Monday's focus is on PMI reports from the US, the UK, and the Eurozone, which will answer the question of whether inflationary pressures are weakening or increasing, as well as what impacts the sharply increased speed of the spread of COVID-19 has had on the economy.

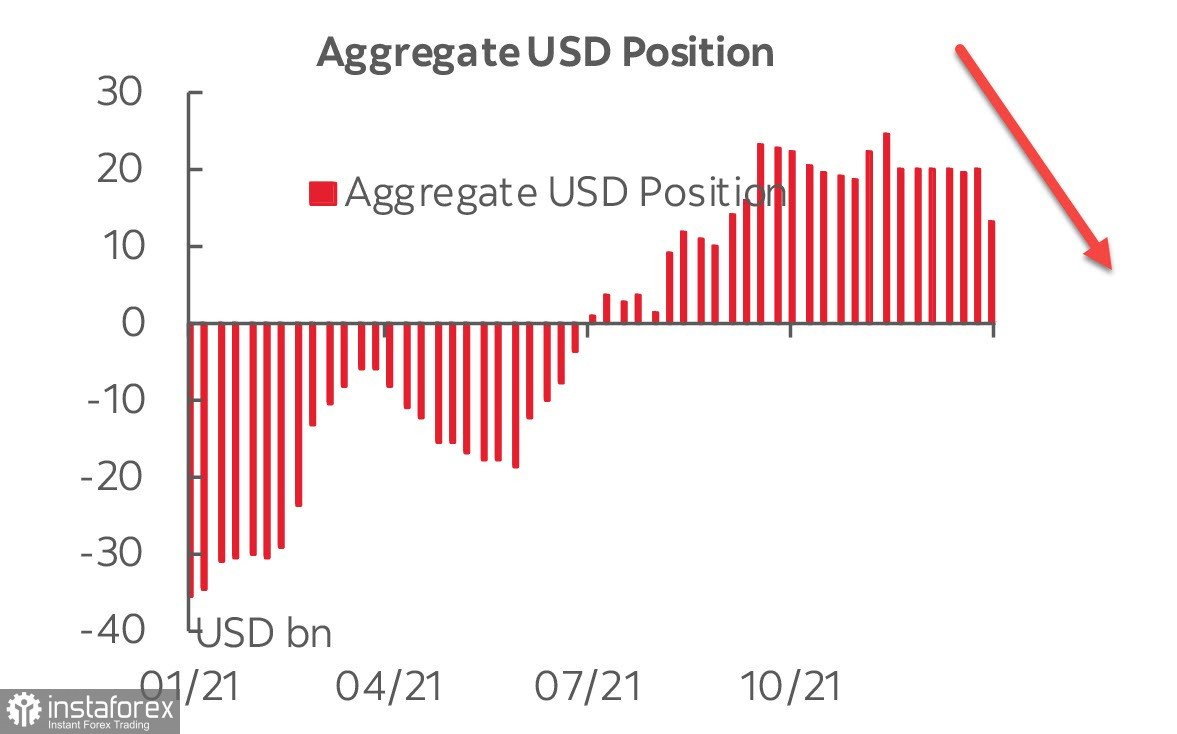

According to the CFTC report published on Friday, the US dollar underwent massive sales during the reporting week. The cumulative long position decreased by 7 billion, which is one of the largest weekly dollar drawdowns since the summer of 2020, and fell to 13 billion – the lowest since September.

Almost all currencies, except the Swiss franc, increased their positions against the US currency. The pound and the euro are having the largest surge.

Markets show mixed dynamics. Stock indices ended the past week in the red zone, a number of industrial commodities (oil, copper, iron ore) were also slightly in the red zone, and UST yields declined and dragged the global yield indices with them. So far, it can be said that the markets are noticeably losing enthusiasm as the Fed meeting approaches, which means an increase in demand for defensive assets.

EUR/USD

ECB President, Christine Lagarde, said at the virtual conference in Davos that the Central Bank did not expect GDP growth, labor market recovery, and high inflation at the beginning of 2021. However, she does not see a threat due to rising inflation and assumes that it will decline to 2% by the end of this year.

