in the quotes of the instrument.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română