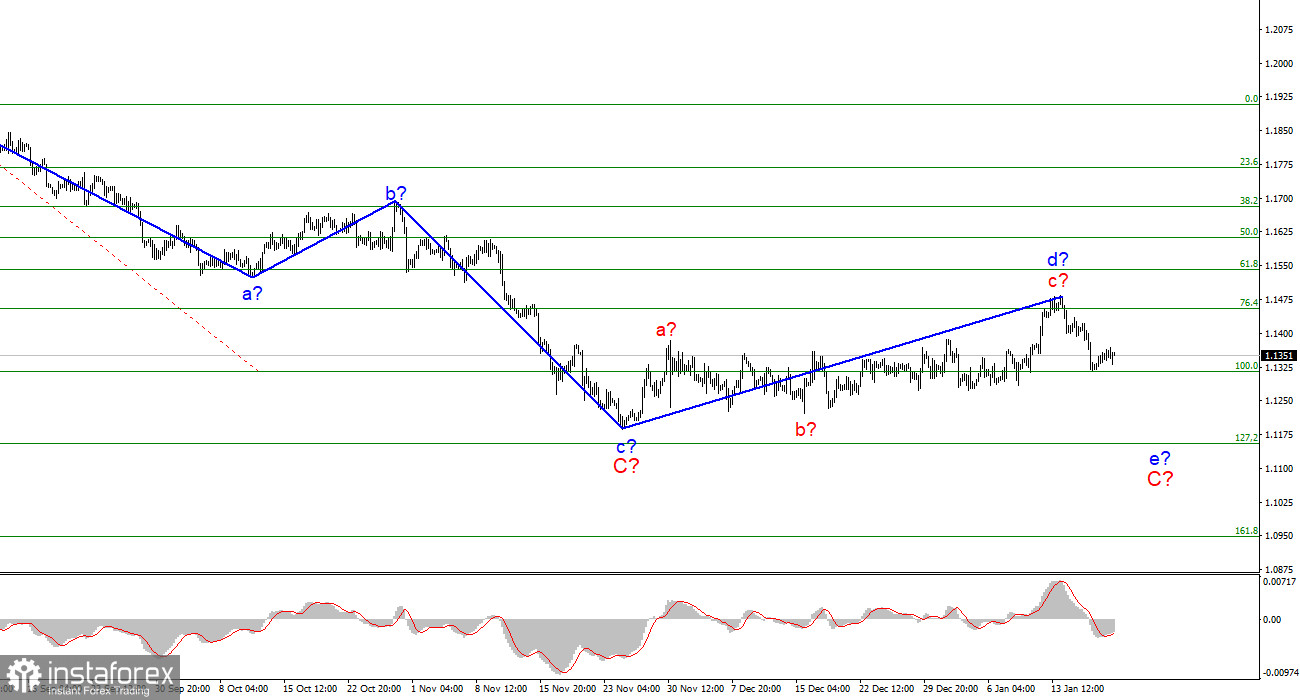

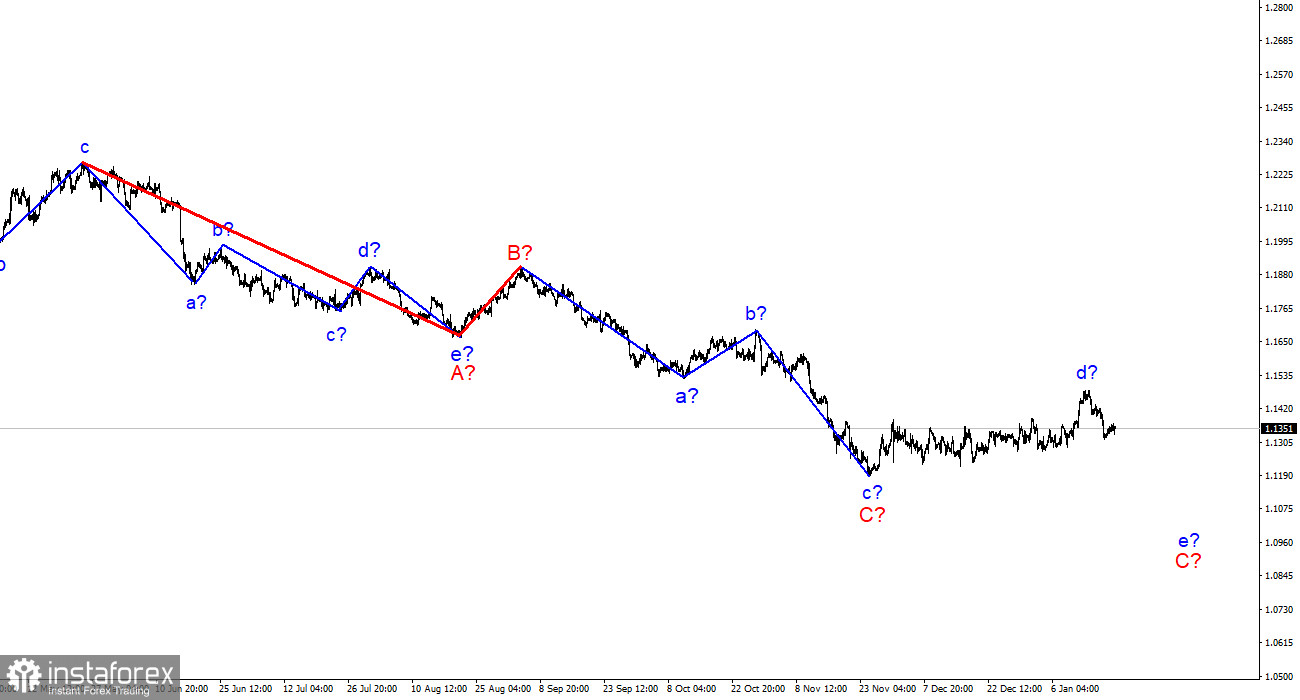

The wave pattern of the 4-hour chart for the EUR/USD instrument still does not require any additions and clarifications. Wave d turned out to be longer than I had initially expected. However, it does not change the essence of the wave charting. I still believe that this wave is corrective, not impulse, as evidenced by its complex internal wave structure. Therefore, it cannot be wave 1 of a new uptrend section. If so, the quotes decrease has already resumed within the anticipated wave e in C. At the same time, the renewed rise of the EU currency quotes may result in the necessity to correct the current wave pattern as in this case wave d will become the longest wave in the downtrend section. A failed attempt to break the level of 1.1455 indicates that the market is not ready for further purchases of the instrument. The withdrawal of quotations from the lows around 1.1314 may be short-lived.

Lagarde continues to believe that inflation will start decline in 2022

On Thursday, the EUR/USD pair moved with an amplitude of about 20 basis points without a clear direction. At the time of writing the article, it is impossible to conclude whether the instrument is raised or declined. Thus, Thursday was not exciting concerning the pair's movements and news background. The EU inflation report was released in the morning. It showed an increase to 5.0% year-on-year. However, December's growth to 5% was common to the markets, as this publication was the second in the same time period. Therefore, the euro did not react to this report. There were no more major economic events in the EU on Thursday. However, I would also like to mention Christine Lagarde's