Just as the U.S. dollar brought bad news to its fans at the start of January, the British pound surprises unpleasantly at the end of the month. It would seem that the tightening of the monetary policy of the Bank of England and the outpacing dynamics of the U.K. stock indices over their counterparts from continental Europe and the United States should have supported the "bulls" on GBPUSD. The reality turned out to be different. The currency pair is ready to lose almost all of their gains since the beginning of the year.

The rise in U.K. inflation to 5.4% in December, the highest since 1990, forced MPC members to turn hawks. The head of the BoE, Andrew Bailey, said that the Central Bank does not intend to tolerate the development of an inflationary spiral, when expectations of higher prices push up wages, which ultimately translates into even more inflation. The regulator is closely monitoring this process and is ready to act. Another member of the Committee, Catherine Mann, is of the same opinion. According to her, the Bank of England is obliged to deal with high prices.

What's the matter? Why is the pound not growing against the background of such "hawkish" rhetoric and investors' faith in raising the repo rate on February 3? In my opinion, the markets are afraid of a surprise from the Fed on January 26 in the form of hints at raising the federal funds rate, not by 25 basis points, but immediately by 50 basis points at the March FOMC meeting, or that the Fed will tighten monetary policy at each meeting. This has not happened since 2006.

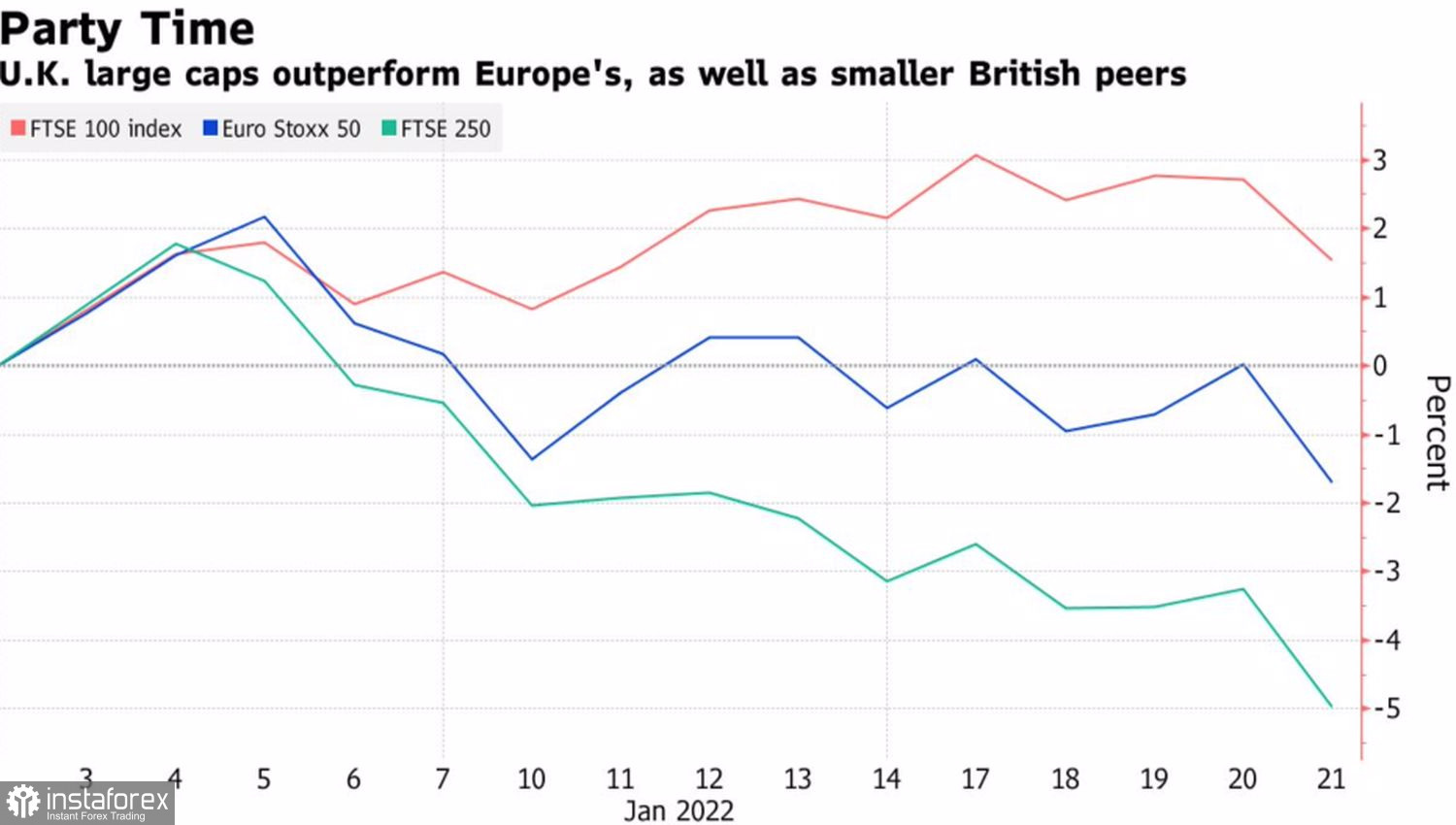

Stock indices also do not support sterling. The FTSE 100 has gained 0.4% since the beginning of the year, compared with -12% for the Nasdaq Composite and -4.7% for the EuroStoxx 600. The reasons should be sought in the high share of bank shares in the structure of the U.K. equity market. Potentially, the transfer of capital from North America to the U.K. is a bullish factor for GBPUSD, but currently, investors are reacting to the deterioration of global risk appetite. And here the pound loses to the U.S. dollar. The latter has adopted its status as a safe-haven currency.

Dynamics of stock indices

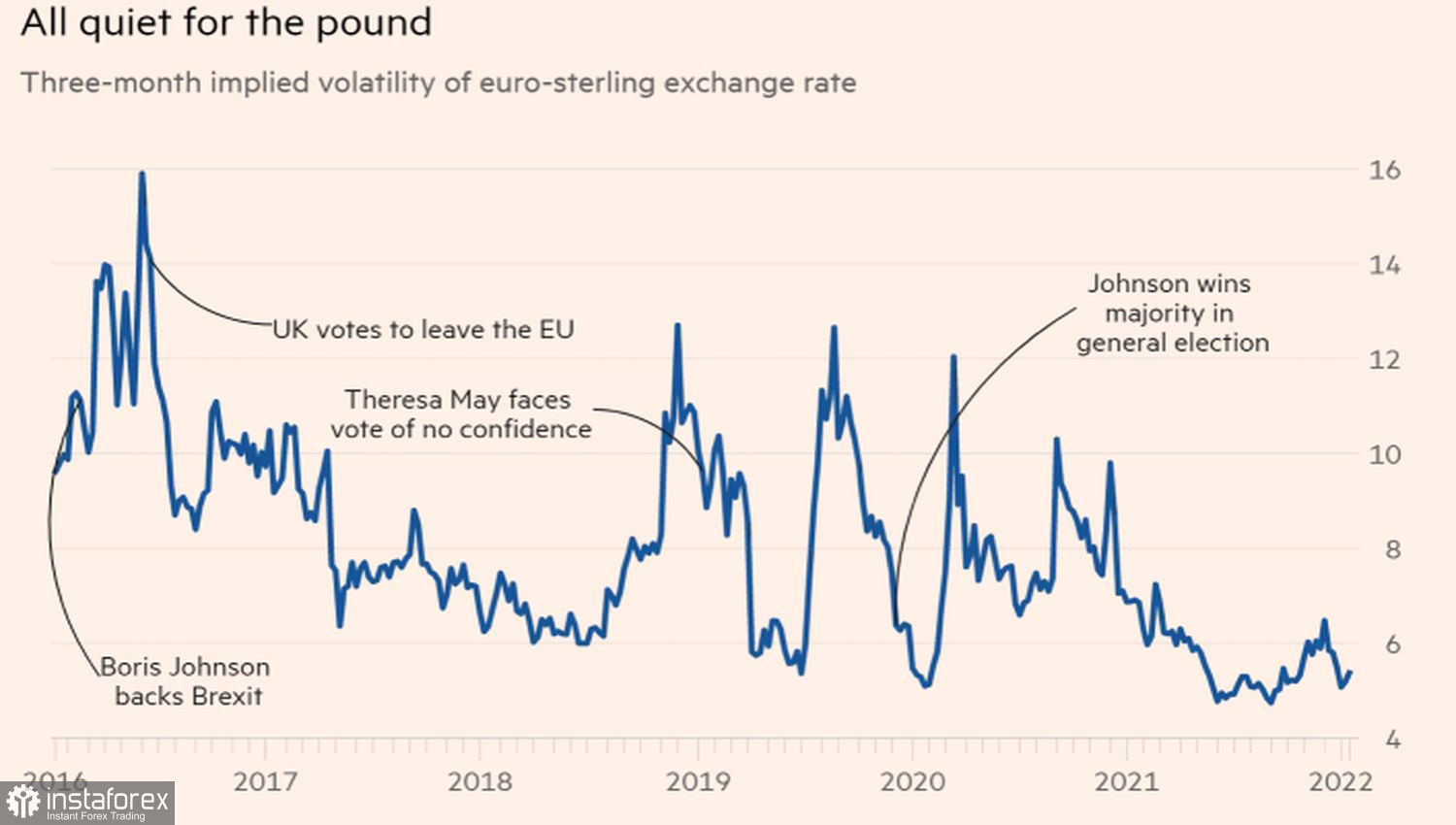

The scandal surrounding the resignation of Boris Johnson as Conservative Party leader does not add whists to sterling, which is equivalent to the loss of his portfolio of prime minister. The pound is a currency that is considered to be political. It was sensitive to the events around the referendums on Brexit and Scottish independence. Nevertheless, now its volatility does not seem to grow, which suggests that Johnson's resignation does not particularly sadden the GBPUSD bulls.

