To open long positions on GBP/USD, you need:

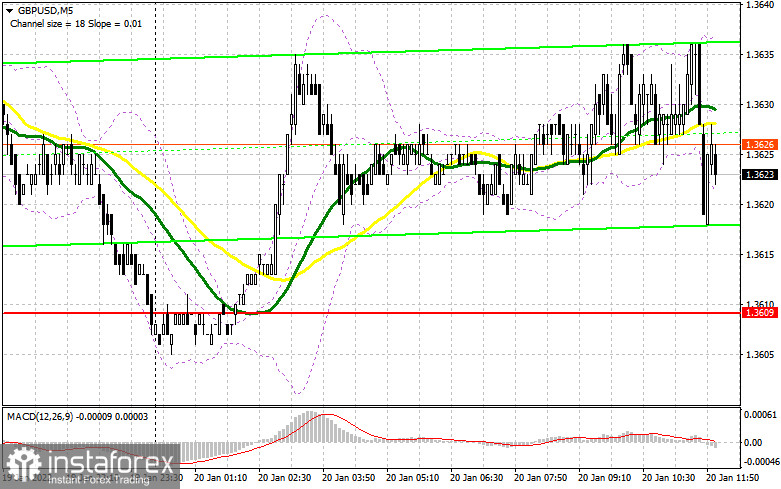

Nothing particularly interesting happened in the first half of the day. Let's look at the 5-minute chart and figure out what we needed to pay attention to. The low market volatility of about 15 points and the same trading volume - all this did not allow us to reach the designated levels and form signals to enter the market. Let's hope that in the afternoon the market activity will be higher. From a technical point of view, nothing has changed. And what were the entry points for the euro this morning?

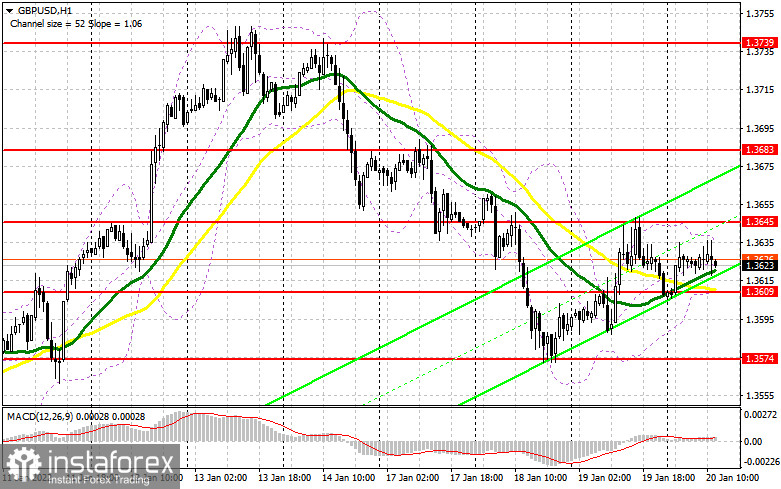

After yesterday's statements by the Governor of the Bank of England, Andrew Bailey, and the hearings of the Treasury select committee, it seems that the pound has lost its direction. At the beginning of the week, everything was clear and many expected the downward correction to continue. However, after yesterday's violent reaction to inflation in the UK, fewer people were willing to sell the pound. There are no willing buyers yet. In the afternoon, several reports on the US economy are coming out, which may support the US dollar or at least become a catalyst for a larger sell-off of the pair. The main goal of the bulls for today remains control over the new resistance of 1.3645, which could not be reached above yesterday. An equally important task is also to protect the support of 1.3609 – missing which you can say goodbye to the growth of the pound in the short term. A false breakout at 1.3609, and there are moving averages playing on the side of the bulls, forms the first buy signal with the prospect of continuing the bull market aimed at growth above 1.3645. Only a breakdown and a test of this level from above will strengthen the position of buyers, which will give an additional entry point into long positions to return to the highs: 1.3683 and 1.3739, where I recommend fixing the profits. Under the scenario of a decline in GBP/USD during the US session against the background of strong data on the US labor and real estate market, as well as the lack of activity at 1.3609, it is best to postpone purchases to the level of 1.3574, from where it will be possible to observe more aggressive actions of bulls – this is their last chance to keep the market under their control in the short term. Only the formation of a false breakdown at 1.3574 will give an entry point in the expectation of further recovery of GBP/USD. You can buy the pound immediately on a rebound from 1.3532, or even lower - from a minimum of 1.3496, counting on a correction of 20-25 points within a day.

To open short positions on GBP/USD, you need:

Bears are not very active yet. The gradual increase in panic moods associated with a more aggressive increase in interest rates in the United States - all this can play a cruel joke with yesterday's buyers of the pound in the afternoon. The primary task of the bears for today is to protect the rather important resistance of 1.3646, going beyond which can hit the sellers' plans for a further decline in the pound very hard. Only the formation of a false breakdown at this level forms the first entry point into short positions, followed by a fall of the pair to the area of 1.3609, where the moving averages playing on the side of the bulls pass. Strong US data and taking control of this level will give a new entry point into short positions, counting on the decline of GBP/USD by 1.3574 and 1.3532, where I recommend taking the profits. If the pair grows during the American session and sellers are weak at 1.3645, it is best to postpone sales until the next major resistance at 1.3683. I also advise you to open short positions there only in case of a false breakdown. You can sell GBP/USD immediately for a rebound from 1.3739, or even higher - from this month's maximum in the area of 1.3790, counting on the pair's rebound down by 20-25 points within a day.

The COT reports (Commitment of Traders) for January 11 recorded an increase in long positions and a reduction in short positions - which indicates the continued attractiveness of the pound after the Bank of England raised interest rates at the end of last year. If you look at the overall picture, the prospects for the British pound look pretty good, and the observed downward correction makes it more attractive. The Bank of England's decisions continues to support buyers of risky assets in the expectation that the regulator will continue to raise interest rates this year, which will push the pound even higher. High inflation remains the main reason why the Bank of England will continue to tighten its monetary policy. Last week, Federal Reserve Chairman Jerome Powell said that he would not shape events and rush to raise interest rates, especially given the sharp decline in retail sales in December last year, which should cool down inflationary pressure a little. This led to a decrease in demand for the US dollar, which will allow buyers of the pound to continue building an upward trend. The COT report for January 11 indicated that long non-commercial positions increased from the level of 25,980 to the level of 30,506, while short non-commercial positions decreased from the level of 65,151 to the level of 59,672. This led to a change in the negative non-commercial net position from -39,171 to -29,166. The weekly closing price rose from 1.3482 to 13579.

Signals of indicators:

Moving averages

Trading is conducted around 30 and 50 daily moving averages, which indicates uncertainty with the further market direction.

Note: The period and prices of moving averages are considered by the author on the hourly chart H1 and differ from the general definition of the classic daily moving averages on the daily chart D1.

Bollinger Bands

A breakthrough of the upper limit of the indicator in the area of 1.3635 will lead to a new wave of growth of the pound. A break of the lower limit of the indicator in the area of 1.3609 will lead to a larger drop in the pound.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - moving average convergence/divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-profit speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between the short and long positions of non-commercial traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română