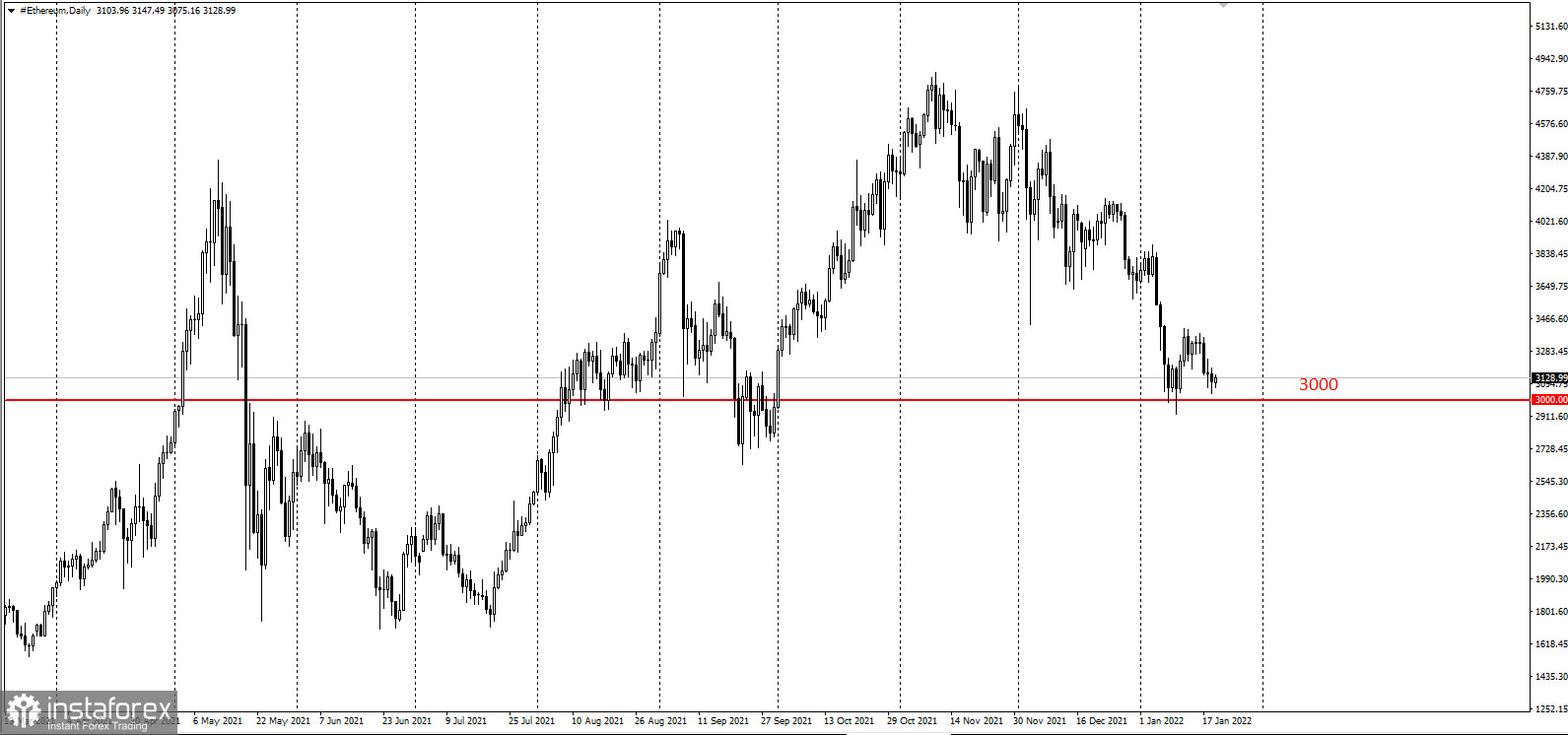

Ethereum almost tested $3,000 on Wednesday as low risk appetite put pressure on some of last year's best-performing assets. It fell 3.7% to $3,048, continuing the slump that has been going on for the past four days. The last time it hit $3,000 was on January 10. Also, Ethereum is 400% higher last year, but this January it is down roughly 15%.

Altcoins were also affected as Cardano and Solana are down 10.1% and 3.7%, respectively.

Susannah Streeter, senior market analyst at Hargreaves Lansdown, said the continued drop in crypto prices is a result of investor sensitivity to speculation about potential interest rate hikes and monetary tightening. There is a chance that if investors do return, Ethereum could return to recent highs, albeit for a short period of time only.

Market analyst Walid Kumani noted that the bears are now eagerly anticipating a dip below $3,000.

And GlobalBlock analyst Marcus Sotiriou said: "We are now seeing the effect of weakness in equities spill over to the crypto market. expect this drop to be short-lived due to $40-41,000 being a key region of support for Bitcoin, after significant sell pressure in recent weeks."

The crypto industry faced several regulatory setbacks in recent days as skepticism about its rapid growth spread around the world. Earlier Wednesday, a official at the European Securities and Markets Authority called for a ban on bitcoin mining, citing the negative impact of the proof-of-work model it uses on the environment.

The UK is also set to tighten its oversight on crypto advertisements as the Financial Conduct Authority proposed limiting the marketing of crypto assets to "restricted, wealthy or sophisticated investors" for fear of the risk that extreme price volatility could pose to consumers. Spain also announced a series of strict controls, and Singapore said crypto firms should refrain from advertising to the public.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română