Pound volatility

Concerns about a slowdown in the economy under the influence of the aggressive monetary restriction of the BoE also contribute to the fall of the analyzed pair. The proof is the collapse of the pound in response to the slowdown in manufacturing activity from 57.9 to 56.9 in January.

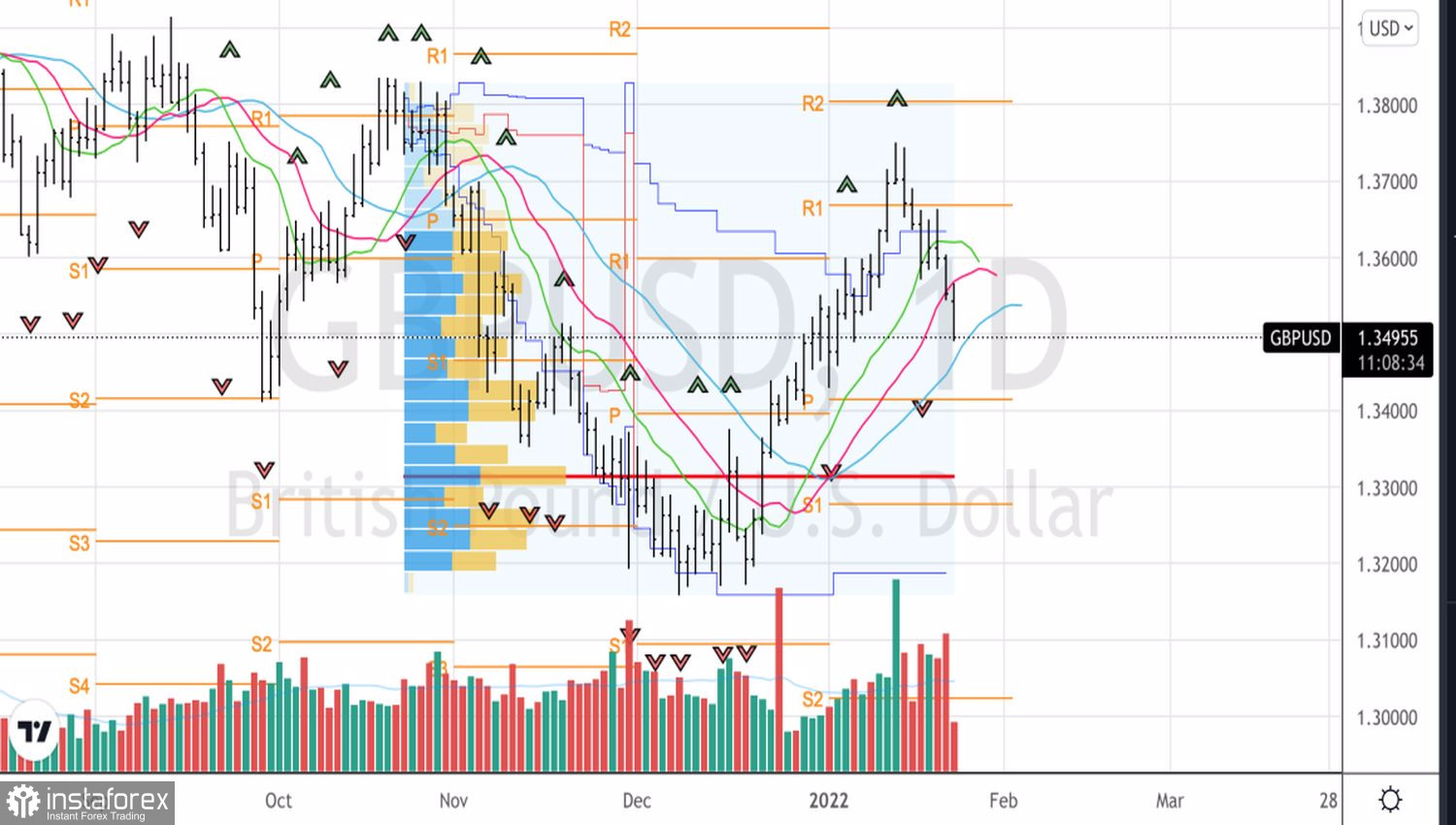

Technically, the GBPUSD sell rate from the level of 1.367 worked like clockwork. However, there was no stop at 1.36 and 1.3565. It makes sense to start forming long positions on the pound against the U.S. dollar on the rebound from the moving average at 1.347 and from the pivot level at 1.341, or in case the pair returns above 1.3565.

GBPUSD, Daily chart

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română