The New Zealand dollar failed to strengthen after the RBNZ meeting held at the end of November, at which the central bank of New Zealand raised the rate by 0.25%.

Against the backdrop of accelerating inflation to a maximum since 2010, the Reserve Bank of New Zealand raised the key rate for the second time in two months (November-October), bringing it to 0.75%. In an accompanying statement, the bank's leaders noted positive trends in the national economy. However, risks of a global slowdown remain due to the spread of the coronavirus and supply chain disruptions.

Despite the interest rate hike, the New Zealand dollar weakened, including against the U.S. dollar, after the publication of the Reserve Bank of New Zealand's forecast for the short-term interest rate, which did not meet market expectations. RBNZ executives are now going to take a wait-and-see attitude to assess the impact on the economy from the interest rate decision, and this seems to have disappointed investors.

Usually, an increase in the interest rate has a positive effect on the quotes of the national currency. However, in this case, the market reaction was the opposite. The NZD declined shortly after the publication of the RBNZ's decision to raise the interest rate. The conclusion is that this increase was already embedded in prices, and the restrained position of the RBNZ management regarding the future prospects of monetary policy disappointed investors.

Moreover, the market is assessing the possibility that the Fed may raise its target interest rate by 0.50% at once during the March meeting, and not by 0.25%, as previously expected, and then several more times this year. If monetary policy tightening proceeds at such a pace, the Fed will overtake other major world central banks in this process.

The New Zealand dollar is also negatively affected by the dynamics of the country's GDP. There was a drop in GDP in the 3rd quarter by -3.7% (after an increase of +2.8% in the 2nd quarter of 2021). Data for the 4th quarter will be published in mid-March 2022, and here, too, economists do not expect strong growth.

Nevertheless, today the NZD/USD pair is growing mainly due to the weakening of the U.S. dollar. The macroeconomic statistics released the day before from the U.S. were distinguished by a sharp drop in the index of business activity in the manufacturing sector of the New York Fed. In January, this figure fell to -0.7 from 31.9 in December. Nevertheless, economists believe that this fall will be short-lived.

The weakness that companies are seeing is due to temporary factors that are not enough to undermine further growth. The sharp drop in the New York Fed manufacturing index in January indicated a short-term decline in activity caused by a wave of infections with the omicron strain rather than the beginning of a downward trend in the industry. Labor market indicators signal that companies have continued to create jobs.

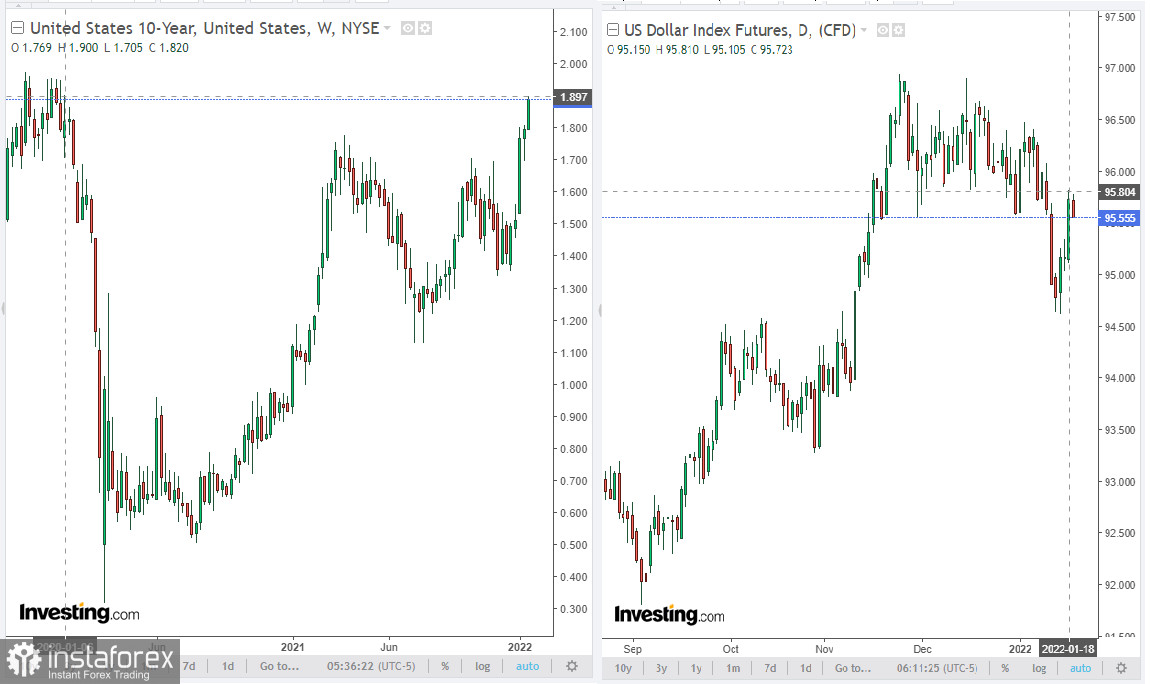

Meanwhile, the fall in the dollar, which we are seeing today, is significantly offset by the growth in the yield of U.S. government bonds. Today, 10-year bond yields hit 1.897%, in line with 2-year levels, while 2-year Treasury yields rose to 1.026%, the highest since February 2020.

