Inflation data in Australia were published during Tuesday's Asian session. The release exceeded the expectations of most experts, as all components of the release came out in the "green zone", reflecting strong inflationary growth in the fourth quarter of last year. The Australian dollar reacted positively to this release: the AUD/USD soared impulsively to the level of 0.7180 despite the fact that the Australian dollar hit a new monthly low last night, reaching the target of 0.7090. However, this upward momentum faded.

The pair reversed quite sharply and declined again, following the US currency. It is believed that the key data was published "at the wrong time" – before the Fed's January meeting, in anticipation of which the US dollar is gaining momentum across the market. Therefore, traders showed only a formal reaction to the publication and then went back to what they are doing.

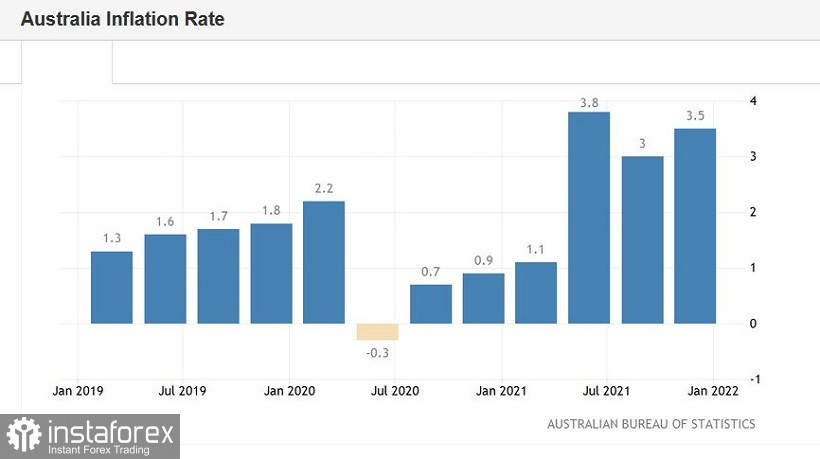

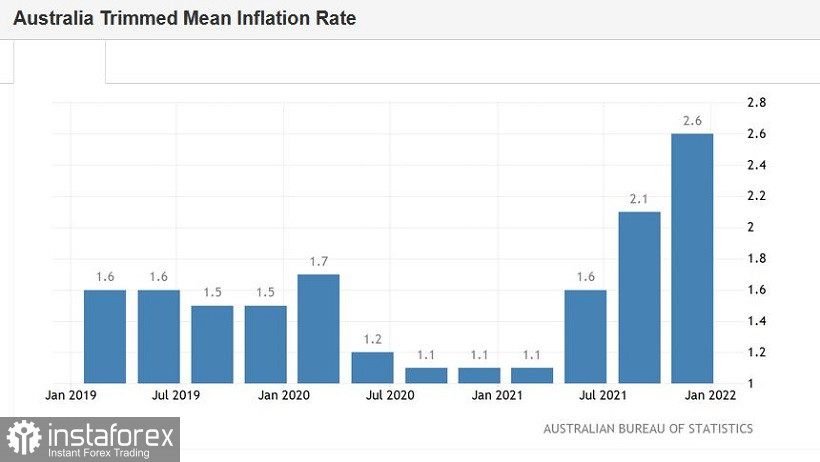

Nevertheless, today's report should not be ignored. Australian consumer price index rose to 1.3% in quarterly terms, with a growth forecast of up to 1.0% and a previous value of 0.8%. Moreover, it also gained up to 3.5% in annual terms with a growth forecast of up to 3. 2% and the previous value of 3.0%. The core inflation index (using the truncated average method) increased to 1.0% qoq and 2.6% yoy, which is the best result since 2008.

In general, inflation in Australia was driven by higher fuel, electricity, and housing costs. Additionally, there is the problem of supply chains. In particular, the construction boom in the 4th quarter of last year, combined with the lack of materials and labor, provoked the strongest increase in real estate prices. In general, last year's low interest rates led to an increase in housing prices in the country by 22% – this is a record increase in the indicator over the past three decades.

It can be recalled here that strong data were published in the Australian labor market just last week. The unemployment rate in the country sharply declined from 4.6% to 4.2%, which is a long-term record: the last time the rate was at this level was in July 2008. The increase in the number of employees also showed positive dynamics. It also outperformed forecasts, coming in at 65,000. The growth was driven by both part-time and full-time jobs.

Such results are "suggestive". For example, even after the release of Australian Nonfarms, many experts suggested that the Reserve Bank of Australia may decide to terminate the bond purchase program at the next meeting to be held next week, February 1. At the same time, the RBA previously oriented the markets towards the May meeting, declaring the need for gradual and smooth steps. We believe that after today's inflationary release, confidence in the early completion of QE will increase in many ways.

There will also be more confident assumptions that the Reserve Bank will decide on the first interest rate increase at the end of this year – in November or December. After all, the Central Bank has actually achieved significant success in moving towards its goals of full employment and inflation, so the head of the RBA, Philip Lowe, may well reconsider his position on tightening monetary policy parameters.

It is worth noting that Lowe recently ruled out the option of raising the rate in 2022. According to him, corresponding conditions for tightening monetary policy will not be created within the year. He also noted that Australia's inflation outlook is very different from that of the US. But here, it is necessary to make an important remark: he voiced this position even before the release of the Australian Nonfarms and the inflation report. Therefore, a certain intrigue in this matter remains.

However, all the above arguments have now faded into the background, even a strong rise in Australian inflation could not stir up AUD/USD buyers. It is obvious that all attention is currently focused on the US Federal Reserve. If the US regulator strengthens the US dollar, its Australian counterpart will dutifully follow, at least in the medium term. Such a scenario will allow AUD/USD sellers not only to consolidate in the area of the 70th mark but also to test the key support level of 0.7000. But if the Fed disappoints the USD bulls tomorrow, the Australian dollar may take the initiative amid the growth of key macroeconomic indicators and the "hawkish" assumptions of experts. In this case, AUD/USD can at least break through the resistance level of 0.7220 (average line of the Bollinger Bands on the daily chart) as high and approach the borders of the 0.73 (the upper limit of the Kumo cloud on the same timeframe).

Therefore, it is recommended to take a wait-and-see position for the pair. All attention is focused on the Fed's January meeting, the results of which will determine the fate of dollar pairs, including AUD/USD.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română