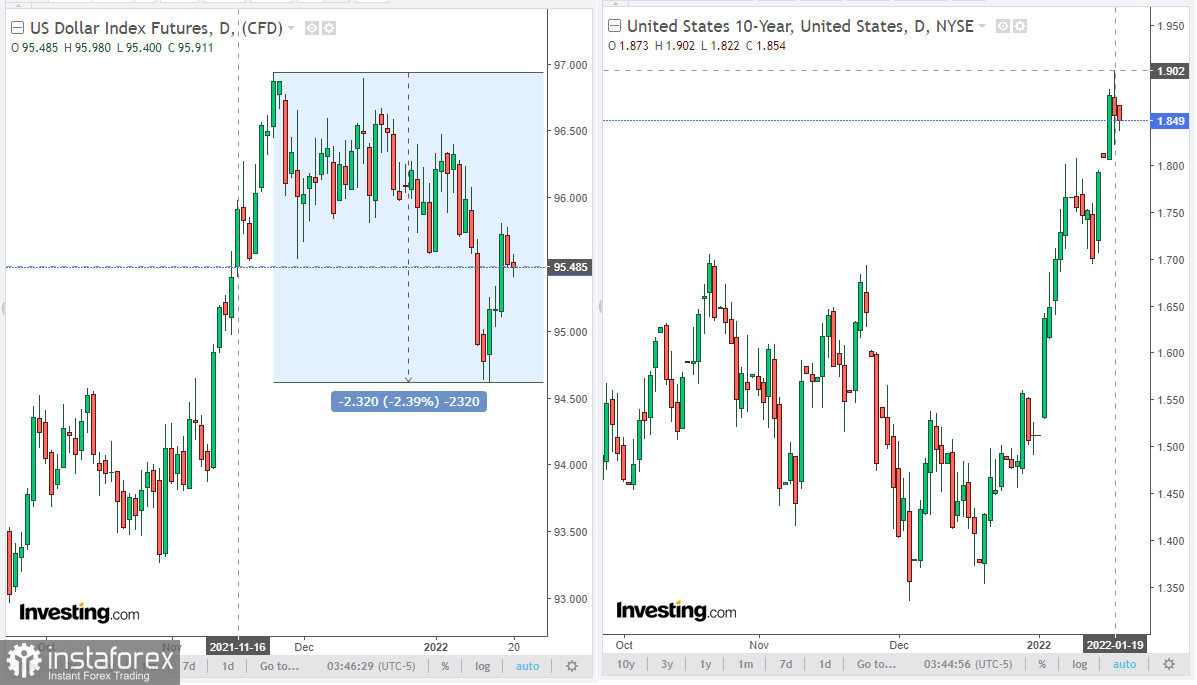

U.S. government bond yields have stalled. At the time of writing, the yield on 10-year U.S. bonds was 1.849%, down from a local 2-year high of 1.897% reached on Wednesday. Along with the decline in government bond yields, the dollar is also declining. Thus, the DXY dollar index, which reflects the value of the dollar against a basket of 6 major currencies, was at the time of publication of this article near the 95.49 mark, remaining in the area below the recent range between the levels of 96.94 and 95.54.

Investors are assessing the prospects for the dollar (in line with the upcoming Fed interest rate hikes) and the threat of accelerating inflation in the United States. Earlier this month, the U.S. Bureau of Labor Statistics reported that consumer prices rose by 7.0% in December (in annual terms) after rising by 6.8% in November. This corresponds to the highs of almost 40 years ago. Core inflation (excluding food and energy products) increased by 5.5% in December (in annual terms).

Thus, inflation has been exceeding the Fed's target level of 2% for several months in a row, and its growth at such a pace forces investors to fix long positions on the dollar: they fear that the Fed may be late with measures to tighten monetary policy. Market participants have already taken into account 3 Fed rate hikes in prices this year, and it seems that some of them believe that this will not be enough to curb the rapid growth of inflation in the United States.

On the other hand, if the Fed starts raising interest rates at an accelerated pace, the higher cost of financing may negatively affect demand and economic growth, while inflation will remain high for some time. It will most likely not be possible to curb it so quickly. In response to such a scenario, the dollar may be inclined to weaken. Recall that the next meeting of the Federal Open Market Committee (FOMC) is scheduled to take place on January 25-26.