The yield on short-term Treasury bonds is very sensitive to expectations regarding the Fed's interest rate hike, and now it best demonstrates the mood of market participants regarding the prospects for monetary policy.

In turn, the New Zealand dollar received support after the publication yesterday of positive statistics on retail sales using electronic payment cards. Sales continue to show strong growth, up 4.2% in December from 2.9% (YoY) in November.

Accelerating growth in prices for dairy products also has a positive effect on NZD quotes. The Global Dairy Trade (GDT) dairy price index released on Tuesday, which gained 4.6% over the past two weeks, well above the 0.3% seen in November, also provided moderate support to the New Zealand currency. A significant part of New Zealand's exports are dairy products, primarily milk powder. Therefore, the increase in world prices for dairy products has a positive impact on the NZD, increasing the level of receipt of export foreign exchange earnings in the country's budget.

Given the rise in prices for commodities and for agricultural products in recent times (especially for dairy products, which are the most important component of New Zealand exports), a strong weakening of the NZD and a fall in the NZD/USD pair should still not be expected, unless the Fed announces an unexpected increase in strong measures to tighten their monetary policy.

Today, market participants will look forward for the publication of statistics on the dynamics of the U.S. construction market. A slight deterioration in indicators is expected in December, which will most likely have only a short-term negative impact on the USD.

In general, market participants are set to further strengthen the USD, betting on the prospect of further increases in Fed interest rates and then on a reduction in its asset portfolio (the Fed's balance sheet is now $8.8 trillion).

Technical analysis and trading recommendations

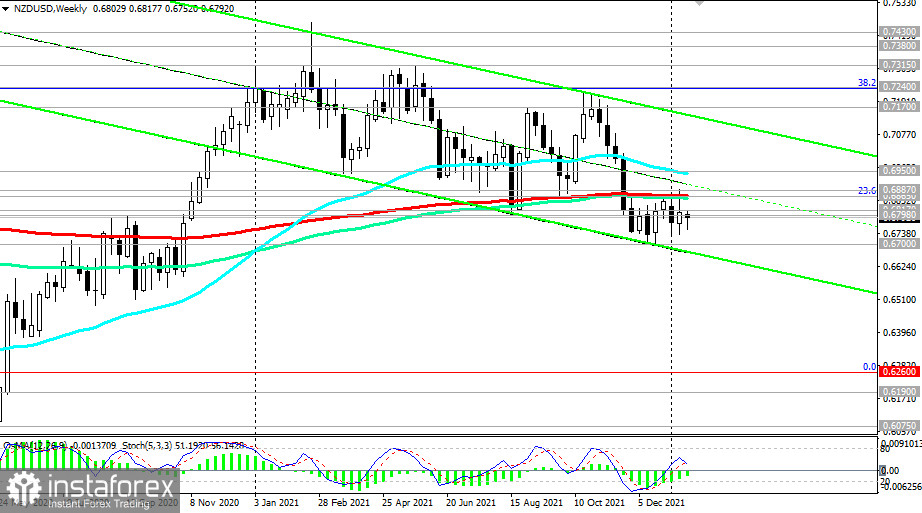

At the moment, NZD/USD is in the bear market zone, trading below the key resistance levels of 0.6865 (200 EMA on the weekly chart and the 23.6% Fibonacci retracement in the global wave of the pair's decline from the level of 0.8820), 0.6950 (200 EMA on the daily chart).

In December, NZD/USD hit a new 13-month low at 0.6700, but then corrected, now trading in a range between 0.6865 and 0.6735. The breakdown of the local support level of 0.6735 will be a signal to build up short positions.

In an alternative scenario, and after the breakdown of the resistance level of 0.6865, NZD/USD will head towards the resistance levels of 0.6950, 0.7100, 0.7170. More distant growth targets are located at the resistance levels 0.7240 (38.2% Fibonacci), 0.7430, 0.7550 (50% Fibonacci), 0.7600, and the first signal for the implementation of this scenario may be a breakdown of the important short-term resistance level 0.6798 (200 EMA at 1 Hour chart).

In the current situation, the determining factor in the dynamics of NZD/USD is likely to be the course of the monetary policy of the central banks of the United States and New Zealand. And most likely, the conditional "scales" will tilt towards the currency of the country whose central bank takes a tougher stance. In general, the downward dynamics of NZD/USD prevails.

Support levels: 0.6735, 0.6700

Resistance levels: 0.6798, 0.6817, 0.6865, 0.6887, 0.6950, 0.7100, 0.7170, 0.7240, 0.7315, 0.7380, 0.7430, 0.7550, 0.7600

Trading recommendations

Sell Stop 0.6750. Stop-Loss 0.6820. Take-Profit 0.6735, 0.6700, 0.6600, 0.6500, 0.6260

Buy Stop 0.6820. Stop-Loss 0.6750. Take-Profit 0.6865, 0.6887, 0.6950, 0.7100, 0.7170, 0.7240, 0.7315, 0.7380, 0.7430, 0.7550, 0.7600

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română