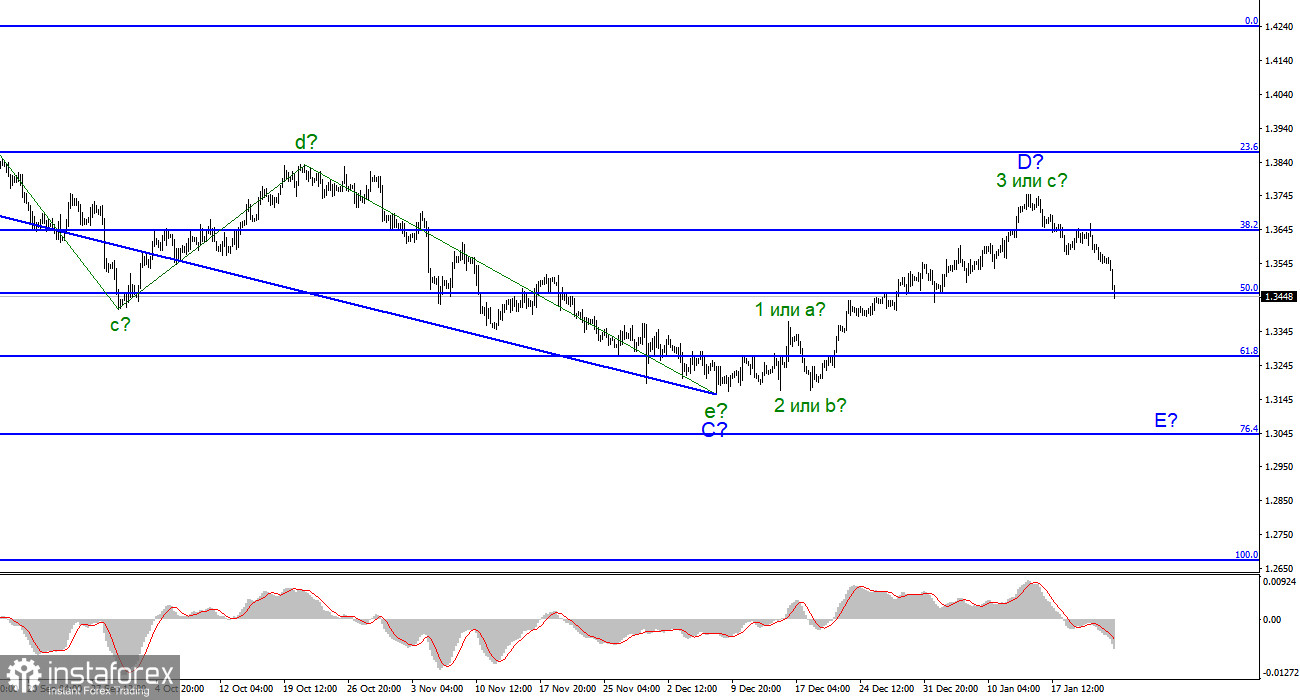

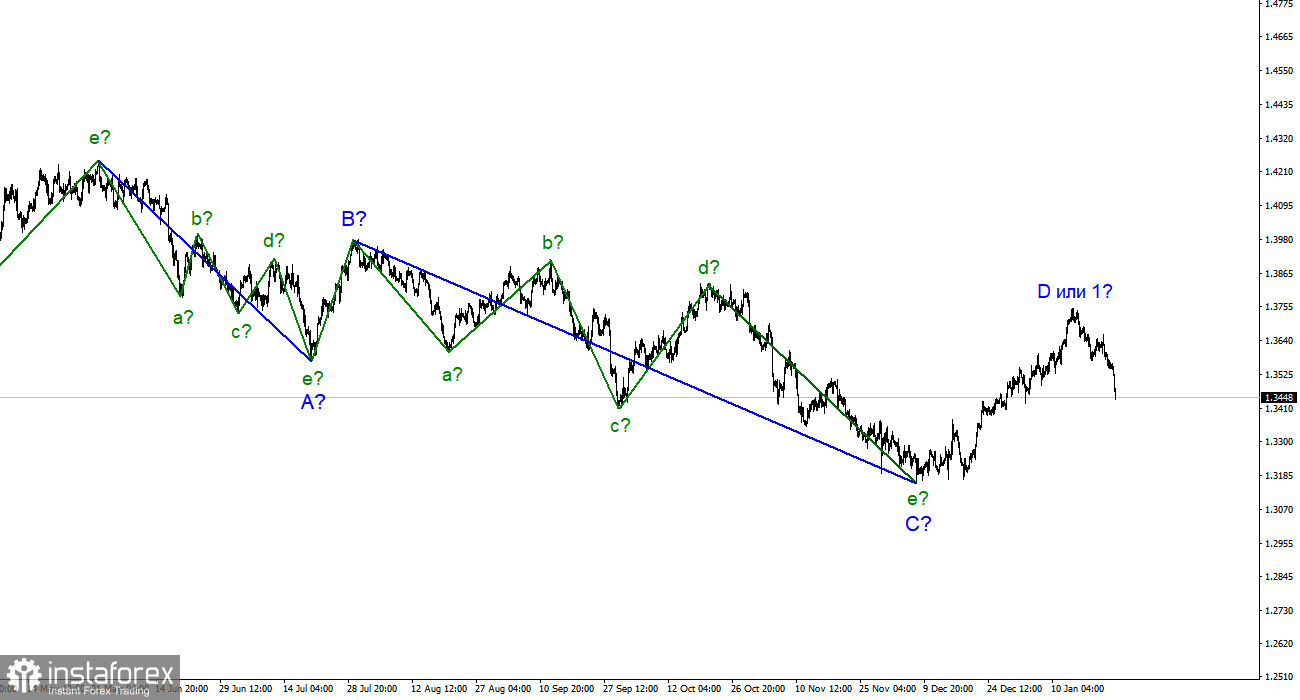

For the pound/dollar pair, the wave markup continues to look quite comprehensive. In the last few weeks, the pair has been building an upward wave, which is currently interpreted as wave D of the downward trend segment. If the current wave marking is correct, then this wave has completed its construction and the formation of wave E has begun. Thus, the entire downward section of the trend may take an even more extended form. Wave D has taken a clear three-wave form and its internal wave marking does not arise any questions now. A successful attempt to break through the 1.3644 mark, which corresponds to the Fibonacci retracement level of 38.2%, signals a sell-off of the pound sterling. If the pair breaks through the 50.0% level, the volume of short positions will jump. Correction waves are not visible inside wave E. So, the wave is likely to be much longer than expected. Thus, both the euro and the pound sterling may significantly sink in the coming months.

Boris Johnson gets away with Partygate scandal

The pound/dollar pair decreased by 120 pips on January 24 following the PMI indexes results. In the UK, a decline in the PMI Indexes was quite small. In the US, figures also dropped in January. Thus, traders did not pay attention to today's statistics. Therefore, the pound sterling declined due to completely different reasons. One of the reasons may be the wave marking, which shows the construction of a new strong downward wave. Another reason could be a political one as Boris Johnson hangs in the balance after a string of media reports emerged in December and January. Allegedly a series of lockdown-breaking parties occurred at 10 Downing Street during the coronavirus pandemic. However, Johnson made a public apology but at the same time, he did not admit his guilt. He insists that these parties were "working meetings".

Even the photos of the prime minister taking part in a cheese and wine social in the Downing Street garden on 15 May 2020 did not shake his confidence. Johnson said that he attended those meetings for no more than an hour, only to discuss important working issues with colleagues. However, few people believed him, even in Parliament. Nevertheless, policymakers did not start the procedure of declaring a vote of no confidence. Traders decided to sell the pound sterling following this scandal. Recently, a possible conflict between NATO and Russia is in the limelight. The situation is escalating as Ukraine may join NATO, which Russia wants to avoid. In general, there is turbulence in the markets right now, which can turn into panic. Notably, the Fed will hold a meeting this week, which may boost the US dollar. According to many analysts, the Fed may start raising the interest rate earlier than March. In particular, the US president spoke in favor of hiking key the rate in January.

Conclusion

The wave pattern of the pound/dollar pair suggests the construction of wave E. If the pair breaks through the 1.3458 mark, traders will open short positions on the pair with the target levels located near the 1.3271 mark. It corresponds to the Fibonacci retracement level of 61.8%. There is no alternative scenario now. Wave E is likely to get a clear five-wave structure.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română