The cryptocurrency market has stabilized over the past seven days and the major coins have strongly consolidated at support levels. At the same time, there has been a decrease in volatility and active coin accumulation. All factors signaled the end of the correction and the upcoming broad market reversal. However, the situation turned out to be the opposite. The total capitalization of the crypto market fell by 3% and the major coins hit new local lows. Why did it occur?

Pros before decline

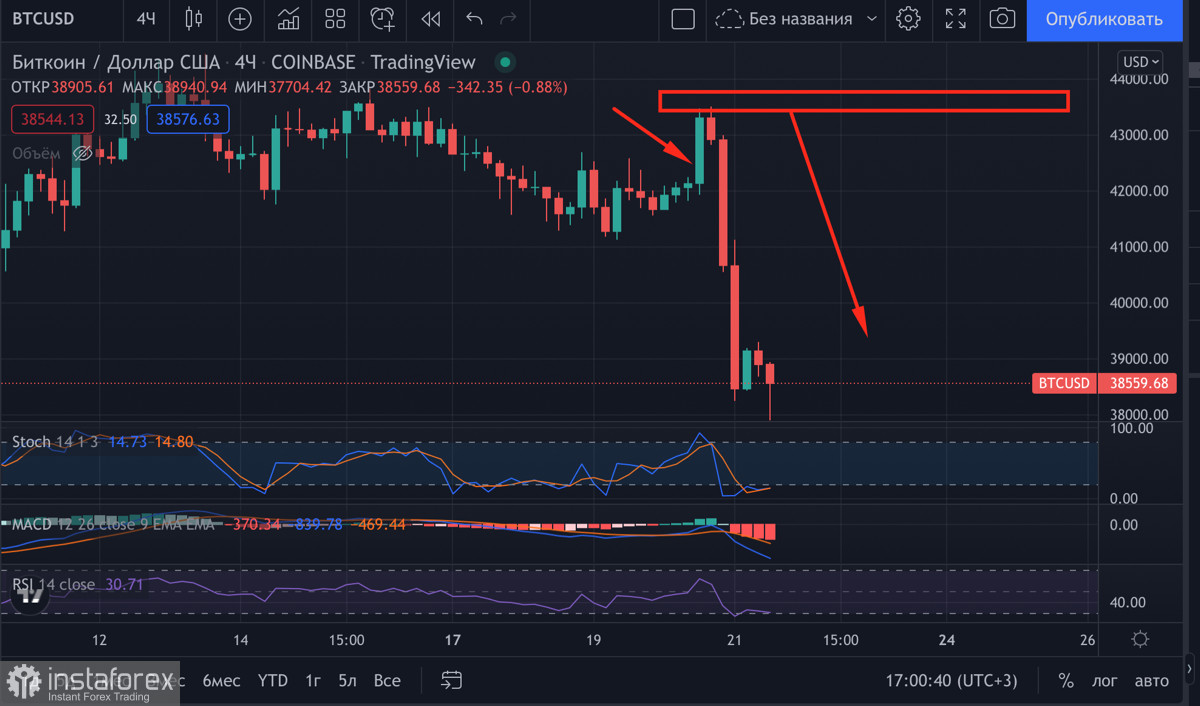

First of all, let's consider the inputs. I will analyze bitcoin, as it was its fall that triggered the market collapse. Before the significant collapse on January 20, the main cryptocurrency was at two strong support zones of $42,100 and $40,500. The asset was moving within a narrow range of $40,500-$44,600 with no impulse movements, indicating a slow consolidation and accumulation. At the same time, there was a drop in volatility and an increase in the cryptocurrency's hashrate. Miners and large investors continued to buy BTC, and the market gradually recovered.

Cons

While moving in the range of $40,500-$44,600, bitcoin made attempts to test the upper boundary of the channel. However, each failed attempt resulted in a 3%-5% collapse. It was considered a warning sign. First, slow growth indicated weak positions of buyers and lack of desire to force the price. Besides, considerable drops underlined sellers' ability to close long positions. Low buying volumes and high exposure to impulse declines raised questions of concern, however they did not affect investors' positions.

Results and possible reasons for collapse

At first the bitcoin price was moving from the upper end of the range to the lower end. However, before the collapse on the 4-hour timeframe, a strong bullish momentum followed, which brought the price to the border of the channel. Buyers did not support the momentum and the price moved towards the support area of $40,500, missing the level of $42,100. Consequently, the asset broke the level and managed to slow the decline around $39,000. The impulsive upward movement before the fall was the local activity of whales, which bought 40,000 BTC within two days. Bears took advantage of a failed retest of the trend resistance zone and launched a sell-off below $42,000. This decline can be seen as manipulation by whales to collect liquidity in the area of $38,000-$40,000. However, the percentage of bitcoin correction fell below 15%. Therefore, it is doubtful.

What is next?

The collapse of bitcoin and the whole cryptocurrency market was most likely caused by passivity of buyers with a huge discrepancy of long / short positions in the direction of the longs. During the market collapse, the positions worth $727 million were liquidated, 80% of them were long positions. The market took no measures. However, the majority of players thought that opening long positions would be the best strategy if the market was on an impulse rise. Consequently, the market did not take the expectations of major players into account, and the cryptocurrency has consolidated below $40,000. The main concern is that investors do not hurry to buy back the fall, which means that the downside potential is pushed back to $35,000.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română