EUR/USD

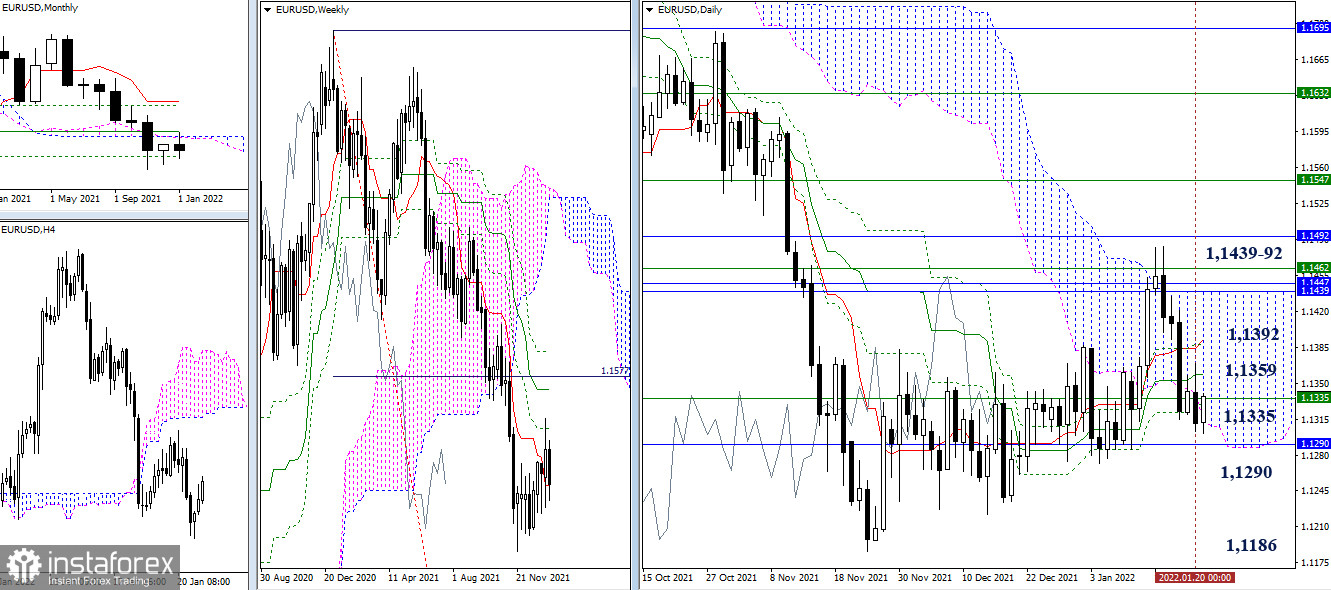

The advantage yesterday belonged mostly to the bears, who updated the low of the previous days. But in general, it is hard to talk about any advantage now, since the pair has returned to the former zone of the long weekly consolidation and is under the influence and attraction of the previously indicated levels 1.1335 - 1.1290 (weekly short-term trend + monthly level). The result of the interaction will determine further opportunities.

For the reliable development of one direction or another, it will be necessary not only to leave the consolidation zone but also to break through some levels. So for bearish traders, it is important for them to update the low (1.1186) and sharply recover the weekly downward trend, while for bullish traders, it is necessary for them to break through important levels at 1.1439-92 (monthly levels + weekly Fibo Kijun + the upper limit of the daily cloud) and consolidate above it. The nearest resistances along the way are 1.1359 (daily Kijun) and 1.1392 (daily Tenkan).

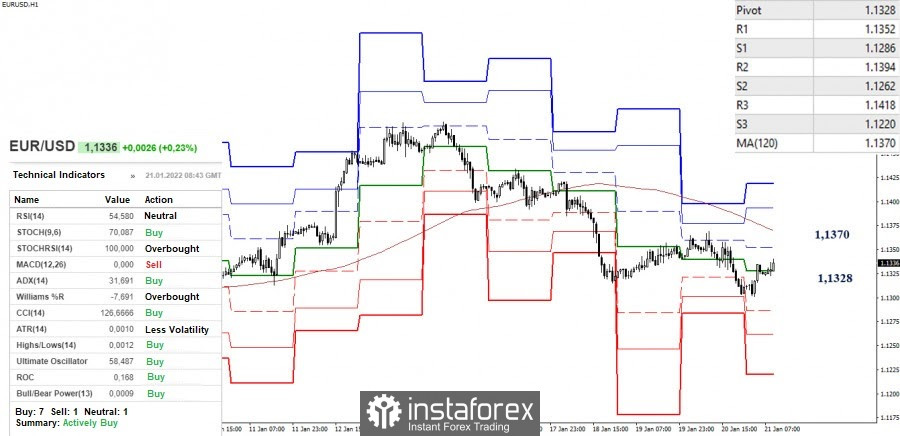

A small upward correction is observed in the smaller timeframes following a decline. The bulls are now trying to take the central pivot level (1.1328) to their side. If they manage to do so, their interests will be aimed at breaking through the weekly long-term trend (1.1370). Once they sharply consolidate above and deploy the moving average, they can take a closer look at subsequent upward prospects. But if the bears return to the market and decline, the support for the classic pivot levels (1.1286 - 1.1262 - 1.1220) will act as the downward pivot points today.