Meanwhile, the Australian dollar was among the leaders of growth in the market today. It strengthened in response to the publication of Australian labor market data at the beginning of today's Asian session. The Australian Bureau of Statistics (ABS) reported that unemployment in December fell to the lowest level since 2008, at 4.2%. This turned out to be significantly better than the forecast of 4.5% and the previous value of 4.6%.

Unemployment in the country has been gradually declining since July 2020. Then it was 7.5%, and its growth accelerated against the background of mass closures of enterprises in the country due to restrictive quarantine measures. Now we see that as the situation with the coronavirus improves in the country, the situation in the labor market is also improving.

Earlier, RBA Governor Philip Lowe has repeatedly stated that one of the criteria when the RBA will consider tightening its monetary policy will be to reduce unemployment to below 4.5%. And now the downward trend in unemployment suggests the possibility that it will soon fall to levels not seen since the 1970s.

This, according to economists, will push the Reserve Bank of Australia to radically adjust the leading indication regarding the timing of interest rate increases, shifting them from the end of 2023 to the current 2022, and possibly to its middle. And this is a positive factor for the Australian dollar. Usually, other things being equal to the average, the quotes of the national currency rise in response to the actions of the central bank of the country aimed at tightening monetary policy.

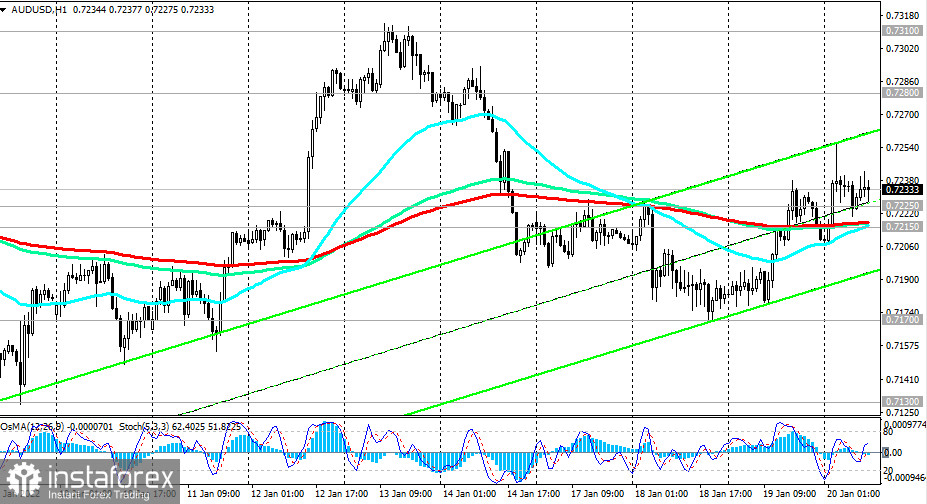

Thus, during today's Asian session, the Australian dollar strengthened quite sharply against the U.S. dollar. The AUD/USD pair jumped to an intraday and 4-day high of 0.7256. Then it weakened slightly, but its upward corrective momentum (within the framework of a global downward trend) remains.

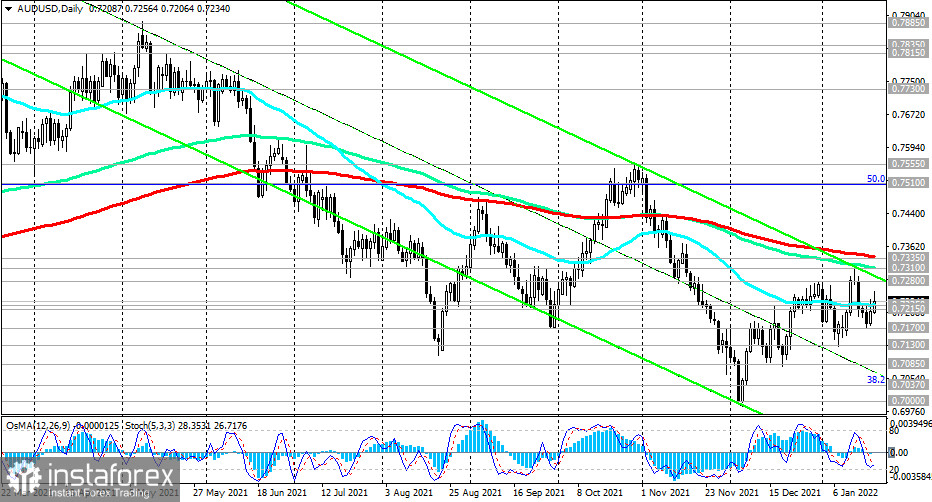

At the time of writing, AUD/USD is trading above the important short- and medium-term support level of 0.7215 (200-day moving average on the 1-hour, 4-hour charts and 50-day moving average on the daily chart). Nevertheless, it is still necessary to keep in mind that AUD/USD remains in the bearish long-term market zone, trading below the key resistance levels of 0.7310, 0.7335.