interview given to France Inter radio. She said that inflation in the EU would gradually slow throughout 2022, as the main factors that contributed to its rise would diminish their influence. Lagarde noted that energy prices would not rise constantly, and supply chain issues would be addressed as the world emerges from the next wave of the coronavirus pandemic. Christine Lagarde also said that the European Central Bank did not need to pursue the same aggressive monetary policy as the Fed was going to do. The ECB president stated that the US economy was recovering much more quickly than in the EU. She added that they had no reason to act as quickly as the Fed. Lagarde noted that they had started to respond to the changing situation and intended to continue it throughout 2022. However, she added that they needed reliable data to make the right decisions. Christine Lagarde also pointed to the rising yields of some types of government bonds. She said that if yields were rising, it was a sign of an economic recovery. However, Lagarde's speech did not boost demand for the euro. Markets are not so sure that inflation will decline without any reason.

Conclusions

Based on the conducted analysis, I conclude that the formation of the rising wave d may be completed. If this assumption is correct, then it is recommended to sell the instrument now counting on the formation of wave e in C with the targets located near the calculated levels of 1.1315 and 1.1154, which is equal to the 100.0% and 127.2% Fibonacci levels. So far, there is no reason to assume the execution of the alternative option, which implies the resumption of the increase in the instrument quotations.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română