GBP/USD

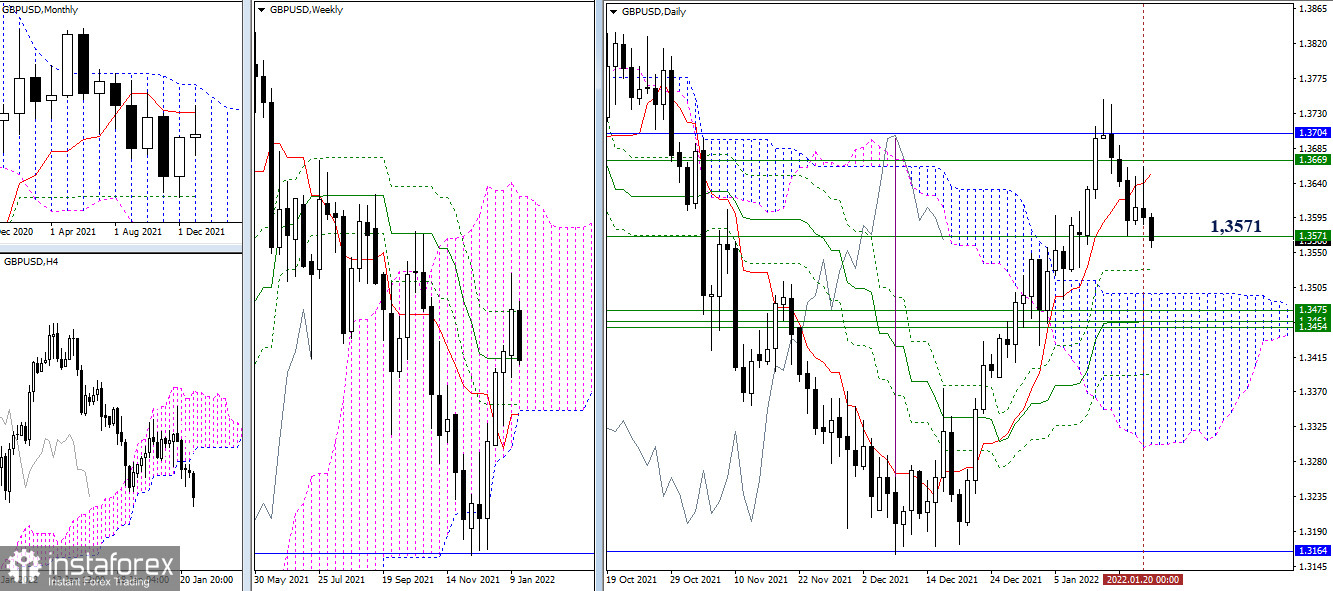

The bears continue to insist on overcoming the weekly medium-term trend (1.3571). We are closing the week today, so an interesting result should be expected. The breakdown of 1.3571 will open the way to the next cluster of important weekly levels (1.3454-75). In turn, a rebound will return attention to the zone of 1.3653 (daily Tenkan) - 1.3669 (weekly Fibo Kijun) - 1.3704 (monthly Tenkan).

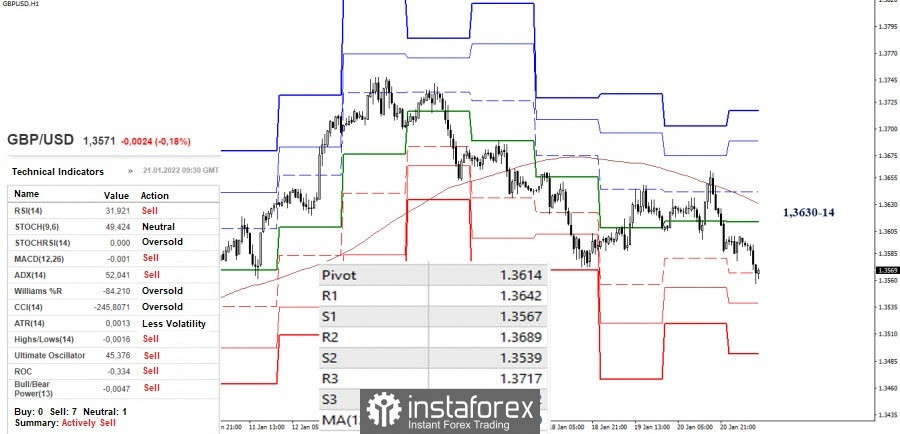

On the smaller timeframes, the advantage currently belongs to the bears. They marked a new low and are now testing the first support of the classic pivot levels (1.3567). After that, the next supports at 1.3539 (S2) and 1.3492 (S3) will be considered. The key levels here are acting as resistance levels. They will protect the bearish interests in the area of 1.3630-14 (weekly long-term trend + central pivot level).

***

Ichimoku Kinko Hyo (9.26.52) and Kijun-sen levels in the higher time frames, as well as classic Pivot Points and Moving Average (120) on the H1 chart, are used in the technical analysis of the trading instruments.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română