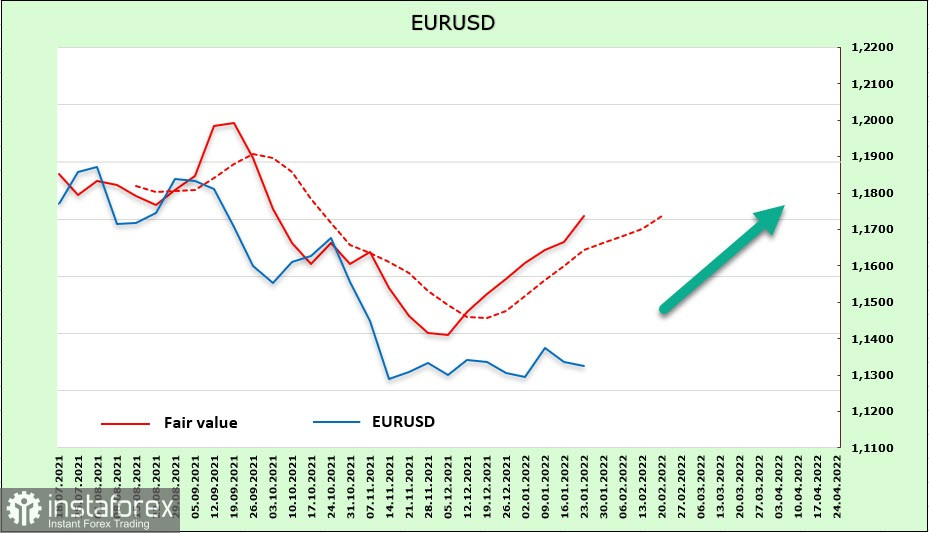

The CFTC report showed a sharp increase in demand for the euro, whose net long position increased by 2.627 billion to 3.48 billion during the reporting week. The estimated price continues to grow steadily.

If we compare the plans of the Fed and the ECB, they are clearly not in favor of the euro. The Fed is likely to start raising rates in March and raise them 4 times by the end of the year, and then start reducing the balance sheet by the middle of the year. On the contrary, the ECB is expected to complete the PEPP program in March. The APP program will also end within a year, but the ECB rate increase is not expected at all until the end of 2023. Accordingly, the rate differential will increase significantly in favor of the US dollar, which will lead to a decrease in the EUR/USD exchange rate in the middle and long term.

But why aren't investors frantically buying up the US dollar then?

Nordea did a bit of research into the impact of the Fed's rate hike cycle on the euro and came to the surprising conclusion that there was no direct correlation. If there was a direct correlation (the Fed raised rates by a total of 175p and the euro fell from 1.20 to 0.90) in 1999/2000, then in the 2004/06 increase cycle, there was no connection at all between the rate and the euro rate. Moreover, after the end of the Fed cycle, the EUR/USD rate turned out to be higher than before the start of the cycle.

Accordingly, it is too naive to expect that the euro will react strictly according to the rule. The increase in the settlement price so far only indicates that there is no growth in demand for the US dollar, despite the tightening of rhetoric. Technically, the euro did not manage to go above the channel border, which means a signal for an attempt to update the low, but the CFTC report and the dynamics of GKO rates indicate the opposite. Focusing on investors' behavior, it can be assumed that a decline in the EUR/USD after the announcement of the results of the FOMC meeting will not happen. The support level of 1.1186 formed at the end of November will remain. A movement to 1.1484 is more likely.

GBP/USD

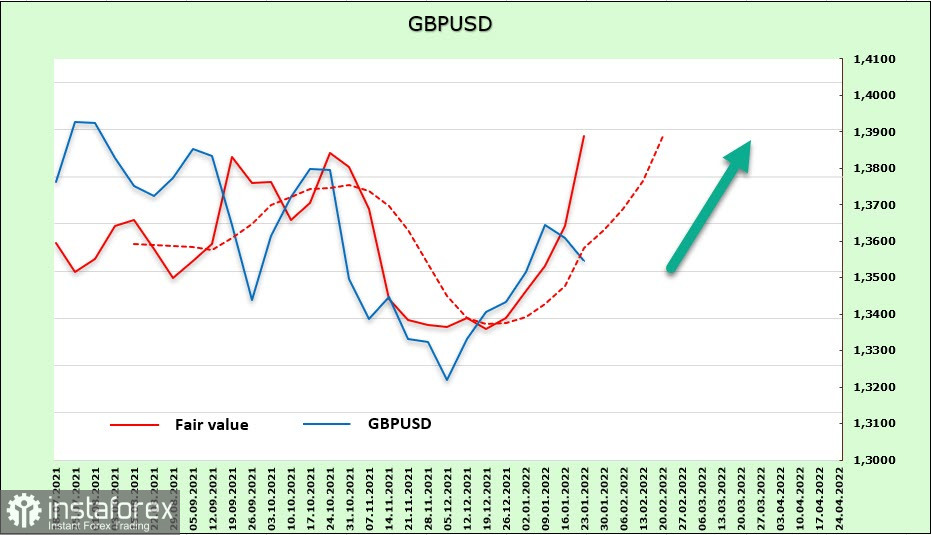

The pound is under short-term pressure after the release of weak retail sales data on Friday, lowering inflationary expectations. On the contrary, the CFTC report turned out to be confidently bullish for the pound, the growth of long positions by 2.465 billion allowed to completely liquidate the net short position. The settlement price is directed strictly upwards.

The possibility of Boris Johnson's voluntary resignation did not arouse any interest among traders, since it is such a small event in the current realities. It can be assumed that if the downward correction ends, the pound will try to find support in the 1.3520/30 zone and continue growth with the target of 1.3830. The breakdown of this resistance will technically mean an upturn.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română