A breakdown of the local support level of 0.7170 will indicate the resumption of the bearish trend in AUD/USD.

Also, today, data on the U.S. labor market is expected to point a decline in initial jobless claims to 220,000 after their unexpected rise to 230,000 the week before last. It remains at the lowest level for several decades - about 200,000. This is a positive factor for the dollar, after it became clear from the recent report of the U.S. Department of Labor that unemployment in the country is at the pre-pandemic and multi-year level of 3.9%.

If the data turns out to be better than the forecast, then the U.S. dollar should strengthen in the short term.

The Philadelphia Fed will also publish the PMI index of business activity in the manufacturing sector. The index reflects trends in the manufacturing sector of the state and is linked to the overall ISM PMI index. The higher-than-expected result (19.8 against the previous value of 15.4) will also have a positive impact on the USD.

Technical analysis and trading recommendations

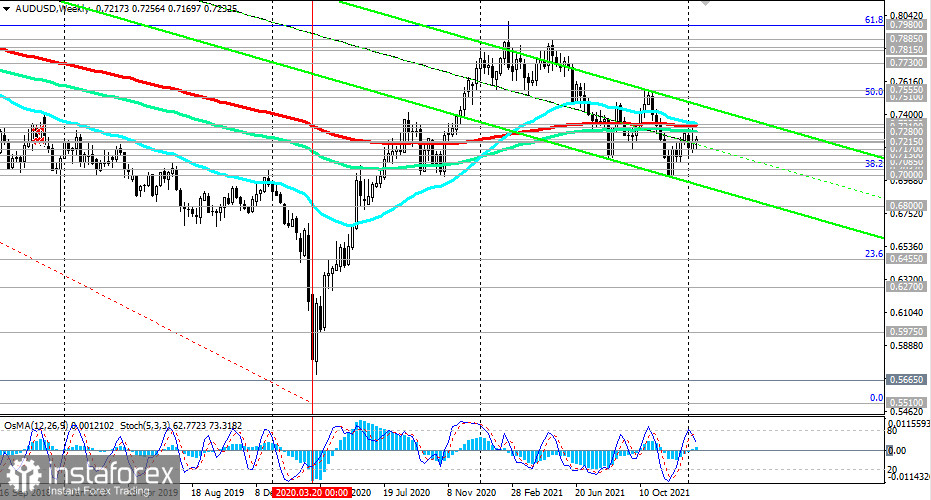

In response to the publication of fresh data on the dynamics of the Australian labor market today, the AUD has strengthened, and the AUD/USD pair rose, breaking through the important resistance level of 0.7215 (200 EMA on the 1-hour and 4-hour charts, 50 EMA on the daily chart). The potential for corrective growth remains until the key resistance levels 0.7280 (144 EMA on the weekly chart and the upper limit of the descending channel on the daily chart), 0.7310 (144 EMA on the daily chart), 0.7335 (200 EMA on the daily and weekly charts).

However, AUD/USD remains in the global bearish trend zone, trading below the key resistance levels of 0.7310, 0.7335.

Therefore, when a sell signal appears, it is worth giving preference to short positions. The first such signal will be a breakdown of the support level 0.7215, and the confirming one will be the local support levels 0.7170, 0.7130. The break of the local support level 0.7130 will confirm this opinion and send AUD/USD inside the descending channel on the daily chart, the lower limit of which is close to 0.6800.

Support levels: 0.7215, 0.7170, 0.7130, 0.7085, 0.7037, 0.7000, 0.6900, 0.6800

Resistance levels: 0.7280, 0.7300, 0.7310, 0.7335

Trading Recommendations

Sell Stop 0.7205. Stop-Loss 0.7260. Take-Profit 0.7170, 0.7130, 0.7085, 0.7037, 0.7000, 0.6900, 0.6800

Buy Stop 0.7260. Stop-Loss 0.7205. Take-Profit 0.7280, 0.7300, 0.7310, 0.7335

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română